Planning and launch of CBDC India

Pilot projects

Types of CBDC India

Current developments in CBDC India

What are the implications for such a digital currency in India?

How to access RBI digital rupee?

The takeaway

India is one of the over 130 nations around the world currently exploring a CBDC or a Central Bank Digital Currency. The Government of India announced the launch of the Digital Rupee in Budget 2022. The RBI defines the CBDC India as the legal tender issued by the central bank in the form of a digital currency. Further, it is exchangeable on par with the current fiat currency and is accepted as a medium of payment, legal tender, and a store of value.

Note that the National Payments Corporation of India (NPCI), which developed the Unified Payments Interface (UPI) in 2016 and initiated the era of cashless payments, is also behind the CBDC India.

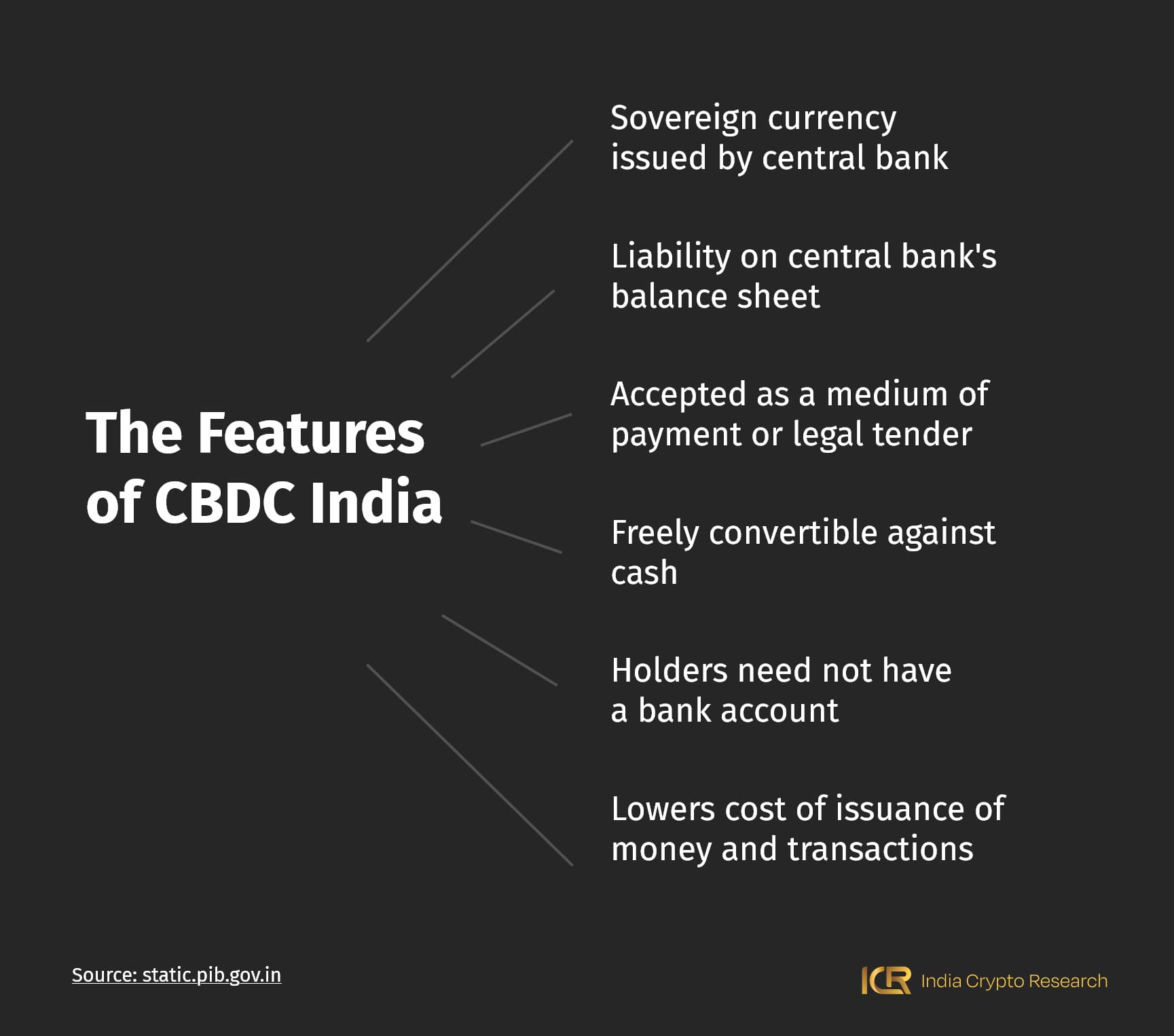

Here’s how the Indian government defines the features of CBDC India:

The RBI has defined two types of CBDCs:

As of now, the retail CBDC project is making significant headway, with the RBI gradually expanding the scope of the pilots to include more banks, users, and locations based on feedback received during the pilots. The banks selected in the phase-wise pilot programme for CBDC India have been the:

All the banks have been launching their Digital Rupee app to allow users to test out the new form of currency. Further, it is now linked to NPCI’s UPI too.

Reportedly, transactions in the e-rupee averaged to just about 25,000 per day by the end of October 2023, until some of the Indian banks decided to disburse employee benefits through the Digital Rupee in December, helping the RBI reach 1 million daily transactions in CBDC by the end of 2023. These banks included the HDFC Bank, Axis Bank, Kotak Mahindra Bank, Canara Bank, and IDFC First Bank.

The Digital Rupee has seen a growing user base too; from 3 million users in December 2023, it was up to about 4 million users in January. As more exciting and unique use cases come forward, this number is expected to go up.

Speaking of which, the RBI is now considering tokenising assets like government bonds and customer deposits to take e-rupee usage to new heights. Such tokenised securities would be ideally purchased with CBDC India, making the settlement instant.

Further, it has been estimated that the e-rupee can cut the cost of cross-border payments in half to about 2-3%. This is another use case of CBDC India being considered, expected to boost adoption.

Advantages of digital currency or CBDC include anonymity for small-value transactions and traceability for high-value transactions. There are some concerns about privacy and cybersecurity, and the RBI is expected to adopt appropriate safeguards.

One thing is certain: India's journey towards implementing a CBDC is a significant step in its digital finance landscape, with efforts focused on ensuring that the digital currency aligns with the modern digital economy's needs.

CBDC has the potential to significantly boost financial inclusion in India through various mechanisms.

The success of mobile money accounts in expanding financial inclusion in regions like Sub-Saharan Africa highlights the potential for CBDCs to play a similar role, especially in countries where a significant portion of the population remains unbanked but has access to mobile phones.

If you have not used the CBDC India yet, you can access it through any of the 13 banks participating in the e-rupee program, spread across 26 cities. Some of these banks are: the State Bank of India, ICICI Bank, Yes Bank, IDFC First Bank, The Union Bank of India, HDFC Bank, Bank of Baroda, Axis Bank, Canara Bank, and Kotak Mahindra Bank.

All of these banks have launched their digital rupee apps to allow easy transactions. You can follow a few simple steps to access them:

Note that with e-rupee, you can scan even UPI QR (quick-response) codes at different merchant outlets and pay for everything from regular small transactions to bigger ones. This is possible as e-rupee is now compatible with UPI.

The Digital Rupee is yet to achieve the mainstream status in India that UPI (and our paper money) enjoys, even as an increasing number of banks make it available to their users from prominent Indian regions. The reason would be that it hasn’t proposed a unique use case yet that is not already served by digital payment systems like the UPI. However, as the government explores the viability of tokenisation of securities to expand the usage of the CBDC India, the coming times are bound to be exciting for India’s digital economy.

India Crypto Research operates independently. The information presented herein is intended solely for educational and informational purposes and should not be construed as financial advice. Before making any financial decisions, it's essential to undertake your own thorough research and analysis. If you're uncertain about any financial matters, we strongly recommend seeking guidance from an impartial financial advisor.