What Is a Crypto-Backed Loan?

How Crypto-Backed Loans Work in Practice

What Happens to Your Loan When Crypto Prices Fall

Who Offers Crypto-Backed Loans

What Is The Tax Treatment of Crypto Loans

Additional Risks You Must Consider

Putting It All Together

FAQs

For most crypto investors, accessing capital usually requires selling their assets. However, there is another way to raise money without selling your crypto, which is by borrowing against your crypto holdings.

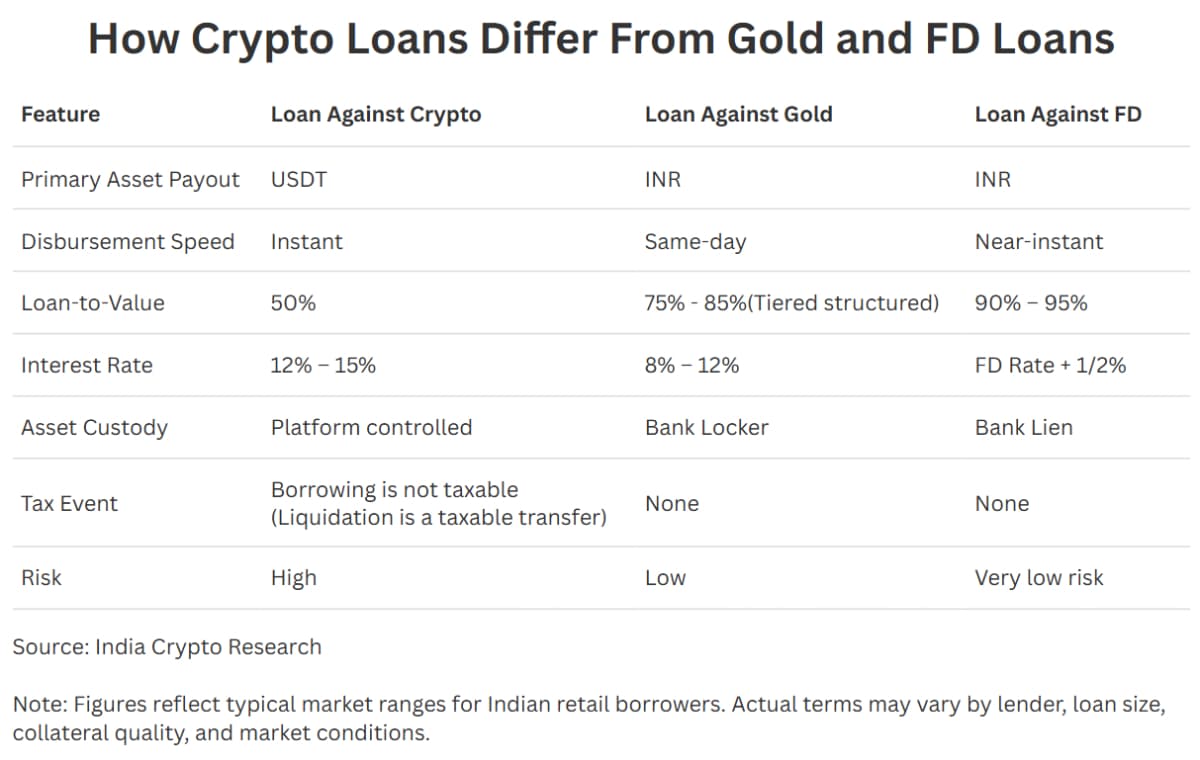

Similar to a loan against gold or shares, crypto-backed loans allow investors to pledge assets like Bitcoin or Ethereum as collateral to raise funds while staying exposed to future gains.

A crypto-backed loan is a secured loan where crypto assets are locked in as collateral to access liquidity, usually in the form of stablecoins or, in some cases, fiat currency.

As long as the loan conditions are met, the borrower has exposure to the asset, and the investment thesis remains unchanged unless liquidation takes place.

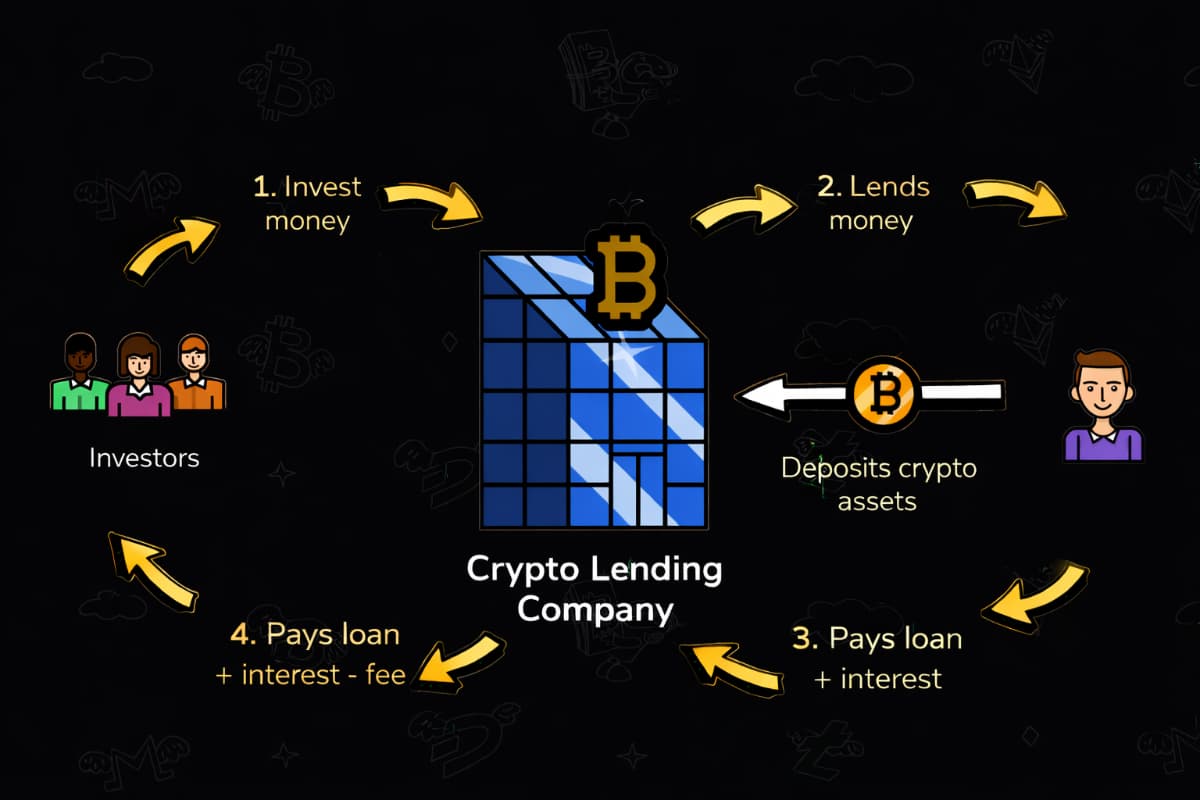

Borrowing against crypto involves a secured arrangement where the value of the collateral and associated risk are constantly monitored.

You start by depositing crypto such as Bitcoin or Ethereum into a lending platform. If it's a centralised platform, the assets are held in the platform’s custody. If it's a decentralised platform, the assets are locked in smart contracts. The collateral remains locked till the loan is paid, though the borrower still has economic exposure to the asset.

The Loan-to-Value ratio (LTV) is set by each platform, which decides how much you can borrow against your collateral. If you deposit ₹10 lakh worth of Bitcoin and the LTV ratio is 50%, your borrowing limit will be ₹5 lakh.

Once the loan is issued, the borrower receives funds, typically in stablecoins or in fiat currency. From that point, interest begins, and the platform tracks the collateral value relative to the loan.

This is where crypto-backed loans differ from traditional loans. As crypto prices fluctuate, the risk profile of the loan also changes in real time, and any fall in collateral value will increase the effective LTV ratio.

For example, an investor deposits ₹10 lakh of Bitcoin and borrows ₹5 lakh at a 50% LTV. If Bitcoin falls by 25%, the collateral value drops to ₹7.5 lakh, and the LTV rises to around 66%.

When the LTV ratio goes above the limit, the borrower receives a margin call to bring the ratio back within a safe limit or repay part of the loan to maintain a safer ratio. If the collateral continues to fall and the LTV ratio exceeds the liquidation threshold, then the lender can liquidate a portion or all of the collateral to recover the loan amount.

The purpose of these mechanisms is to safeguard lenders against default. Borrowers, on the other hand, face the risk of liquidation when markets decline.

Crypto-backed loans operate through either centralised platforms or decentralised platforms. Both allow investors to borrow against crypto, but the way risk is managed and who bears it differs.

Centralised platforms operate like digital lenders. They hold custody of the collateral, define loan terms, monitor risk, and execute liquidations when required. The experience is similar to dealing with a financial institution, with interfaces, customer support, and set policies. Examples include Nexo, Ledn, and Amina Bank.

The primary risks in CeFi are institutional rather than technical, as borrowers have to depend on the platform’s custody and their internal risk management system. Platform agreements may allow the rehypothecation of collateral, meaning it can be redeployed within the platform’s balance sheet. In times of market stress, users remain vulnerable to sudden policy shifts, withdrawal restrictions, and system failures.

In short, CeFi prioritises convenience and simplicity, but requires trust in the institution behind the service.

In DeFi, all loans are facilitated through smart contracts on the blockchain, and there are no intermediaries. And because of this, all loan terms, from collateral metrics to interest rates, are governed by code and are visible on-chain. Examples include Aave and Compound.

The risks in DeFi are technical and market-driven. Borrowers have to depend on the security and operational reliability of the blockchain itself. Liquidations are automated and executed without discretion.

Unocoin, which is an Indian platform, has introduced lending structures that allow users to borrow against Bitcoin. The availability and structure might differ or change with time, so current details should be verified directly.

In India, gains from the transfer of Virtual Digital Assets (VDAs) are taxed at 30%, and a 1% TDS. But borrowing against crypto is not considered a transfer because the asset is not sold; it is just pledged. Thus, investors can obtain liquidity without incurring capital gains tax or TDS obligations.

However, if the crypto pledged as collateral is liquidated after exceeding the loan‑to‑value limits, the transaction will be considered a taxable transfer and will be subject to tax.

Crypto-backed loans are a way to access liquidity without selling crypto holdings. They involve trade-offs between flexibility and risk, including exposure to price volatility, liquidation mechanisms, and platform-related considerations.

For investors who use them, borrowing against crypto is primarily a liquidity decision. The outcome depends on how conservatively the loan is structured and how effectively risks are managed over time.

India Crypto Research operates independently. The information presented herein is intended solely for educational and informational purposes and should not be construed as financial advice. Before making any financial decisions, it's essential to undertake your own thorough research and analysis. If you're uncertain about any financial matters, we strongly recommend seeking guidance from an impartial financial advisor.