Overview

Prerequisites

Deposits, Withdrawals and Funds Storage in CEXs

Risks of keeping your funds in a CEX

CEXs vs DEXs

Key Features of Centralised Exchanges

Regulatory Landscape in India

Conclusion

FAQs

A Centralised Exchange (CEX) is a regulated platform that facilitates the buying, selling, and trading of cryptocurrencies, where a central authority or company facilitates all the transactions. Some examples of CEXs in India are CoinDCX, Coinswitch and Zebpay.

In a centralised exchange, users create accounts within the platform, and the exchange holds custody of the assets on behalf of the users. CEXs are typically user-friendly, offering easy access to a wide variety of cryptocurrencies and providing features such as fiat-to-crypto trading, high liquidity, and advanced trading tools. The biggest advantage of a CEX is that users can buy and sell crypto directly into their local fiat currencies compared to DEXs where trading is done into crypto-crypto or crypto-stablecoin pairs.

While everything in this article can be understood as a beginner we recommend you go through the below resources before reading this article completely

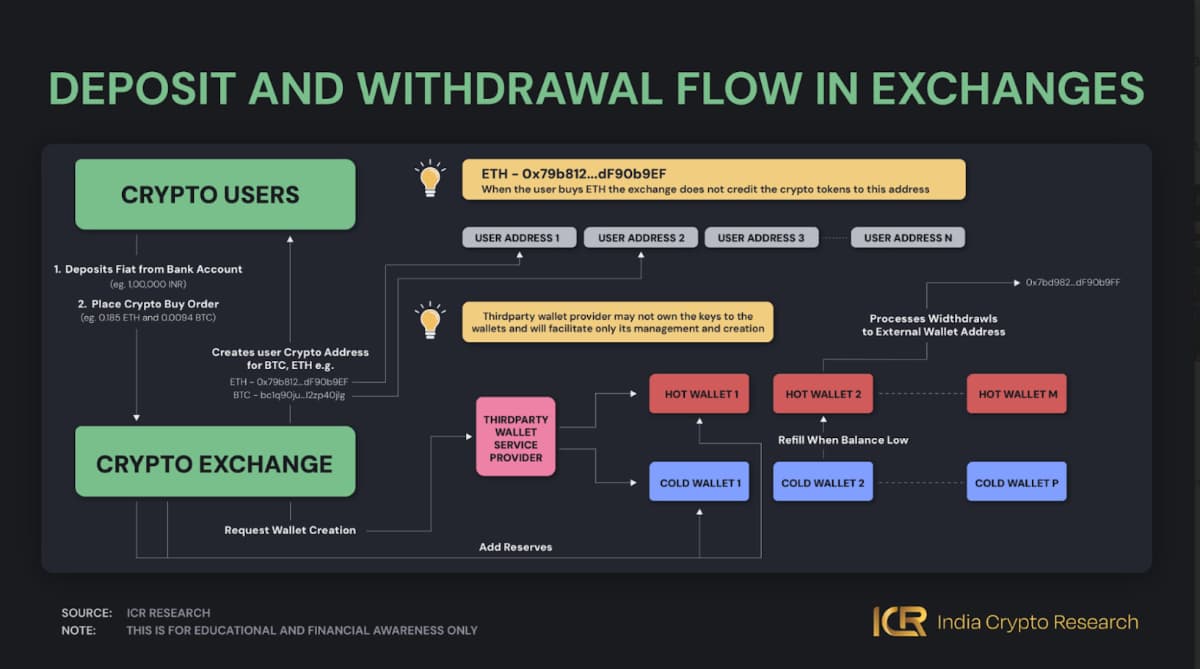

The above diagram shows an architecture of a CEX for processing deposits, withdrawals and storing user funds.

When users signup on a CEX, the CEX creates a blockchain address for every user, for every blockchain it supports deposits and withdrawals. Users can now either buy crypto from the exchange using Fiat or deposit crypto into a CEX from their personal wallet or another CEX.

When users buy crypto through fiat, the exchange will simply allot them the funds that would be available for withdrawal, but will not be credited to the user’s blockchain address that was created during signing up. These funds remain in the Exchange’s Cold Wallets. When the user withdraws these funds from the Exchange, the CEX will process these transfers through one of their hot wallets.

When users deposit crypto from their personal wallet into the blockchain address created by the CEX for them, the CEX will usually consolidate these funds into one of their cold wallets for safety reasons. When the user wants to withdraw their funds, they process it using the funds in their Hot Wallets and charge a transaction fee for the same.

💡CEXs regularly consolidate all user deposits into their cold wallets. They store a small percentage of the total funds in hot wallets that are used to process customer withdrawals. These hot wallets are periodically refilled from cold wallets. CEXs might use a third-party wallet provider for such complex automations and wallet safekeeping

2024 has seen over $1bn lost from exchanges such as WazirX, BingX, DMM due to CEX hacks and 2025 has been even more notorious with ByBit being hacked for over $1.4bn. Since, user deposits are consolidated into the Exchanges' cold wallets, the users do not actually own the crypto they have purchased on the exchange/ deposited from another exchange. In case these cold wallets are compromised, the users could end up losing their funds completely or partially depending on the severity of the hack and the extra reserves

While large exchanges such as ByBit and Binance can pay back the users despite getting hacked, smaller exchanges such as WazirX might lack the ability to compensate for lost funds. Hence, it is extremely important to self-custody your digital assets. In case, self-custody is complex for you and you prefer keeping your funds in a CEX, we insist you check out the safety score of your exchange. Factors such as making proof of reserves live, having more than 1:1 ratio of user assets to CEX reserves, attractive bug bounty programs, third party security testing and in-house penetration testing team can make a CEX trustable.

Remember: “Not your Keys 🔑, Not your Crypto 🪙”

Other than CEXs being centralised and regulated by a single entity and DEXs being completely decentralised, a piece of software with pre-defined rules there are many other differences.

Buy/Sell with Fiat vs Buy/Sell with Crypto

In CEXs you can buy, sell and trade cryptos to and from your local fiat currencies. CEXs are localised and integrated superbly with your local payment providers. In contrast, in a DEX you can only trade a crypto such as ETH for another crypto such as POL, AVAX or USDT.

Same Network Limitations

In CEXs you can sell ETH for BTC directly or ETH for SOL by first selling ETH into fiat or a stablecoin and buying SOL with fiat or stablecoin. However, a DEX usually only supports a single network. For example in DEX such as uniswap you can only swap ETH or an ERC-20 token for another ERC-20 token. You could swap a token on the Arbitrum network for another token on the Arbitrum network. In Jupiter, you can SOL or other SPL tokens for other SPL tokens only.

In short, DEXs can be used to swap tokens only on the same network, whereas a CEX does not buy or sell assets to you directly, but only allots it to you, such complex swaps are much easily managed by the user.

Transaction Fees

While trading in a DEX, crypto is truly transferred between one account and another via smart contracts. Hence there is always a transaction fee for every trade on top of the cut that the DEX keeps for itself. Since, CEXs only allot and map user funds they do not charge any transaction fee.

Friendlier UX in CEXs vs Crypto Native UX in DEXs

CEXs make their user experience extremely smooth since they don't really have to deal with the complexities of smart contracts and crypto transfers on every buy and sell that only crypto native users understand. CEXs are usually where 99% of the new crypto users are onboarded. DEXs know that their users are advanced and have understood the basics of blockchains, hence go on to create much more complex user experiences and journeys.

Centralised Exchanges such as Binance seem like an amusement park of features with so many different features for users to trade, earn , stake etc. Some of them are

India currently does not allow users to withdraw funds from Exchanges into their personal wallets due to money laundering and tax evasion reasons. Users have to pay a flat TDS of 1% on every sale in spot and 30% tax on their profits on every crypto at the end of the Financial Year. Users cannot offset the loss of one crypto such as ETH with the profits of another such as BTC. For detailed tax guidelines refer to our in-depth tax guide on crypto.

In conclusion, Centralised Exchanges (CEXs) offer a convenient way to trade cryptocurrencies with fiat support and user-friendly features. However, they come with risks, particularly regarding security and control over your funds. While CEXs are ideal for beginners, it's important to assess their safety measures and consider self-custody for long-term security. Ultimately, understanding both CEXs and DEXs will help you make the best choice for managing your crypto assets.

India Crypto Research operates independently. The information presented herein is intended solely for educational and informational purposes and should not be construed as financial advice. Before making any financial decisions, it's essential to undertake your own thorough research and analysis. If you're uncertain about any financial matters, we strongly recommend seeking guidance from an impartial financial advisor.