The potential of crypto

How to buy a cryptocurrency in India: Avenues

Tax laws in India for crypto investments

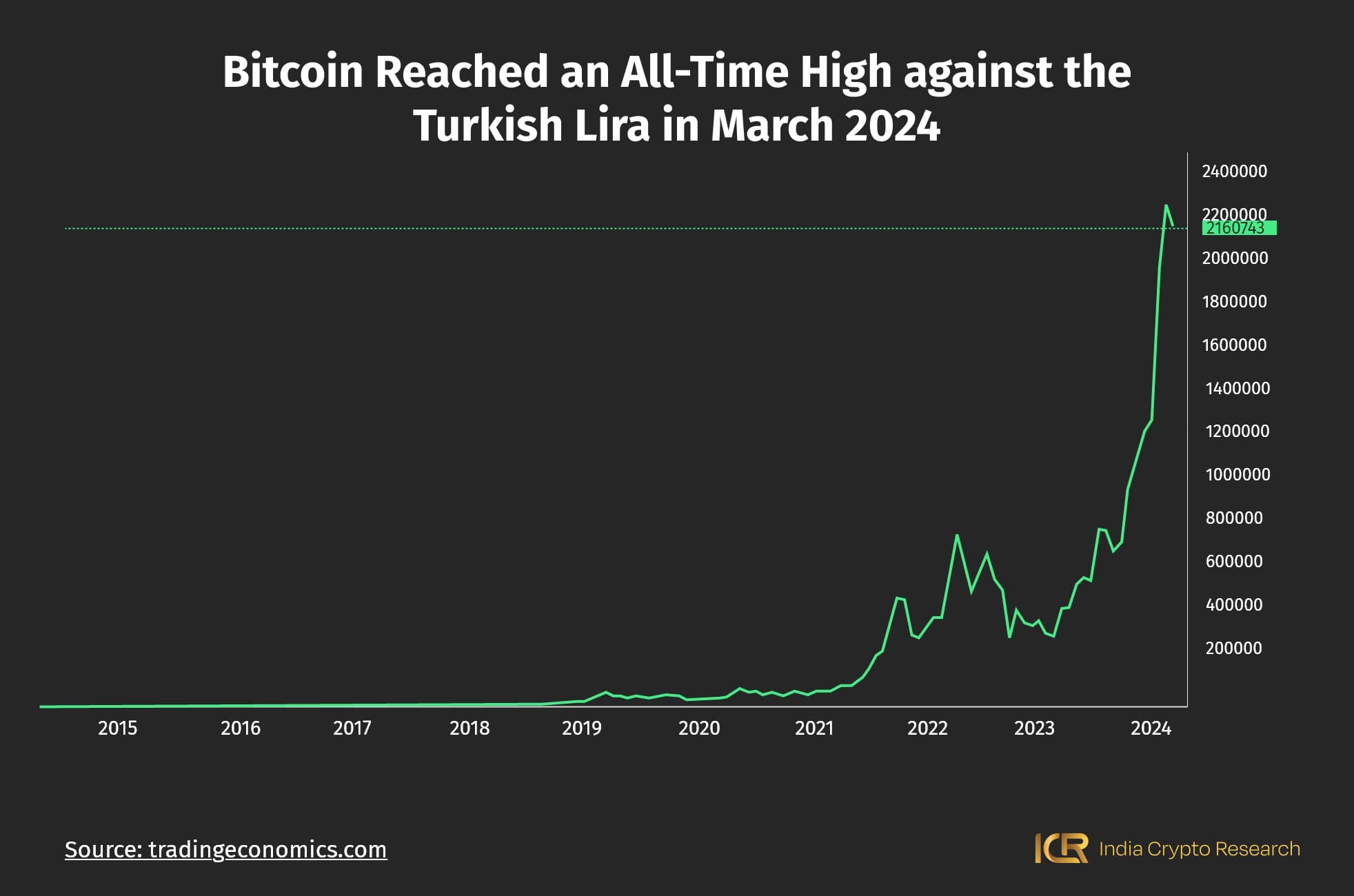

If you had bought one bitcoin for around $10 dollars in 2012, it would be valued at around $70,000 in March 2024. This growth curve over just twelve years is plain insane, right?

Now, you are someone who has heard plenty about how cryptocurrency in India is the future, and is finally ready to put a part of your savings into virtual assets; there’s just one problem, you are not sure where to start. Well, if how can I buy any cryptocurrency in India is your question, we have answers.

Before you begin to understand how to buy any cryptocurrency in India though, you have to put the potential returns and the tax obligations against each other, so you’re entirely aware of what you’re getting into.

Let’s start there.

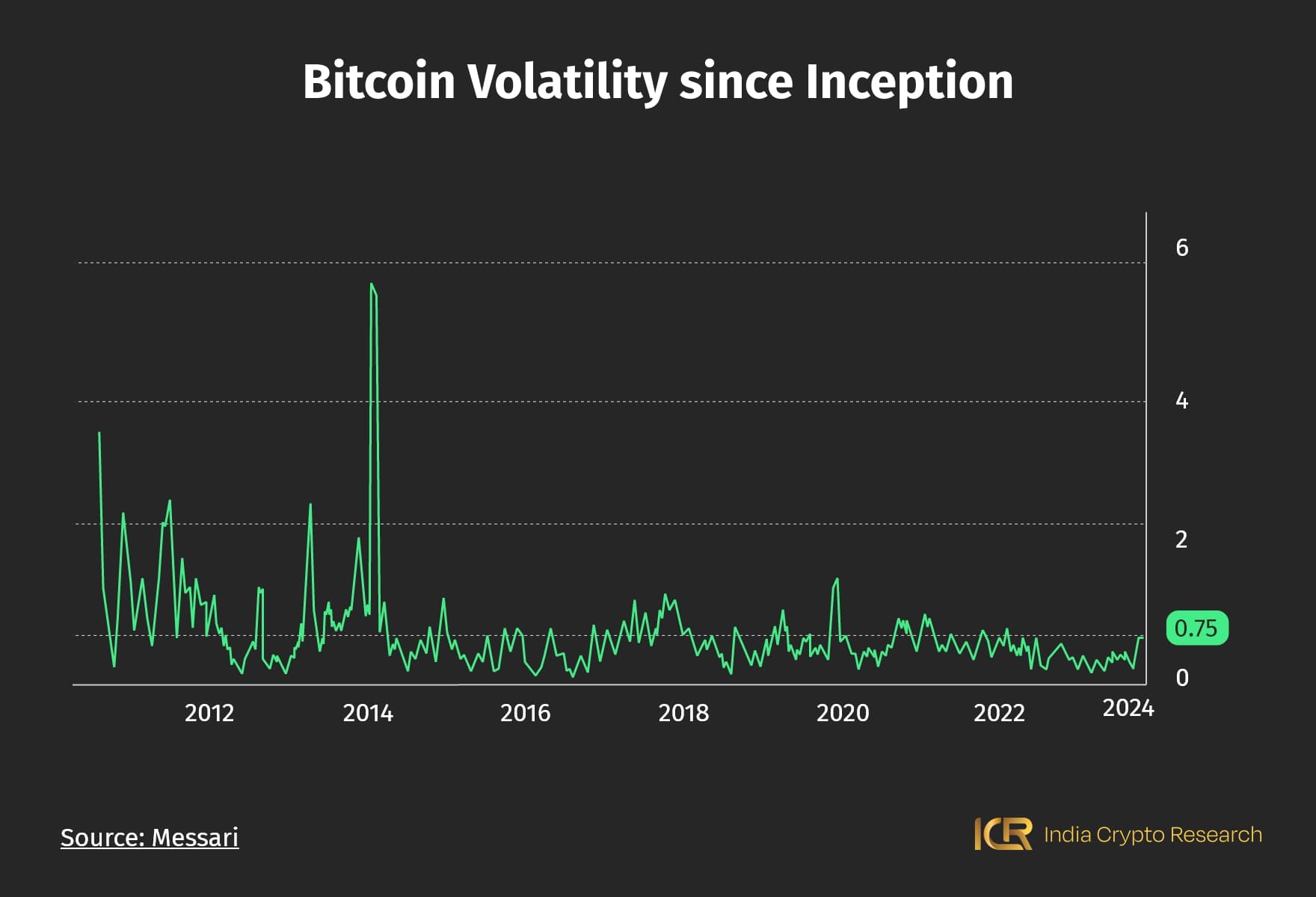

When we say crypto, it’s natural for Bitcoin to pop into your mind immediately - after all, many of us see Bitcoin synonymously with the entire crypto space. ‘How to invest in bitcoins in India?’ is a commonly searched phrase online. Let’s take a look at the potential:

The easiest way to buy crypto coin in India is through crypto exchanges. There are both centralised and decentralised options available for you- with differing benefits. The centralised exchanges provide a UX similar to web2 stock trading platforms, but in exchange, they take control over your assets, so you still need someone to approve your transactions.

Decentralised exchanges on the other hand allow you to transact and extract however you want, but there is no hand holding at all. You are solely responsible for your assets, and the UX can be complex, as web3 has not become completely user-friendly just yet.

If you ask us, for a beginner, a centralised platform may be a better option just because it lends you a bit of familiarity before you navigate unknown waters. As for how to buy a cryptocurrency in India through these platforms, here’s a quick step-by-step guide for you!

To keep your crypto secure, you need to know exactly how to safeguard them. Well, we have tips for you here too:

Just knowing how to buy any kind of cryptocurrency in India is not enough; you need to learn about storing your crypto as well. On centralised exchanges, you do not possess complete control over your assets. So any issues in a company’s management and any wrong actions on their end can put your investments in jeopardy, as happened with Vauld investors after they failed to recognise the market turn from bull to bear.

It is essential as a rule to trust only those centralised exchanges who make their proof of reserves publicly available information.

Further, some globally renowned centralised platforms like Binance, Kucoin, and OKX are now banned in India as they have failed to comply with money laundering laws, registration, and tax rules in the country. This is another lesson for you- only choose a centralised exchange after thorough research on its background and compliance with Indian laws.

In the decentralised world, there’s a common saying - Not Your Keys, Not Your Crypto.

This basically means that either you store your crypto by yourself in a wallet only you know the private key for (crypto wallets are secured by a pair of keys, private key for transaction authorisation and accessing your wallet, and public key to be shared with others to receive transactions), or you stand to lose your earning.

By this principle, even when you trade frequently on a centralised exchange, you should move your long term holding crypto portfolio to another wallet owned by you.

The final step to know before you start buying/investing in cryptocurrency in India is the relevant tax laws you have to abide by. Do read our detailed blog on crypto tax in India, but here’s a quick overview for you:

Now you have a comprehensive idea of the benefits you get out of investing in crypto, vs. the tax laws. Have you made up your mind? Well then, it’s finally time to start; but let us reiterate: always do your own research before making any investment decision.

Well, that was it from us on ‘how to buy a cryptocurrency in India.’ For more insights into the world of crypto, keep following the India Crypto Research blog!

India Crypto Research operates independently. The information presented herein is intended solely for educational and informational purposes and should not be construed as financial advice. Before making any financial decisions, it's essential to undertake your own thorough research and analysis. If you're uncertain about any financial matters, we strongly recommend seeking guidance from an impartial financial advisor.