Ethereum Financials: Fees & Revenue Growth

Token Incentives & Long-term Sustainability

Ethereum Valuation Metrics: P/F and NVT Ratios

ETF Inflows and Institutional Demand

Final Takeaways on Ethereum’s Long-Term Outlook

Ethereum is the most well-known smart contract blockchain that allows decentralised applications in the areas of finance, games, and real estate. Apart from being a technology layer, ETH has become a multi-purpose asset with distinct properties: it secures the network, powers applications, and is increasingly viewed as an investment option. With increasing ETH ETFs in major markets, Ethereum has reached a new stage of mainstream adoption, which requires a more in-depth examination of its financials, valuation, and sustainability. In contrast to Bitcoin, which is looked upon as a store of value, Ethereum is the network of decentralised finance (DeFi), NFTs, stablecoins, and an expanding layer-2 ecosystem.

| # | Financial Statement | August-25 (As of 16th Aug) | July-2025 | June-2025 | May-2025 | April-2025 |

| a | Fees | 21.47M | 49.68M (+27.2%) | 39.06M (-8.2%) | 42.56M (+96.3%) | 21.68M |

| b | Supply-side fees | 13.31M | 24.31M (+23.9%) | 19.65M (-2.9%) | 20.22M (+53.8%) | 13.15M |

| (a-b) | Revenue | 8.16M | 25.37M (+30.5%) | 19.44M (-13.0%) | 22.34M (+161.8%) | 8.53M |

| Token incentives | 170.2M | 265.5M (+33.2%) | 199.4M (+2.5%) | 194.5M (+44.5%) | 134.6M | |

| Price | 4,419.9 (+36.90%) | 3,228.4 (+28.4%) | 2,515.0 (+5.9%) | 2,375.9 (+40.9%) | 1686.6 | |

| Source: Token Terminal, ICR Research | All values are in USD | |||||

Ethereum’s financials reflect a stable increase in network activity during the past months. Fees have increased by 130%, going up to $49.6M in July compared to $21.6M in April, indicating a rise in demand. Currently, fees are already at 21.4M as of 16th August, implying that the month might record a high close in case the current rate is maintained. This has continued to raise revenues, which reached $25.3M in July, thus the price of Ethereum has surged almost 37% in August, showing high confidence in the network value in the long run.

Token incentives are rewards distributed to validators and stakers. These rewards are the primary component of Ethereum’s expense. In July 2025, Ethereum distributed $265mn million in Token incentives, which is far more than its revenue. This is common across most top blockchains, but the key lies in whether these incentives convert into real usage and fee generation in the long term.

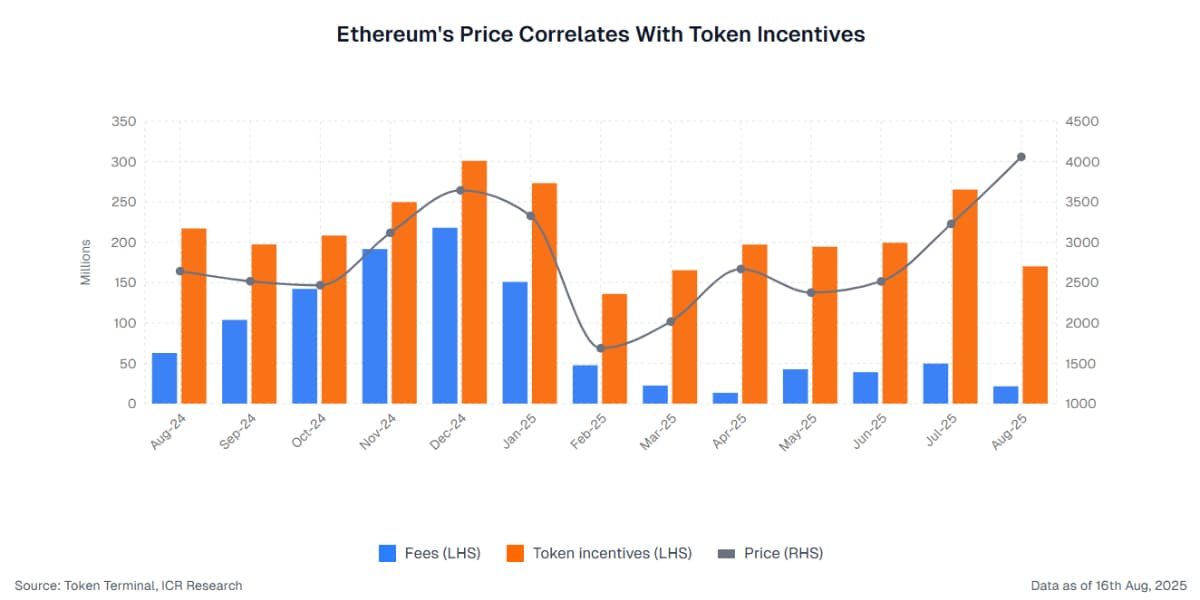

We can see in the chart that Ethereum’s price moves very closely to token incentives, which act like a growth fuel for the network. These incentives attract validators and more users, which ultimately secures the protocol and encourages more activity. However, not every coin succeeds in converting these high token incentives into more economic activity and price growth.

While such incentives can spark initial growth, long-term success depends on the protocol’s robustness and the ability to generate real user value. In Ethereum’s case, it has the scale and a fairly strong ecosystem, so token incentives here show direct correlation with the price.

Ethereum can be valued using network-specific metrics like the Price to Fees (P/F) ratio and the Network Value to transaction (NVT) ratio.

Price to Fees (P/F) - The P/F ratio is a valuation metric that compares a token’s market capitalisation to the annualised fees its network generates. It’s conceptually similar to the price-to-earnings (P/E) ratio in traditional finance. The P/F ratio helps gauge whether a protocol is overvalued or undervalued relative to its usage. Ethereum is currently trading at a premium valuation compared to its peers, part of this is due to its dominant ecosystem, high liquidity and the recent institutional demand.

Network value to Transaction (NVT) - NVT ratio is a metric that compares a token’s market cap to the daily transaction volume settled on its network. At its core, NVT shows how much value the market assigns to each dollar of on-chain activity. A high NVT suggest potential overvaluation and vice versa. When compared to both its historical levels and similar smart contract platforms, Ethereum’s transaction activity remains strong relative to its market capitalisation, which is reflected in a lower NVT ratio.

| Valuation of Top Smart Contract Platforms | |||

| Token | P/F | NVT | ICR Score |

| Ethereum | 517 | 22 | 81.7 |

| Solana | 107 | 22.9 | 71.4 |

| Tron | 48 | 41.1 | 77.4 |

| Arbitrium | 164 | 8.5 | 72.1 |

| Avalanche | 1130 | 21 | 61.7 |

| Sei | 10530 | 9.8 | 58.2 |

| Source: ICR Research | Data as of 16th August, 2025 | ||

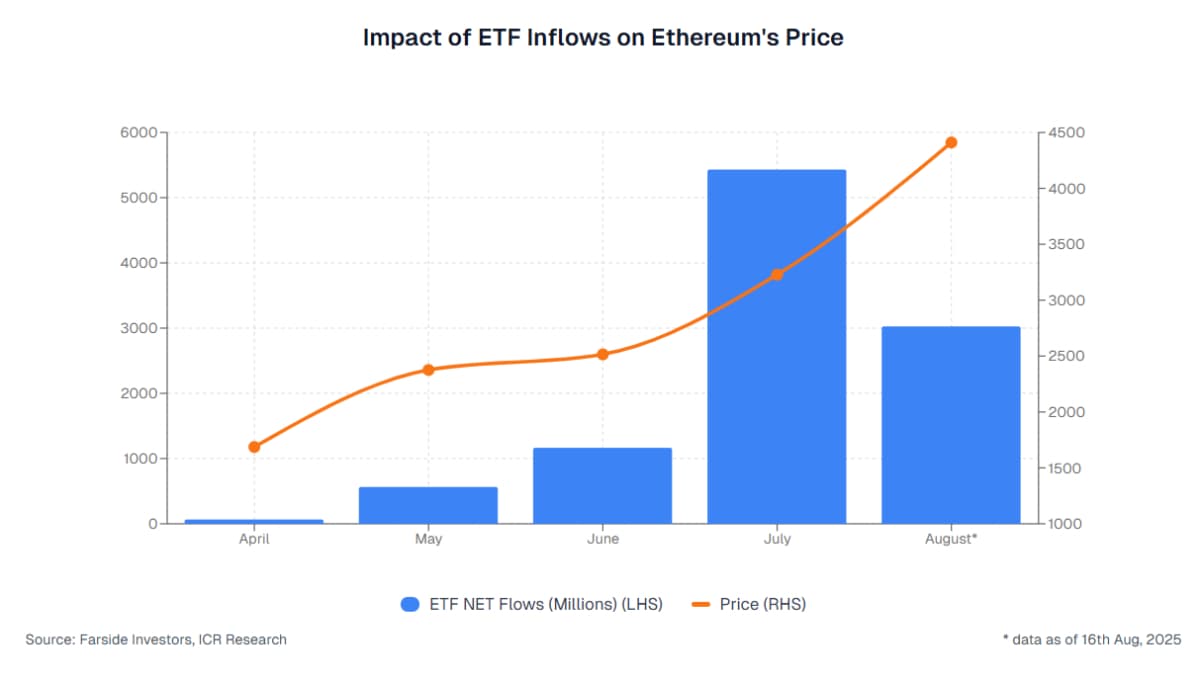

The approval of spot Bitcoin and Ethereum ETFs has marked an important shift in the crypto industry. Bitcoin’s recent rally demonstrated how consistent ETF inflows can drive prices to an all-time high. Ethereum now follows a similar path; there have been consistent high inflows in the past two months, and such allocations from institutional investors create a steady buy pressure independent of short-term network earnings.

From the institution's point of view, crypto ETFs provide them with a simple and regulated way to get Ethereum exposure, making it part of their wider portfolio strategy. This flow-driven demand has been a key factor in Ethereum’s price appreciation.

Ethereum’s financial profile is shaped by high token incentives, which are growth capital to secure the network and generate participation. The critical question is whether such incentives can convert into long-term fee generation and user demand. Based on fundamentals, its size, liquidity and growing institutional investments in Ethereum indicate that it is still one of the strongest cryptos for the long-term.

India Crypto Research operates independently. The information presented herein is intended solely for educational and informational purposes and should not be construed as financial advice. Before making any financial decisions, it's essential to undertake your own thorough research and analysis. If you're uncertain about any financial matters, we strongly recommend seeking guidance from an impartial financial advisor.