Example Workflow

Conclusion

They said DeFi can replace Banks. Blockchains are capable of removing the intermediaries. If this is actually happening you must be wondering how. In this blog we will walk you through how one of the core functions of DeFi (Decentralised Finance) - “Lending and Borrowing” works.

In Banks, customers deposit funds that Banks use to further lend to customers. Customers guarantee payback of the borrowed money by pledging a collateral of similar value, such as a house (real estate), gold (commodity), stocks (securities). In case, the borrower fails to repay, the Bank can Liquidate (sell) the collateral and cover up for the losses.

Similarly, in DeFi, borrowers borrow money from lenders who lock funds into a protocol’s smart contract and pledge an acceptable cryptocurrency of similar value as collateral by locking it into the protocol. In case the borrower fails to payback the collateral will be automatically liquidated to pay back the lender.

Let us take a closer look at Lending and Borrowing with an example of a DeFi Protocol such as AAVE.

There are two types of customers for AAVE to cater to:

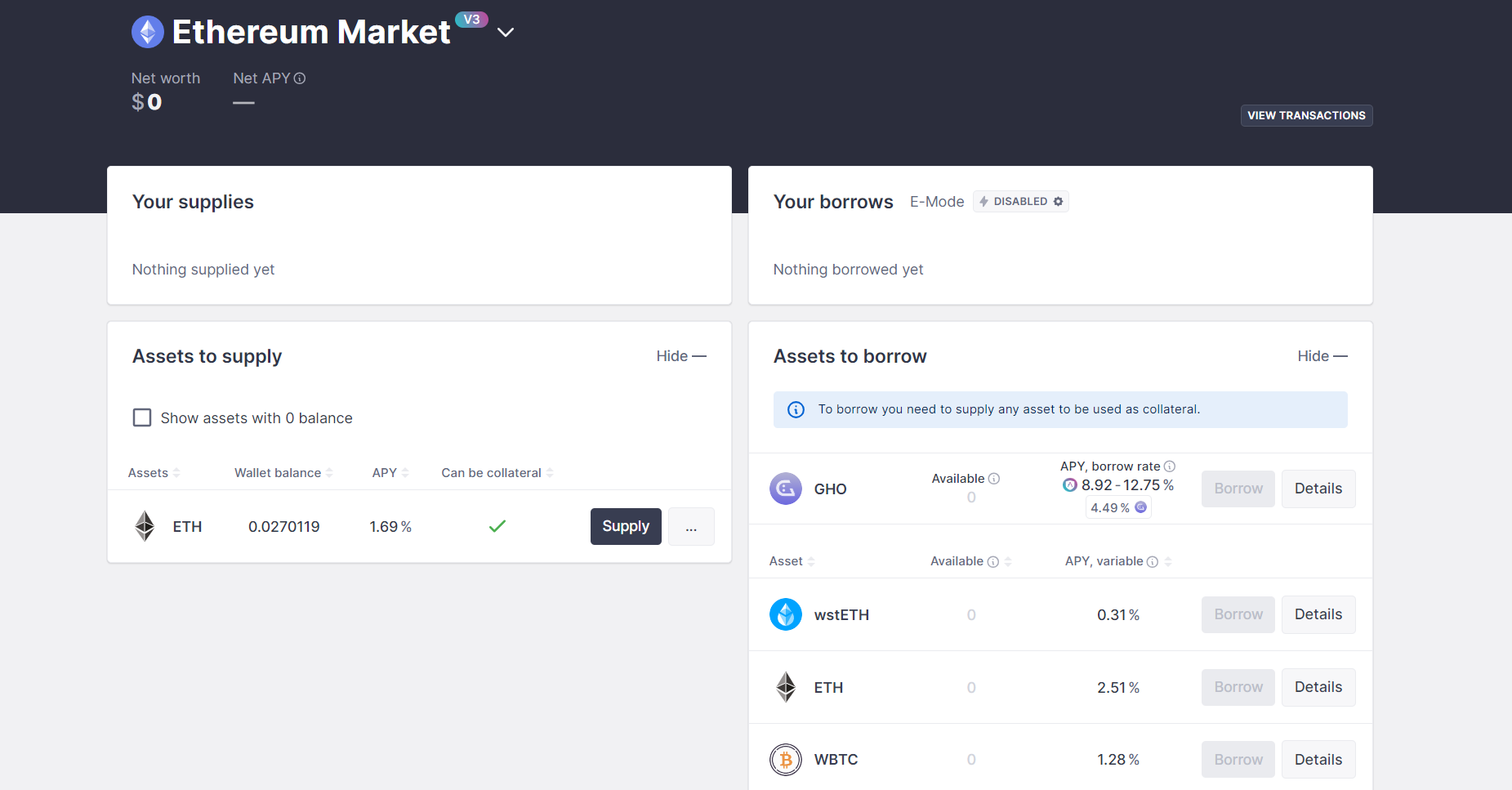

Lenders connect their crypto wallet to the protocol and whatever funds they have will show under assets to supply. Refer to our blog on Using Crypto Wallets. Observe the APY that AAVE is offering at 1.69%. APY (Annual Percentage Yield) is the interest rate the lender will earn for depositing or supplying the funds.

For example, if the lender supplies 5 ETH, at the end of the year he/she will receive 0.0845 ETH as earnings. This percentage depends on the supply demand and is usually different for different cryptocurrencies.

Once the lender confirms the deposit, AAVE will further lend that crypto to borrowers who need it at a higher interest rate. For example, AAVE lends ETH at 2.51%. This is how AAVE makes money. According to Defillama, AAVE has an annualized revenue of over $80 million.

Borrowers also connect their wallets to borrow funds. A borrower will first have to supply funds that act as collateral. The difference between clicking on supply as a borrower and a lender is that the lender will receive the APY since those funds will not be used as collateral for borrowing in the future.

Say the borrower wants to borrow USDT against 5 ETH collateral. The APY as of June 8, 2024, is 8.89%. The borrower will have to pay an interest of 8.89% yearly in USDT against the sum he/she borrows, that will be automatically distributed to the lender.

All this can happen without any documentation, KYC, credit score checks or phone calls. Hence an intermediary such as a Bank is not required! A piece of code or a smart contract can take care of all the delegation of funds. In case the borrower fails to repay, AAVE smart contract can simply liquidate the collateral and pay back the lenders.

All this sounds so cool, but nothing cool comes without risks. The crypto market is highly volatile. For example, ETH over a year ago was $1,000 and today it sits at $3,700. What if today I borrow 3,700 USDT against 1 ETH and ETH prices go back down to $1,000 in 4 months?

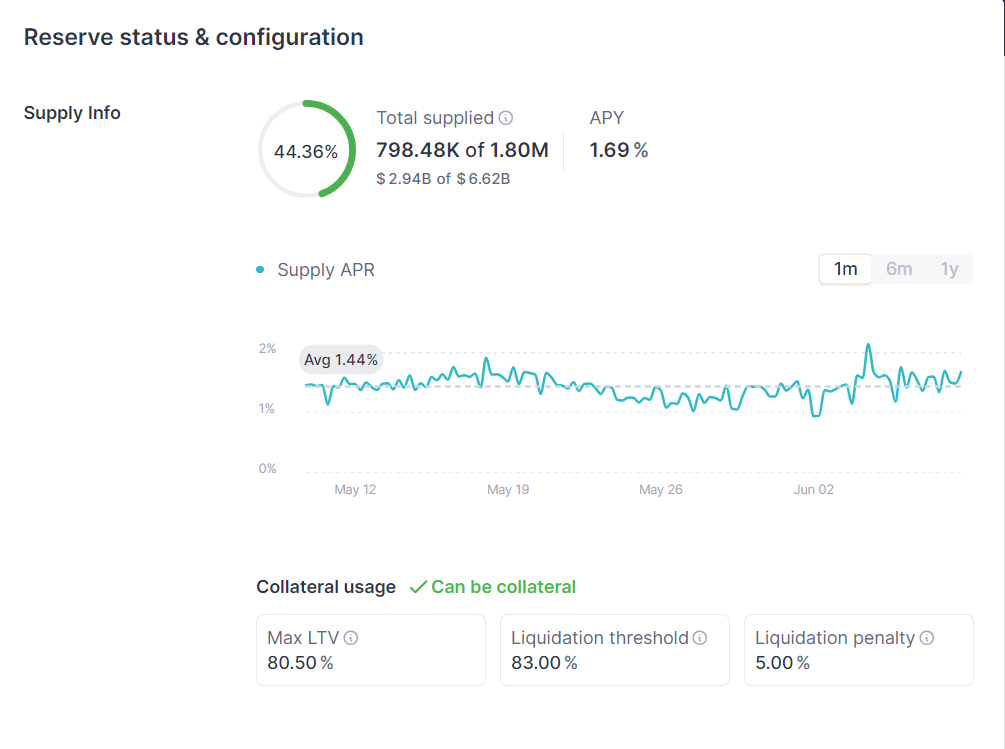

There is no incentive then for me as borrower to pay back the loan since he would be willing to let go of the collateral. Crypto price volatility is a huge problem for DeFi. Let’s have a look at how AAVE handles these problems. By clicking on Details of ETH borrowing, the below is what shows up:

Here observe the rules on collateral usage.

To avoid getting liquidated, borrowers can keep the position open by supplying more funds.

If you are curious, check how Three Arrows Capital got liquidated on AAVE with more than $250 million of funds in AAVE.

The road ahead for DeFi is still filled with challenges that include bugs in smart contracts leading to hacks, complexity of off-chain processes such as document verification, regulations, taxations, non-acceptance from governments, and price volatility among cryptocurrencies.

A lot is being built in the DeFi space that is slowly trying to solve these problems but only perfecting on-chain and protocol software will not be enough.

For example, there is no way to keep a house as collateral to borrow crypto from DeFi protocols today. In case a house is tokenized, there could be a way to implement it in the future. Government regulations and taxations should work in sync to truly eliminate the need of Banks. There is still a long way to go!

India Crypto Research operates independently. The information presented herein is intended solely for educational and informational purposes and should not be construed as financial advice. Before making any financial decisions, it's essential to undertake your own thorough research and analysis. If you're uncertain about any financial matters, we strongly recommend seeking guidance from an impartial financial advisor.