What is digital gold?

Is Bitcoin universally accepted?

Valuation of Bitcoin

Bitcoin as an inflation hedge

Bitcoin has been touted as digital gold right since its earliest years. There are three primary reasons for this:

We’re not here to debate the first two - basic and unimaginative as they are, pardon us - but we certainly have a lot to discuss if we’re going to compare Bitcoin to gold as an asset class.

So, is Bitcoin digital gold? What is digital gold, anyway? Our take lies ahead.

What can be accepted as a digital gold currency? To know the answer, we have to first know why gold is so valuable and reliable.

Therefore, a digital gold currency or a gold crypto coin would possess these characteristics too. As it happens, BTC satisfies all four of these aforementioned conditions, which justifies the Bitcoin digital gold title.

Or does it? We don’t like such simple victories, so let’s dig deeper.

A great question in the cryptocurrency vs gold debate, and the answer is no, not just yet. Bitcoin is only 15 years old as an asset class, and within this time it has broken into the top 10 assets by market capitalization across the world and was even the best performing asset of the last decade.

Even though most governments and regulatory bodies speculate on its viability as an asset class and raise the question of BTC facilitating money laundering and funding other illegal activities, it’s a fair argument that Bitcoin is well on its way to universal acceptance. The reason? Retail and institutional adoption grows every year, and the US has even recently approved BTC spot ETFs, implying a positive stance and setting an example for the rest of the world.

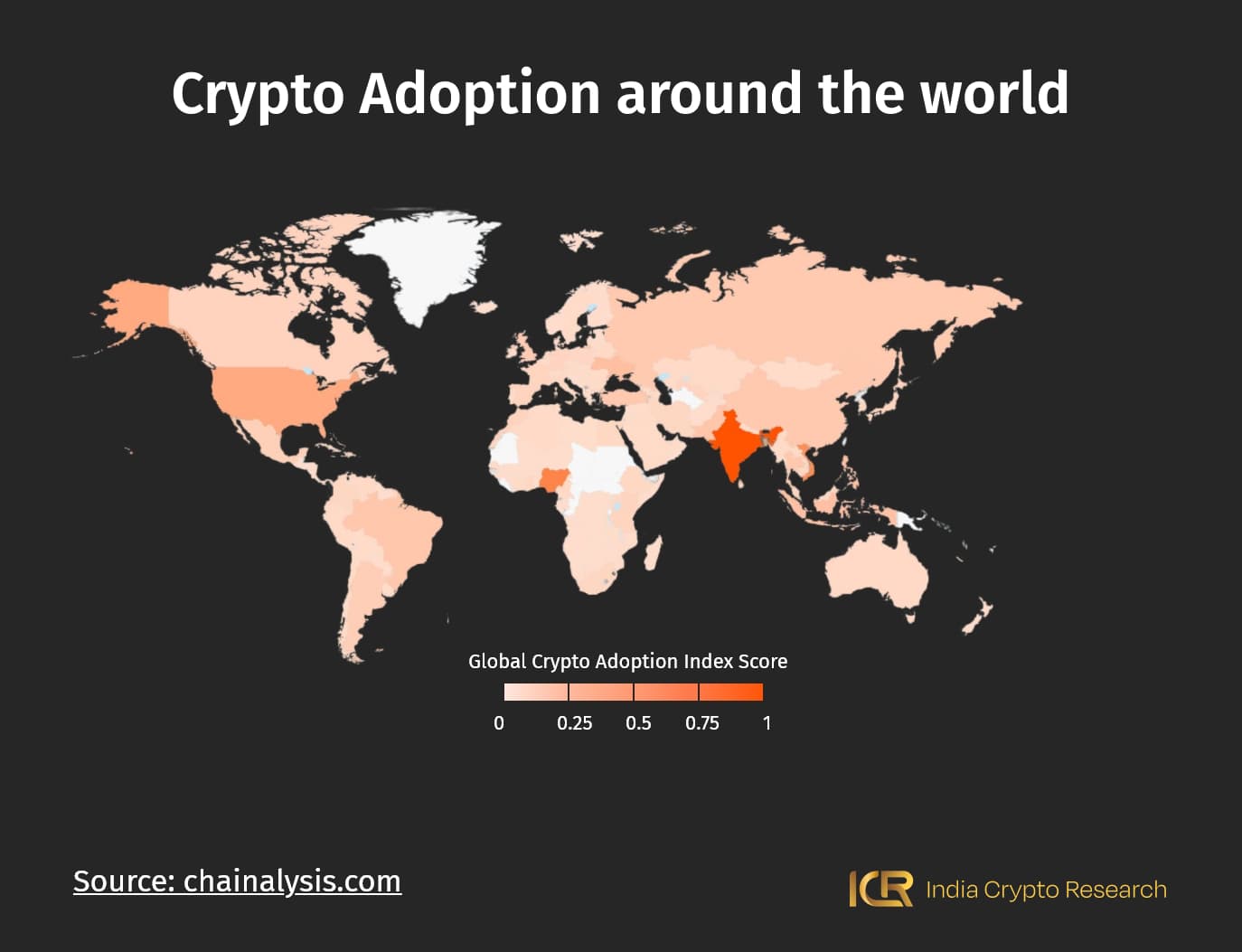

Breaking it down further, Bitcoin and crypto at large is yet to achieve regulatory oversight in many countries, which keeps many away from it. However, adoption at the grassroots level has still grown over the years, with a majority of countries around the world adopting crypto to some extent.

In the chart below from Chainalysis Global Crypto Adoption Index, any countries scoring above 0 have adopted crypto at the grassroots level, which in the gold vs cryptocurrency debate means crypto like Bitcoin (as it is the most popular and most widely accessible one with all crypto exchanges having it) are nearing widespread adoption across borders.

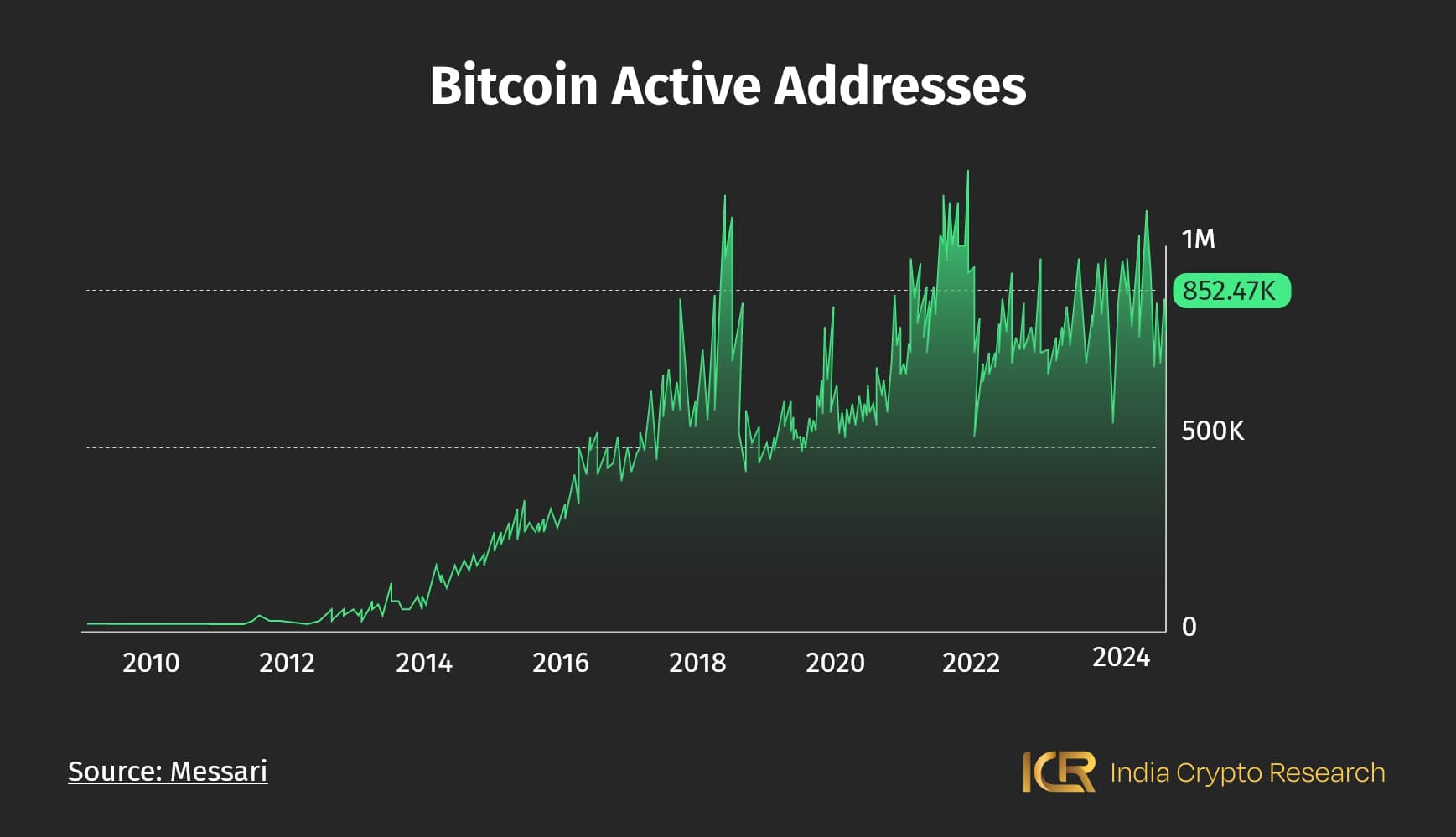

We have collected data from Messari regarding the active address count for Bitcoin since its inception; as you can see, the numbers have mostly set an upward trajectory, which again proves Bitcoin is becoming widely accepted.

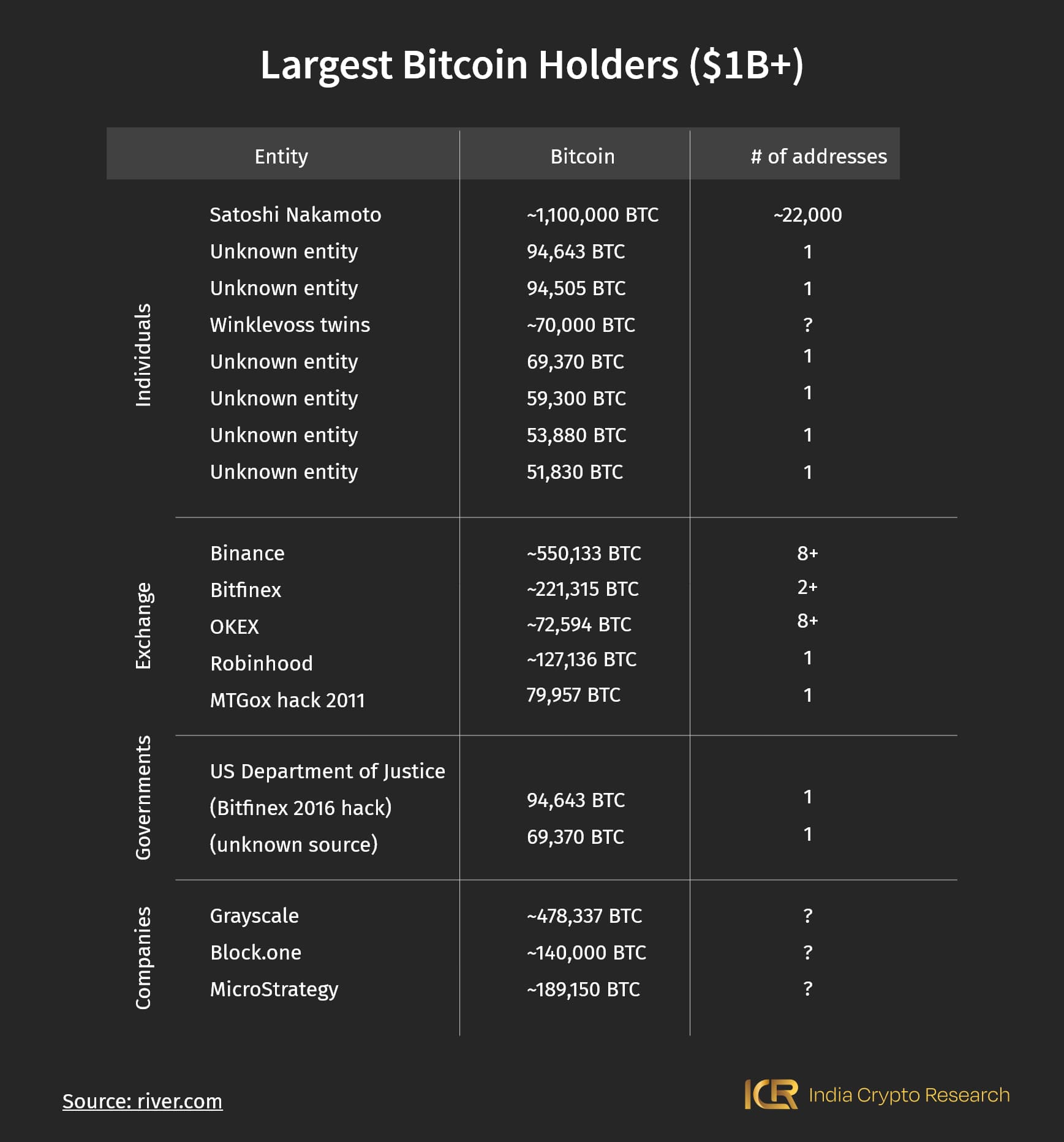

While we’re at it, there are a couple of concerns to be addressed for Bitcoin to become a digital gold currency. Firstly, out of the 19 million+ bitcoins out in circulation so far, a good percentage is held by large holders also known as whales (i.e. anyone holding over 10,000 bitcoins). This means a good part of mined BTC is held by a handful of individuals, whose movements cause significant price shifts.

The concentration of wealth and power could change over time as the market evolves and more people adopt Bitcoin, and the decentralised nature of the Bitcoin network is certain to serve as a safeguard against concentration in the long term.

There’s another concern that can be solved by wider and more diversified Bitcoin holdings: a good chunk of Bitcoin is inactive or lost. For instance, Satoshi Nakamoto is the biggest Bitcoin whale according to the image above, but the BTC held by them has been inactive since they vanished in 2010.

There are also bitcoins lost due to a loss of private keys, or sent to burn addresses to be removed from circulation. All of these inactive bitcoins amount up to 4 million, and if they enter circulation again, it may drive up Bitcoin’s volatility.

Here’s how the Bitcoin digital gold promise can be fulfilled through broader adoption:

Both Bitcoin and gold are assets with a limited supply. Gold’s market capitalisation is currently around $13.74 trillion, while Bitcoin has around $1 trillion as of the end of February 2024. There are similar factors responsible for both assets’ valuation, namely:

However, there’s another key factor that drives up both of these assets’ prices, directly coalescing with our previous topic of discussion: widespread adoption of the technology/ value proposition. This one singular factor may bring Bitcoin up to `par with gold as the ‘digital gold’ in the near future.

One of the key roles Bitcoin has played thus far has been that of a store of value and an inflation hedge. Its limited supply keeps it safe from the inflationary pressures traditional assets put up with, the same being true for gold.

A $1 saved in 2010 would have lost 8.7% of its value by 2015, nearly 19% of its value by 2020, and a whopping 41% of its value by 2024, according to US CPI data. In other words - you’d need your savings or investments to grow by 41% over this last decade and a half simply to break even.

Gold has struggled to deliver on this front. Its 2010 high of about $1430/oz, was lost soon and only reclaimed in 2019. As of Q1 2024, it trades at $2030 - having delivered gains of exactly 41%.

Bitcoin, on the other hand, is one of the best-performing assets in history - having gone from $2 in late 2011 to over $50,000 in 2024 - those are 2,500,000% gains.

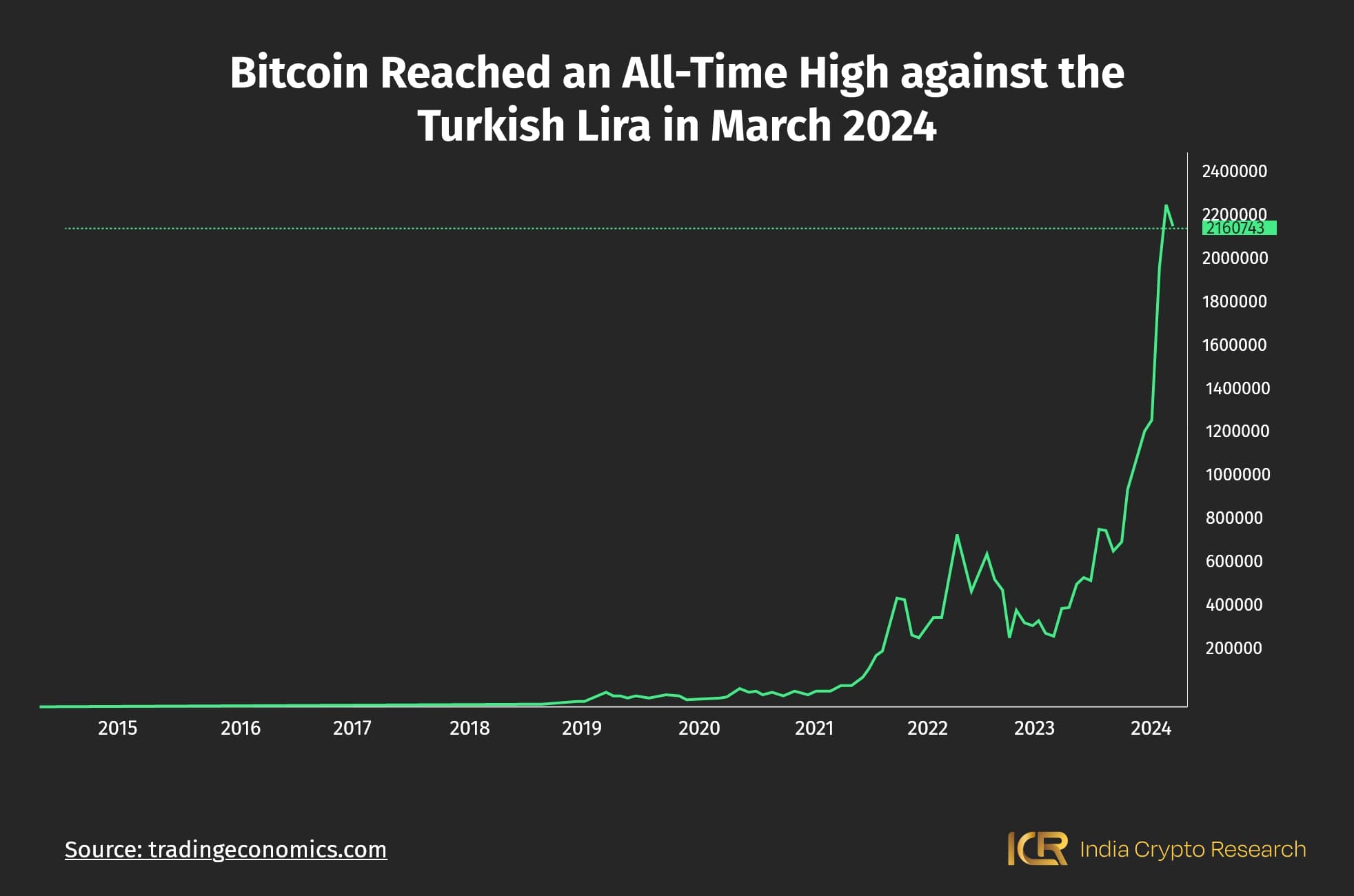

Further, countries that have dealt with hyperinflation in the recent past like Venezuela have found Bitcoin to be a pretty stable store of value. The technology itself has been a big reason for Bitcoin’s adoption- decentralised, peer-to-peer transactions are critical in an economy fraught with inflation.

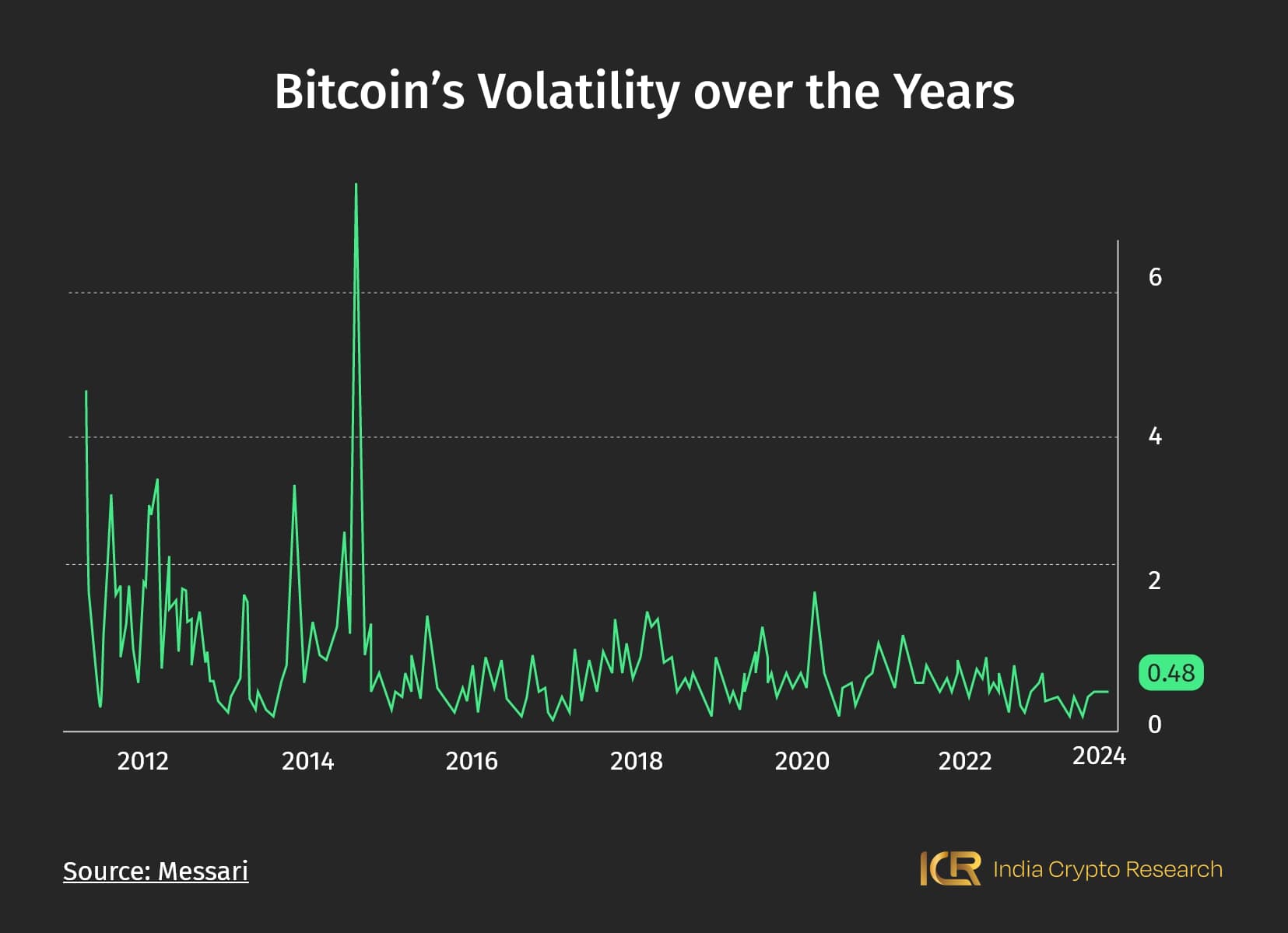

Bitcoin’s signature volatility has been a concern for some investors when it comes to BTC’s position as a store of value, which is not the case for gold. However, Bitcoin has been stabilising, especially as Bitcoin spot ETFs in the US and across the world now lower the entry barrier into crypto for traditional investors. Take a look at the chart below, and you’ll see a tapering out volatility for Bitcoin.

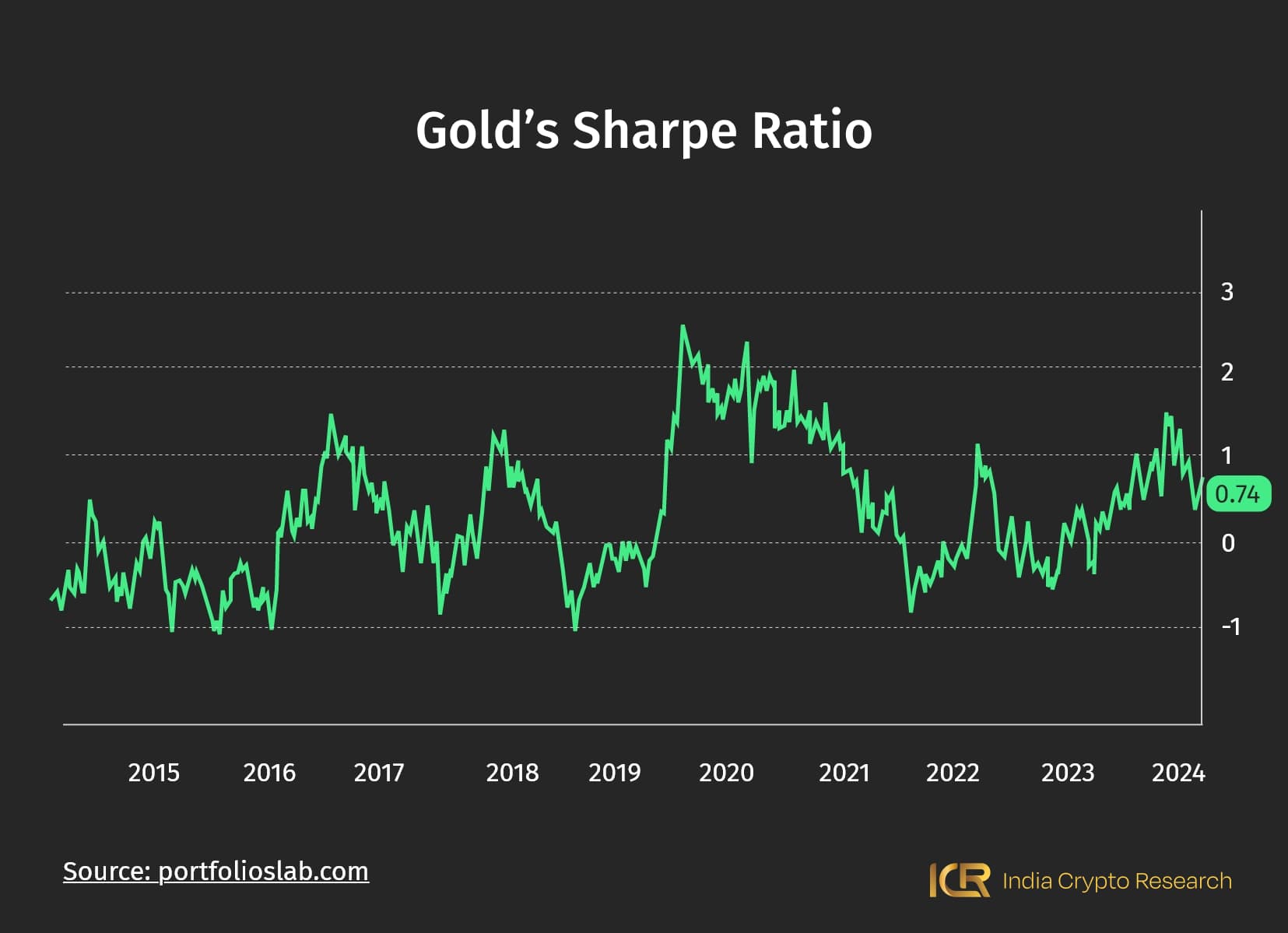

The sharpe ratio is a good indicator to gauge the risk-adjusted performance of an asset. It basically sums up the returns vs. per unit of volatility, showing how efficient an investment is. A higher Sharpe ratio shows the potential for higher profits from an asset compensates for the associated volatility. The current Sharpe ratio for gold is 0.74.

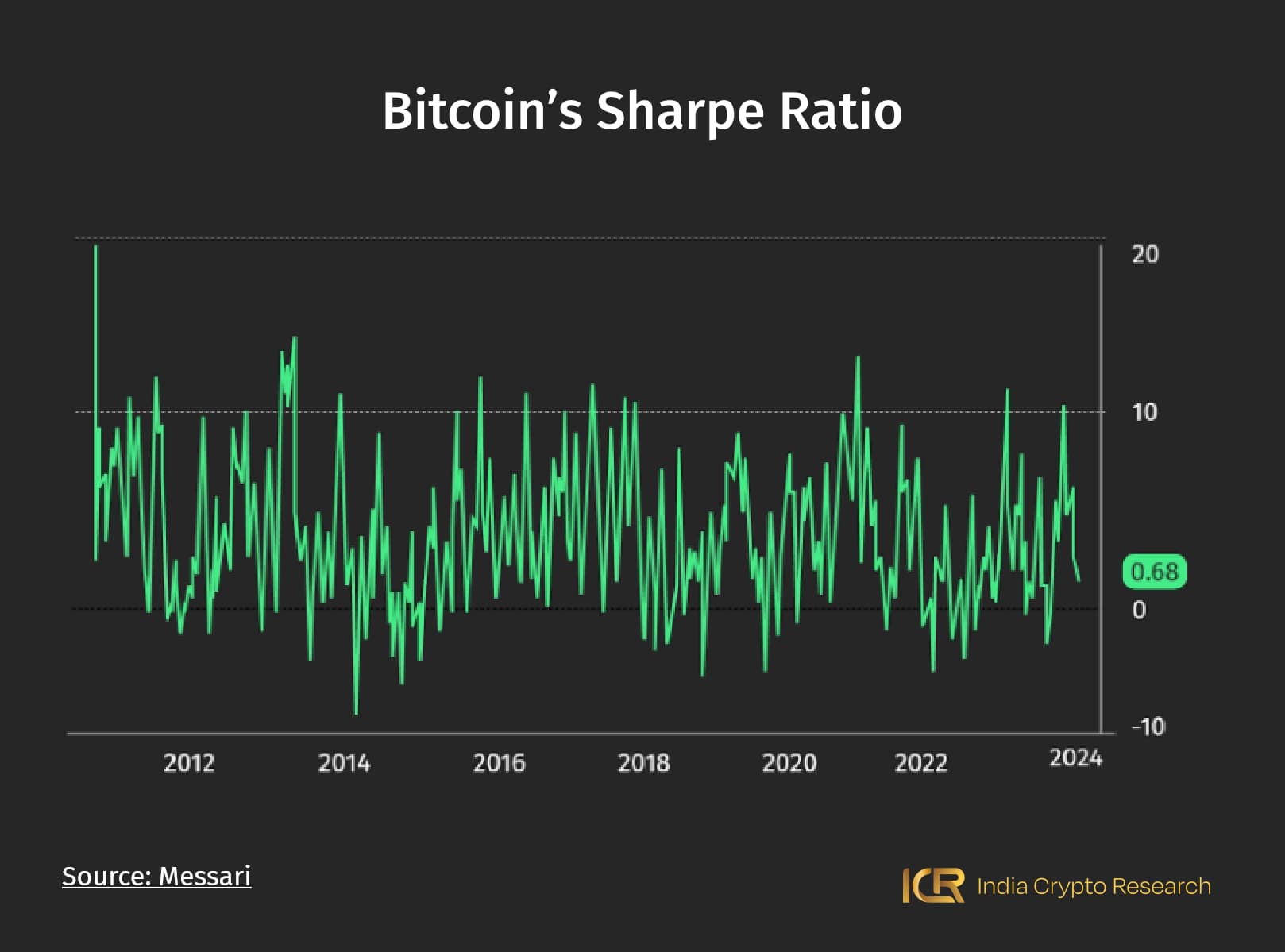

Meanwhile, the current Sharpe ratio for Bitcoin is 0.68, bringing it almost shoulder to shoulder with gold.

Therefore, Bitcoin is slowly but most certainly becoming a gold crypto coin, thus bringing our discussion today to an end.

Stay hooked on India Crypto Research module Bitcoin: the Basics for more!

India Crypto Research operates independently. The information presented herein is intended solely for educational and informational purposes and should not be construed as financial advice. Before making any financial decisions, it's essential to undertake your own thorough research and analysis. If you're uncertain about any financial matters, we strongly recommend seeking guidance from an impartial financial advisor.