Understanding Uniswap’s Core Metrics

Trading Volume Drives Token Value for Uniswap

The Importance of Monitoring Fees While Analysing Uniswap

Uniswap vs. Other Centralised Exchanges

Uniswap’s Outlook

Most people are familiar with trading on centralised exchanges like Binance and CoinDCX, where accounts, order books and custodians are part of the system. Uniswap represents a new approach to crypto trading, think of a self-governing market where anyone can swap tokens straight from their own wallet, there are no order books, no custodians or any lengthy registration. Uniswap relies on automated market makers (AMMs) and liquidity pools.

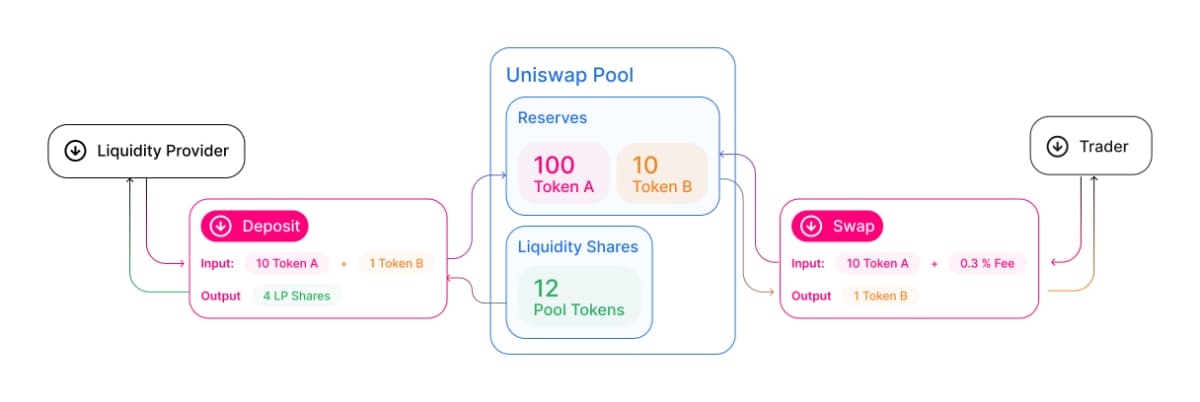

Here’s how it works:

Liquidity providers deposit pairs of tokens in a pool, like token A and token B. In return, they get a pool token that shows how much of the pool they own and gives them a share of trading fees generated in the future.

So whenever a trader wants to swap, they can simply exchange one token for another with the pool by paying a small fee, which is distributed back to the liquidity providers

Everything functions with the help of smart contracts, so users always stay in control of their assets. Anyone can take part, whether as a trader or liquidity provider. This makes Uniswap an open and efficient platform that stays self-custodial, keeping the power in the hands of its users.

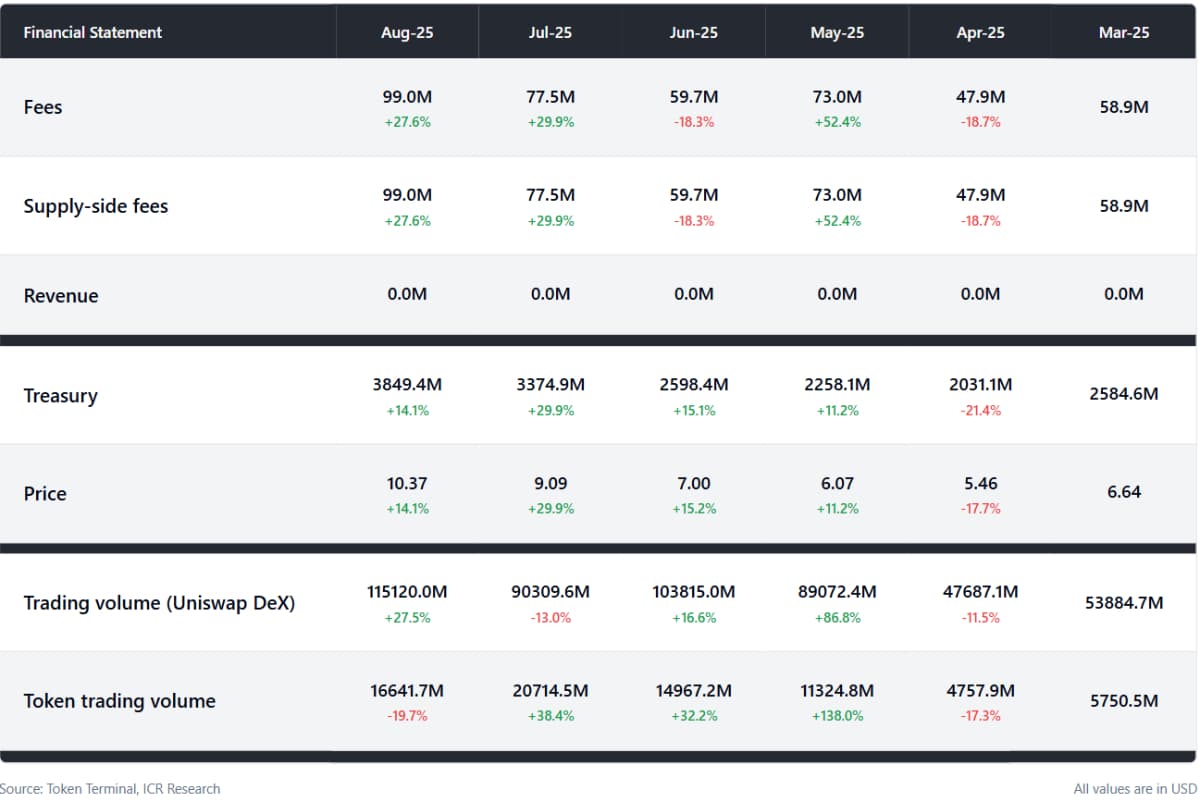

Trading volume is an important indicator when analysing exchanges. It shows real-world usage and market demand. When trading volume rises, as shown in the chart, it means more users are actively swapping tokens on the platform. So an increase in trading volume not only boosts fees but also tends to support a price increase. So, a high trading volume is a strong sign for DeXs.

Uniswap’s fees directly relate to the volume of trade; the higher the volume of trade, the higher the number of fees collected. Each swap comes with a small fee of approximately 0.3% which is pooled and given out proportionately to those providing liquidity to the pool. These are simply the transaction costs that are paid by the Uniswap traders and Unichain users.

Higher trading volume will result in higher fee collection, which benefits liquidity providers and helps keep the protocol financially sustainable. Such a close relationship between volume and fees makes fees an important metric when thinking about Uniswap activity and its development.

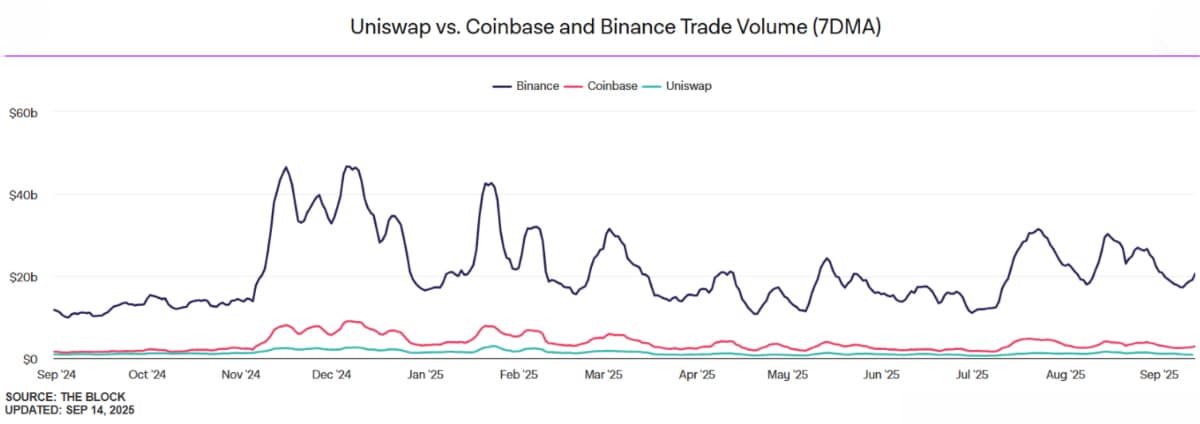

Both Uniswap and large centralised exchanges like Binance and Coinbase are capable of dealing with large trading volumes. But Centralised exchanges usually dominate in terms of user base and volume, due to the easy fiat deposits and advanced trading tools. There’s a mandatory KYC on most exchanges, where users must trust the exchange to hold their funds. In contrast, Uniswap allows users to trade directly out of their own wallet without KYC, giving them full control over their assets.

We’ve seen what makes Uniswap unique; it holds a clear lead over other DeXs, but it's still behind big centralised exchanges like Binance and Coinbase, so the potential room for growth is there. For anyone looking at the Uniswap token, the key lies in its fundamentals. In the last 6 months, trading volumes and fees have both grown, with a strong jump in August. This suggests that Uniswap is in a good position to grow, provided this growth trajectory continues, which is why it is important to track the main metrics driving Uniswap’s Price.

India Crypto Research operates independently. The information presented herein is intended solely for educational and informational purposes and should not be construed as financial advice. Before making any financial decisions, it's essential to undertake your own thorough research and analysis. If you're uncertain about any financial matters, we strongly recommend seeking guidance from an impartial financial advisor.