Tokenisation definition: What is tokenisation of real world assets?

How can real-world assets be tokenised?

The various RWAs that can be tokenised

Real world asset tokenisation implementations

Proof of reserves in tokenising real world assets

Can RWAs be traded through DeFi?

RWA tokenisation in India

The DeFi space has made a range of financial products and services available to a wide range of users - regardless of their geographical location and financial background.

The concept of RWA - real world assets - in crypto is an invention of this DeFi space again. It’s quite popular too- the total value locked in tokenised RWA is sitting at over $4 billion as of late March 2024. Moreover, estimations suggest the market can be valued at hundreds of trillions of dollars.

Say you own a piece of art from John Singer Sargent that you want to sell; you can use tokenisation of real world assets on the blockchain to allow fractional ownership of this art to investors. This means you can create multiple tokens out of the art piece, each symbolising a share of the asset and each owned by different investors.

Tokenisation of real world assets therefore lends better exposure to your assets, and allows people from the global market to invest in assets like real estate, art, manuscripts, gold, financial securities, and just about anything you can think of.

While you may have trouble finding one single buyer for an entire asset, tokenisation of real-world assets would lead the web3 community to buy and trade shares of this asset amongst themselves, once they recongnise the value of it.

In this article, our goal is to tell you all there is to know about real world asset tokenisation.

Tokenised real world assets are creating quite the buzz: as CoinGecko’s RWA Report 2024 highlight, USD-pegged assets currently dominating fiat-backed stablecoins, accounting for 99% for all the stablecoins in existence. Further, commodity-backed tokens have hit $1.1 billion in market capitalization, with gold as the most popular commodity.

There’s more: tokenized Treasury products have grown by 641% in 2023, amounting up to $861 million now. Meanwhile, the demand for private credit is concentrated in the automotive sector, making up 42% of all loans.

A quick tokenisation definition for those slow on its uptake: it’s a process where real world assets are transformed into virtual, blockchain-based tokens carrying all relevant data such as origin, owner(s), history of transfer, value per token, and more.

For example, tokenisation in real estate is something you can opt for, and the same technology works for commodities and intellectual properties too.

The benefits are many: more liquidity, confirmed authenticity, transparent records of ownership and transactions, and of course, greater accessibility. Let’s take financial assets for example.

The tokenisation of real world assets brings everything from the distribution to the clearing to settlement, and even safekeeping, into one single space. This means you have an efficient and self-sufficient blockchain-based financial system that is transparent, basically does away with counterparty risks, and best of all: where capital is mobilised with the utmost ease.

In other words, times are changing, and the digital generation increasingly needs digital means to buy big fancy assets from the comfort of their homes, while still being sure that what they get is authentic.

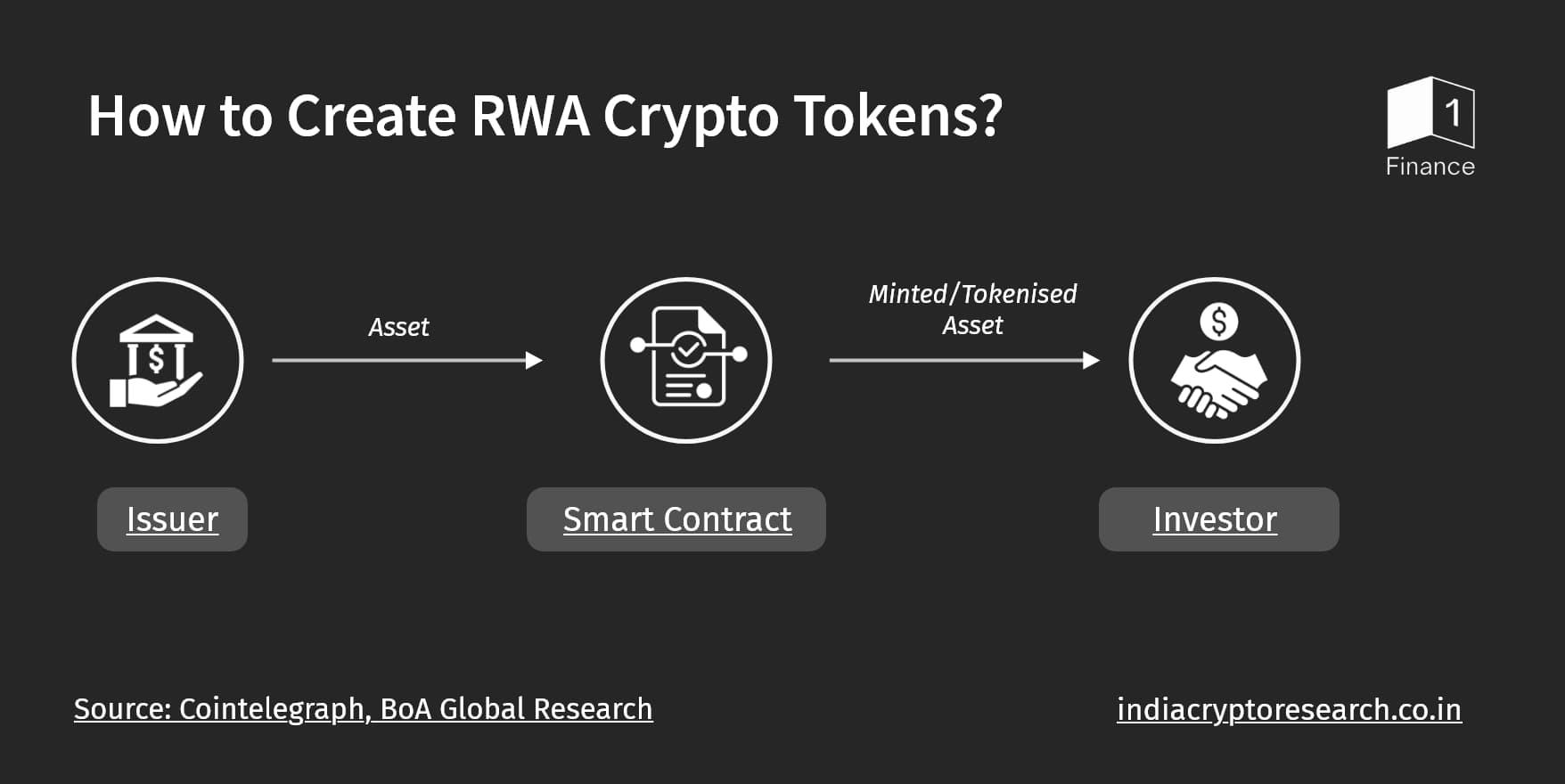

Time for the nitty-gritties of the technology we keep mentioning. Creating RWA tokens is of the most interest to entities like banks, hedge funds, brokerages, crypto exchanges, and more organisations who want to offer appealing schemes to their up and coming clients. Plus you have the HNIs, who are filthy rich and may own items hard to mobilise and yet needing to be sold.

For such entities, here’s a step-by-step rundown of how tokenisation of real worlds assets work:

The created RWA tokens now represent your physical asset(s) in the virtual world of blockchains, allowing for enhanced accessibility and liquidity. When you sell it- whether as multiple tokens or as one token- you transfer their ownership to another fractionally or fully.

Real world tokenisation of assets can span across any physical objects you can think of.

RWA crypto tokens can be made out of:

Of course, this was to name only a few.

It’s time to look at some examples of tokenisation of real world assets.

It’s important for both buyers and sellers to verify the assets underlying RWA crypto tokens are authentic. Here’s where proof of reserves come in, allowing autonomous and timely verifications of the off-chain assets behind RWA tokens.

Proof of reserves enhances transparency and protects users, by proving that the underlying assets for RWA tokens are in safe custody, and on-chain assets are collateralized by off-chain, real-world assets. Chainlink is one of the most well-known entities in the blockchain space to publish such proof of reserves.

There are both centralised and decentralised exchanges available to trade RWA crypto tokens. Decentralised exchanges can offer tokenisation of valuable real world assets for trading, bringing RWA to DeFi.

Going back to the basics again, RWA is basically representing any physical asset on the blockchain for easy exchange of value. The Indian CBDC or the e-rupee can be called an example of RWA tokens by this RWA tokenisation definition, since there is a certain amount of rupee backing the CBDC tokens at a 1:1 ratio.

India’s GIFT City (Gujarat International Finance Tec-City) is racing ahead too; reports say India’s very first regulated real estate and infrastructure asset tokenisation platform is very likely to be set up there.

GIFT City’s IFSCA (International Financial Services Centres Authority) has already given a tentative approval to some projects for the same, Realdom India being one of them. The goal is to let smaller investors have fractional ownership in projects in real estate and infrastructure, while owners of said assets earn liquidity.

We hope this post has clarified tokenisation of real world assets for you! For more information on the world of crypto and blockchain, stay tuned to the India Crypto Research blog.

India Crypto Research operates independently. The information presented herein is intended solely for educational and informational purposes and should not be construed as financial advice. Before making any financial decisions, it's essential to undertake your own thorough research and analysis. If you're uncertain about any financial matters, we strongly recommend seeking guidance from an impartial financial advisor.