The Stable-Economy of 2025

Key Factors Behind the 2025 Stablecoin Boom

Genius Act: Guiding and Establishing National Innovation for U.S. Stablecoins Act

Stablecoins-Use Cases in the Real World

Conclusion

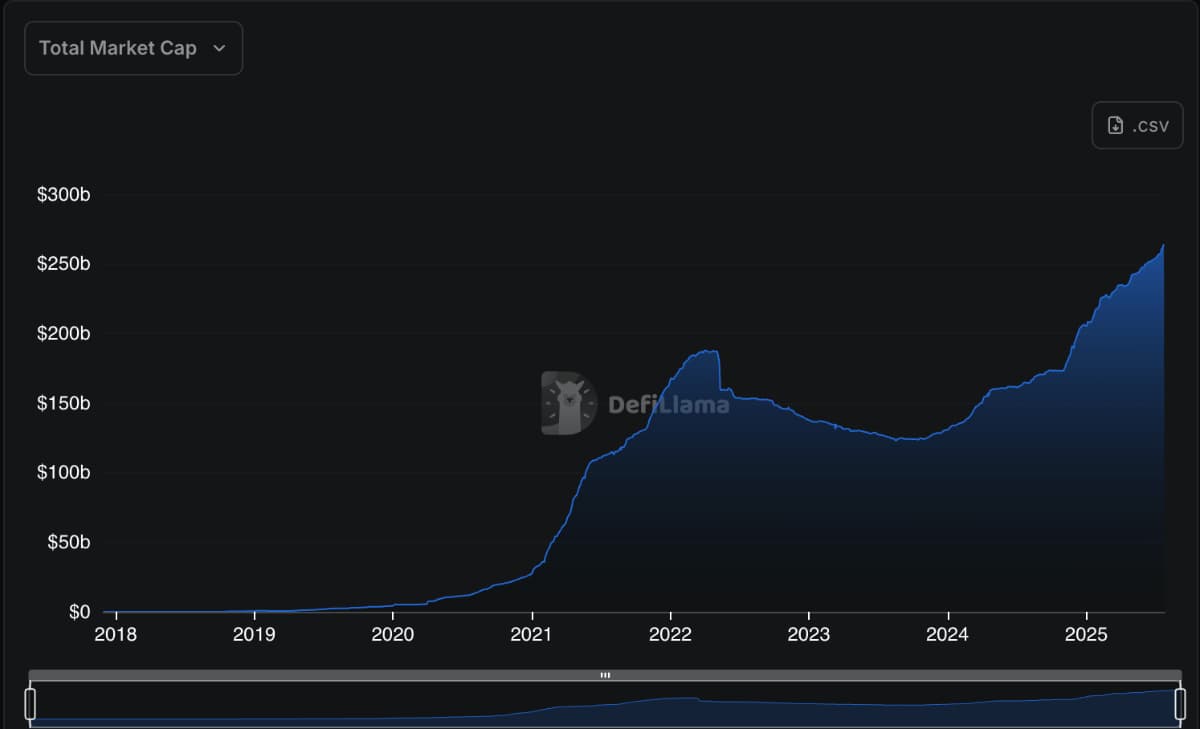

As of July 2025, the market capitalisation of stablecoins is over $265bn (+60% YTD) with daily transaction volume averages of over $150bn ($2 trillion+ monthly). Though more than 90% of stablecoin volumes today originate from the Crypto Exchange business, i.e. by traders, market makers, etc, stablecoins are gaining attention from a large number of businesses and Banks interested in using them for cross-border payments and tokenised RWAs.

Source : DefiLlama

For years, stablecoins were viewed as a useful tool for traders, but not much more. In 2025, that narrative has flipped entirely. Stablecoins are now the foundation of a new financial infrastructure, one that's programmable, borderless, and increasingly woven into the operations of the global economy.

In case you are new to crypto and do not fully understand what stablecoins are, read our article on what stablecoins are and how they are important in building a global payment rail

With such participation and investments by large institutional players, global adoption into payments is imminent. The above catalysts are definitely going to drive stablecoin adoption, however, the Genius Act introduced in July 2025 by the U.S. will shape how stablecoins will be issued and regulated in the coming years!

The turning point came in July 2025 with the signing of the GENIUS Act, the first comprehensive U.S. law regulating dollar-pegged stablecoins. The act mandates that stablecoin issuers in the U.S. must

Signed by President Donald Trump, the law not only brought long-awaited regulatory clarity but also repositioned stablecoins as geopolitical tools. In short, stablecoins backed by dollars are extremely bullish for the U.S. since it can export its treasuries across the globe through private companies with much better distribution.

“We are going to keep the U.S. the dominant reserve currency in the world, and we will use stablecoins to do that.” – Treasury Secretary Scott Bessent

Stablecoins have immense potential other than facilitating the trading of crypto in Centralised and Decentralised Exchanges.

Stablecoins definitely represent an early opportunity that can have massive potential for institutions that embrace it correctly. We recommend you also check out Fireblock’s report on the stablecoins for how enterprises such as Banks are adopting this new age programmable money. India is lagging far behind in terms of regulation clarity, lacking stable issuers and providing institutions the confidence to build businesses in this space. Now is a wake-up call for India to make efforts to understand and regulate the asset class better, or we will just keep losing every major global tailwind opportunity in the digital asset space.

India Crypto Research operates independently. The information presented herein is intended solely for educational and informational purposes and should not be construed as financial advice. Before making any financial decisions, it's essential to undertake your own thorough research and analysis. If you're uncertain about any financial matters, we strongly recommend seeking guidance from an impartial financial advisor.