Crypto taxes: How do different countries approach it?

Crypto tax in India

What should be the takeaway for crypto traders or investors?

The Indian government is receptive to blockchains, as the release of the paper National Strategy on Blockchain by MeitY back in December 2021 made clear. As it stands, the Ministry of Electronics and Information Technology (MeitY) looks to enable ‘Made in India’ blockchain tech for international use by 2027, converging with other emerging tech. However, crypto is yet to receive such mainstream status in our country. The regulations for cryptocurrency tax in India included in Budget 2022 is the only guidance we have so far.

Now, something is almost always better than nothing, which is what we can say about the crypto tax rules in India as compared to the regulatory opacity for the same space.

How does taxation on cryptocurrency work in India? And how is India’s tax treatment of crypto different from other countries? We go for a detailed overview in this article.

Before discussing crypto taxes India, let’s take a look at crypto tax rules across prominent countries in the world.

Crypto taxes in the USA is something many remain curious about, due to the country’s status as the heart of the world of finance, with sociopolitical events in the country sending ripples across the global economy. Crypto is taxed in the USA similarly to stocks, with crypto transactions treated as capital gains in the case that you use crypto to buy goods and services or profit from sale/trading.

Short-term capital gains taxes apply if the crypto is held for less than a year, ranging between 10% to 37% based on an individual’s annual income.

On the other hand, crypto taxes in the USA treat gains from assets held for more than one year as long-term capital gains. The tax rate is 0% for people earning up to $44,625 per year, 15% for individuals earning up to $492,300 per year, and 20% for individuals earning beyond that.

Further, the following types of crypto transactions are taxed as usual income, with 7 brackets ranging between 10% and 37%.

If you sell this crypto though, the profits from that sale are taxed as capital gains.

Similar to the US, crypto is treated as capital gain if you sell/trade, and spend it on goods and services. However, tax rates don’t vary depending on how long the asset is held. The capital gains tax is 10% for individuals earning up to £50,270 annually, and 20% for earning more. Investors do not need to pay capital gains taxes on their first £6,000 in capital gains in a year.

Further, the following are treated as income, with 20% tax for up to £37,700 of annual income, 40% tax on income between £37,700 and £125,140, and 45% tax on income above £125,140:

In terms of crypto taxes, this country does not seek capital gains taxes on profits from crypto or other investments. Further, most crypto transactions here are not subjected to income tax either, the only exception being professional traders and businesses earning crypto part of their income.

Profits from crypto investments held for at least a year are tax-free in Portugal. However, short-term crypto investments are taxed at a rate of 28%, and profits from activities like crypto staking, mining, airdrops, and more are taxed as usual income.

The first ever country to accept Bitcoin as legal tender, El Salvador is pro crypto, and their crypto tax rules reflect that attitude. Crypto transactions are not taxed in the country, and businesses are taxed on their crypto profits similarly to ordinary income.

Hong Kong has run ahead of the pack in the Asian crypto landscape and introduced a crypto licensing regime for businesses operating in the space, ensuring a pro-crypto atmosphere that favours innovation while protecting users. Crypto investors in the region are not weighed down by capital gains taxes, and professional traders and corporations earning crypto are subject to income tax.

There are other countries like Switzerland and Germany that do not charge capital gains taxes on crypto, and only count income from activities like mining, airdrops, staking, and wages earned in crypto as taxable income. Moreover, Belarus is offering essentially a tax holiday for all crypto transactions until January 1, 2025, meaning neither capital gains taxes nor income taxes are going to be levied on crypto transactions and profits.

Now, let’s compare crypto tax in India to the aforementioned crypto tax rules.

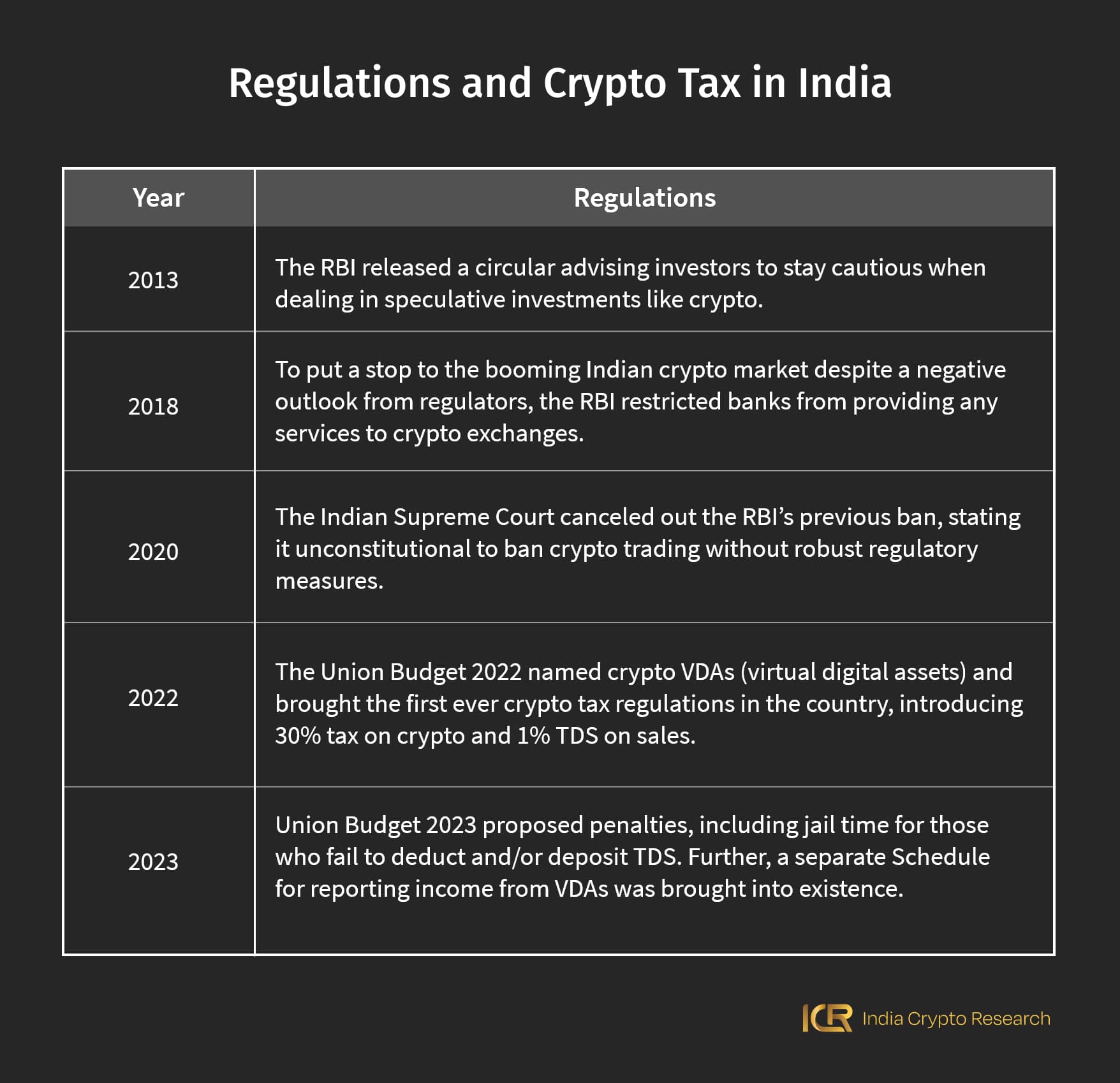

Taxes on crypto in India were first clarified in the 2022 Budget, where cryptocurrencies were defined as VDAs or virtual digital assets.

Crypto taxes in India are the same for both short and long-term profits. Crypto trades, sales, and swaps are therefore all taxed at a 30% + 4% cess, regardless of the income being capital gains or regular income.

TDS is deducted at the source when crypto traders and investors execute a transaction. In a peer-to-peer scenario or while trading on a foreign exchange, a buyer has to take out the TDS amount and send it across to the Indian central government (by filling ITR form 26QE or 26Q), forwarding the balance to the seller.

If a crypto transaction is carried out on an Indian exchange, the platform is responsible for subtracting the TDS and sending the balance to the seller.

In the case of a virtual digital asset to a virtual digital asset transaction, the TDS will apply to both the buyer and the seller at the rate of 1%.

Like we said, any crypto gains are taxed at 30% with a 4% surcharge, and salarymen are no exception. Any salary drawn in crypto is taxed at those rates.

Here’s a look at how different types of transactions are subject to crypto tax in India:

If you participate in crypto staking, crypto tax in India applies to the interest you earn. Your income will be taxed at 30% once again, with a 4% surcharge. Further, when you sell your base assets, you will again be taxed at 30% as a capital gains tax, with a 4% cess.

However, crypto funds moved between wallets do not come under taxation on crypto.

As per crypto taxes in India, income from crypto mining is taxed at 30% again. The cost of acquisition for crypto mining will be considered zero, which means electricity costs, infra costs, and more can not be included.

Once again, crypto airdrops are taxed at 30% as per crypto tax India policies.

Crypto gifts received are taxed as ‘income from other sources’ in the usual income tax slabs when the total value of the gifts is over 50,000. However, any crypto gifts received from relatives are considered tax-exempt, and crypto from non-relatives is considered taxable income. Gifts received in crypto through inheritance, wills, and other similar situations are considered tax-exempt as well.

As the rules suggest, any loss from VDAs can not be set off against other income. Therefore, if one invests 50% of their portfolio in Solana (SOL) and 50% in Bitcoin (BTC), and makes a loss of 20% in the former and a gain of 20% in the latter, the losses incurred in the former can not be set off against the profits in the latter.

Especially compared to the crypto tax-free countries we mentioned above, crypto rules in India are stringent to say the least. But our country is slowly warming up to the concept of crypto, and the existing crypto tax rules form part of a bigger whole when it comes to proper crypto regulations in India. Instead of losing patience, it’s time to sit tight as the blockchain landscape in India flourishes and regulators parse out the fundamental value of crypto.

The launch of a CBDC in India is another frontier that proves the inherent worth of blockchain-based, tokenised transactions. During India’s G20 Presidency in 2023, participating countries already agreed on a coordinated regulatory approach for crypto across borders, adding hope for positive intra-country regulations in India. However excruciating the wait may be, the slow but steady does win the race in the end, right?

Stay tuned India Crypto Research module Crypto 101 for more insights into the Indian and international crypto space!

India Crypto Research operates independently. The information presented herein is intended solely for educational and informational purposes and should not be construed as financial advice. Before making any financial decisions, it's essential to undertake your own thorough research and analysis. If you're uncertain about any financial matters, we strongly recommend seeking guidance from an impartial financial advisor.