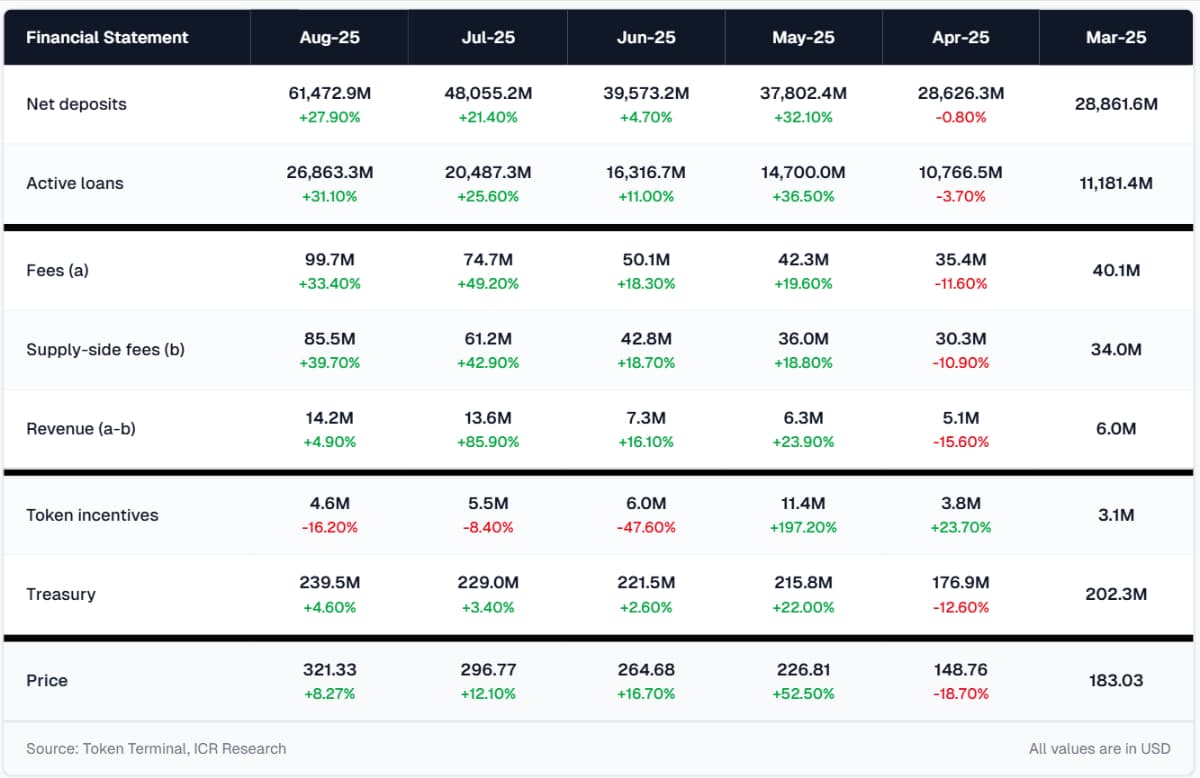

Financials of Aave

Aave’s Price Moves Closely with Fees

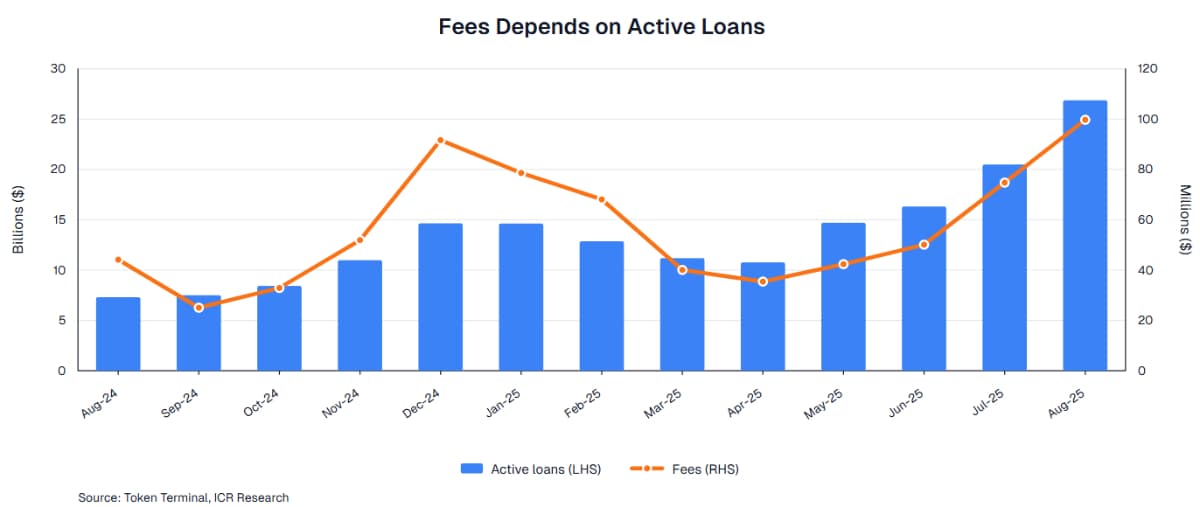

Fees Depend on Active Loans

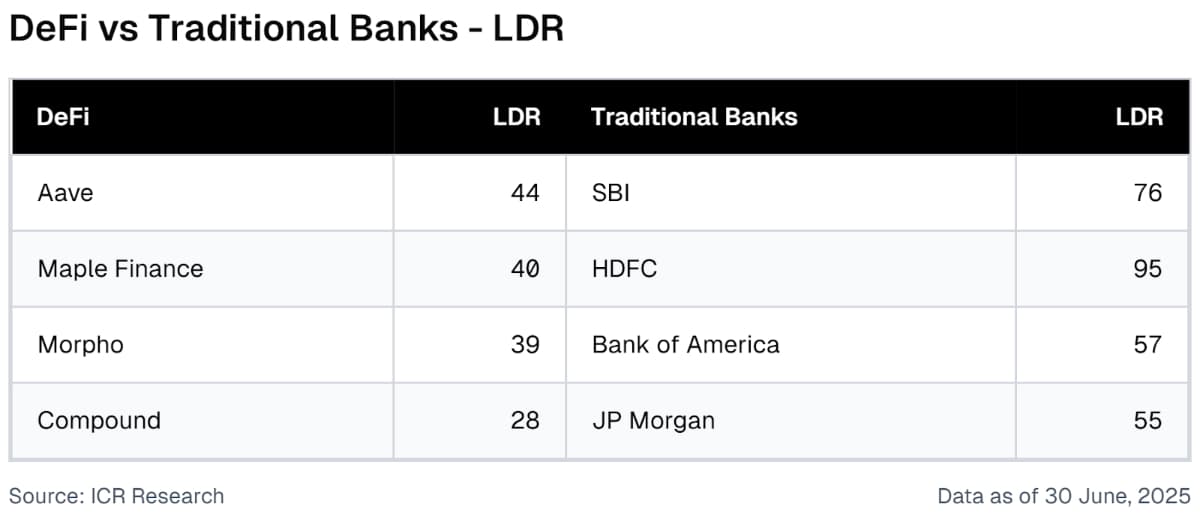

Loan-to-Deposit Ratio (LDR) in DeFi

Outlook for Aave

If you think banks are the only place where you can earn interest, Aave might surprise you. DeFi (Decentralised Finance) lets anyone with a crypto wallet become a lender or borrower directly through smart contracts. Among the many protocols in this category, Aave is one of the most popular. It allows users to supply crypto assets to liquidity pools and earn interest or borrow instantly by providing collateral, without the need for banks or other middlemen.

In this report, we’re going to look at Aave’s financials to understand what truly drives its value.

Look at the table above. Over the past six months, Aave’s net deposits and active loans have grown significantly. Fee generation and supply-side fees distribution have also more than doubled; as a result, its revenue has also jumped from $6 million in March to $14 million in August.

These are really great signs for Aave, signalling strong ecosystem growth and heightened usage.

In the previous research report, we saw how Ethereum’s price moves very closely to token incentives. This isn’t the same case for Aave; token incentives distributed by Aave do not directly mirror movements in Aave’s coin price, because Aave is a DeFi platform, whereas Ethereum is a smart contract platform where token incentives drive validators. So, the question arises: what are the metrics that affect Aave’s price?

There’s a strong relationship between Aave’s price and the fees it generates, more often than not, price moves in the same direction as fees. During the months where fees surged, Aave’s price also showed an immediate or parallel surge, such as during the spike from November 2024 to January 2025. So overall, market participants see protocol fees as a key driver of value, rewarding heightened on-chain activity with a higher asset price.

The observed pattern supports the idea that utility and economic output (fees) are significant drivers of Aave’s market performance.

We saw that Aave Price moves closely with fees, but what influences fees?

Fees in Aave are fundamentally driven by active lending activity, as they represent total interest, flashloan, and liquidation fees paid by borrowers.

Recently, fees have surged more than the previous highs from December and January; however, this time the growth is backed by a strong increase in active loans. So because of this alignment fee growth looks more sustainable, since it is supported by real loan demand rather than any one-off event.

The Loan-to-Deposit Ratio (LDR) is a crucial metric in traditional banking, but it can also be used in DeFi. For platforms like Aave, it shows the proportion of available deposits that is actually being lent out. A stable or rising active loan volume can mean different things depending on how LDR and net deposits move together.

Aave’s LDR has historically been around the ~35%-45% range, which is higher than other DeFi protocols like Compound and Maple Finance, but this is still less than the LDR of traditional banks. Aave is structured in a way that its ideal utilisation rate (LDR) varies, but to simplify it, it should be above 80%, so there is ample room for growth before reaching the systematic risk limit. DeFi protocol should strike a careful balance, a higher LDR can boost active loans, which in turn can boost fees and price, but also raises the risk of liquidity in a period of high withdrawal demand.

As Aave continues to mature, monitoring LDR together with net deposit trends provides valuable insight into its capital efficiency and sustainability. While an overall growth in the DeFi category might see Aave’s LDR go even higher, the ideal balance is context-dependent and must be weighed against market conditions, its technical design, and user confidence. These factors should always be taken into consideration when evaluating Aave’s long-term prospects.

Aave’s growth potential is supported by its solid fundamentals and increasing usage across the platform. Recent months have shown strong momentum and positive growth trends for Aave, which is an encouraging outlook. As long as this growth trend continues, there’s good reason to expect Aave’s value and adoption to rise further.

India Crypto Research operates independently. The information presented herein is intended solely for educational and informational purposes and should not be construed as financial advice. Before making any financial decisions, it's essential to undertake your own thorough research and analysis. If you're uncertain about any financial matters, we strongly recommend seeking guidance from an impartial financial advisor.