What are NFTs?

How is NFT different from regular crypto tokens?

Real world use cases of NFTs

The 2021-22 NFT madness

How to mint NFTs: mint an NFT on OpenSea in 3 steps

You may have heard of NFTs already, in the context of gaming and entertainment. The NFT full form is of course non-fungible tokens, which basically give you a unique asset on a blockchain that has no match. Since the Ethereum-based game CryptoKitties got popular in the late 2010s, NFTs have had their turn in the crypto spotlight, but you’d find many saying that popularity is fading now.

They would be dead wrong, of course. While the initial hype may have died down, NFTs have unprecedented potential to grant you ownership of value in the digital world. Our goal in this post is to give you a comprehensive look at NFTs today, and additionally tell you how to mint your own!

As we just mentioned, the meaning of an NFT is a non-fungible token, representing a unique digital item on blockchain. You may have heard the concept of NFTs primarily associated with the digital art and collectibles market, but it extends to other domains like virtual real estate, digital goods, and more.

Here are the three main components of a non-fungible token:

A dead giveaway is the name itself - an NFT cannot be replaced by another token of its own kind. An NFT’s hash is what makes it non-fungible, as no two NFTs can possess the same hash, and they often have varying value. On the other hand, your regular crypto tokens like bitcoins are fungible - so if you replaced one unit of bitcoin with another, there is no difference of value, characteristics, or anything else between the two units.

Distinctions not clear enough for your liking? A table is our favourite solution:

| NFT | Your average crypto |

| NFTs are unique and can not be exchanged for another NFT since they have distinct attributes and therefore different values as well. Basically, each NFT is one of a kind. | Each crypto token is identical to tokens of the same type. So one ETH token can be interchanged with another with no impact whatsoever. There are no X-factors to separate one from another. |

| NFTs are usually indivisible, so you can not own or trade a part or a fraction of these tokens natively at a Layer 1 infrastructure. Fractionalising NFTs is a pretty complex affair, and a custody solution and mapping layer on top of it might need to be implemented. | These are divisible, so you can own half or a smaller fraction of a crypto token. A wallet with 0.5 bitcoins is more than respectable, after all. |

| NFTs are handy in areas where you need to uniquely identify items and know that they are authentic. Therefore, beyond just in-game characters and artwork, they can secure your identity, certificates you earn, and even unique services or experiences. | Their usual purpose is to serve as a mode of payment, signify a stake in governance, and more. Overall, they are more geared towards financial applications. |

What does this all tell you? While both NFTs and regular crypto tokens are digital assets existing on a blockchain, their uniqueness, divisibility, and applications clearly set them apart.

Let’s expand upon that applications bit: where may you find NFTs being used?

Now, away from the NFT use cases, there’s quite a lot about the early 2020s NFT mania to know. Just for fun, here are some NFT sales bound to leave your jaw hanging open:

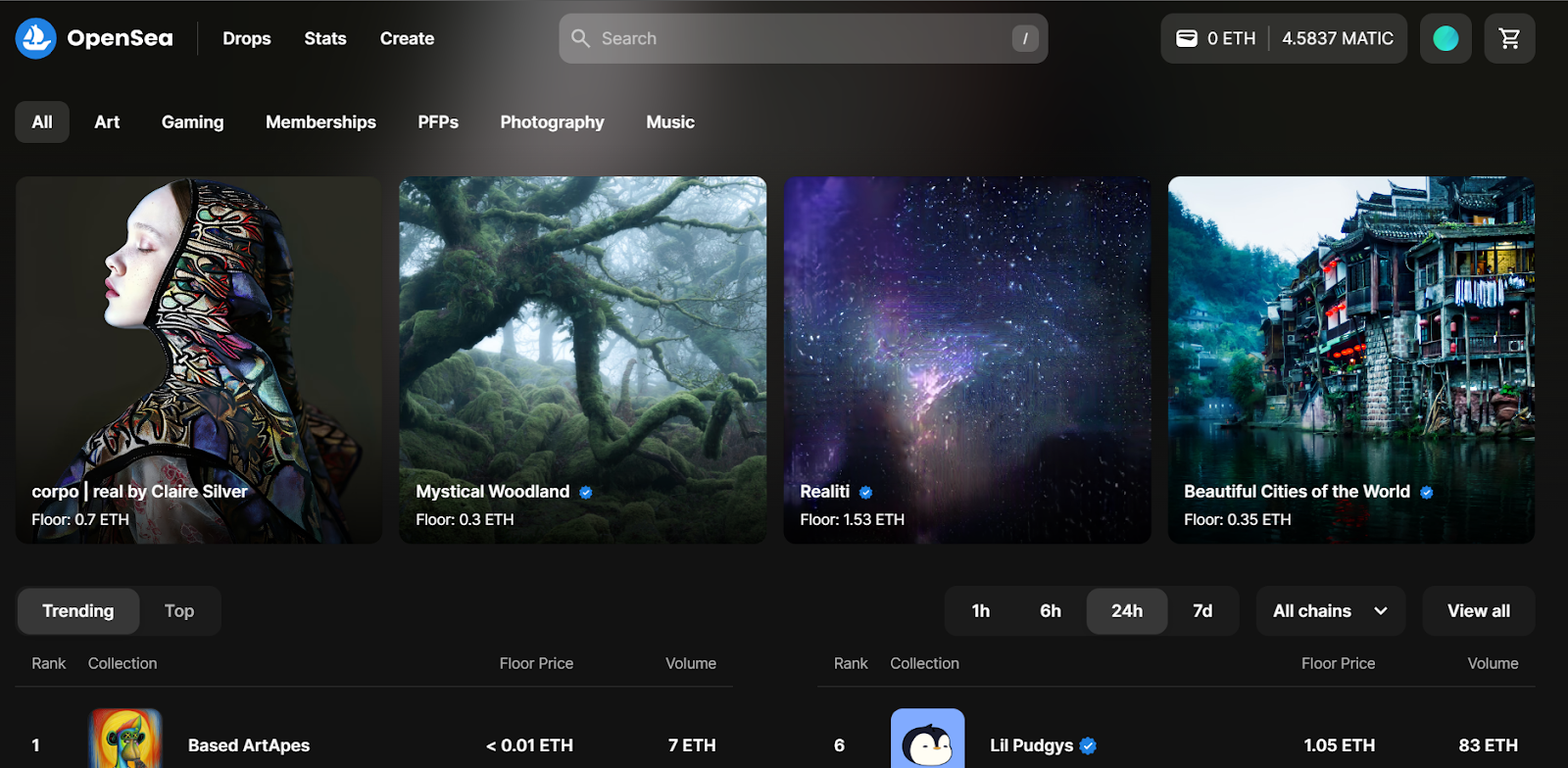

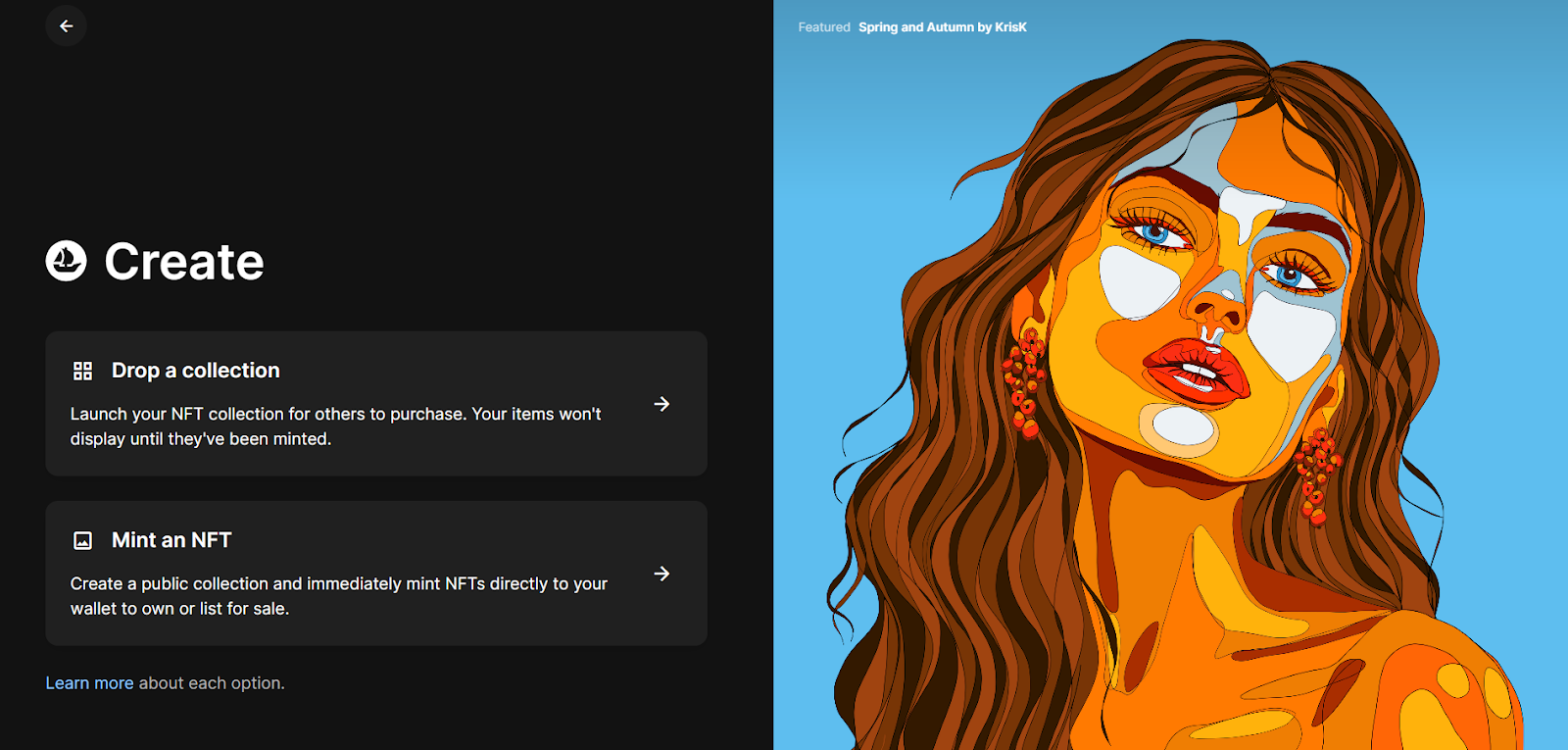

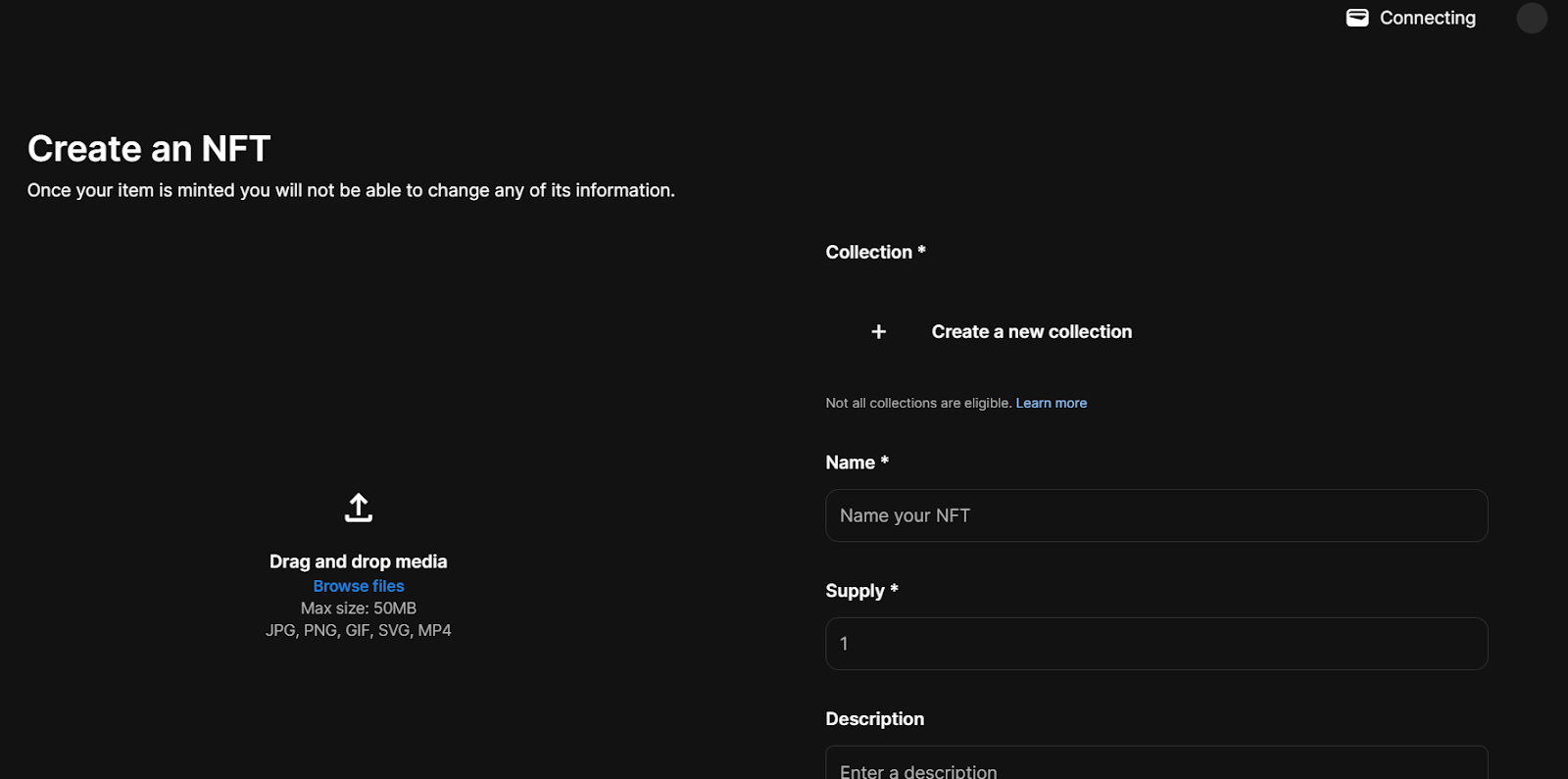

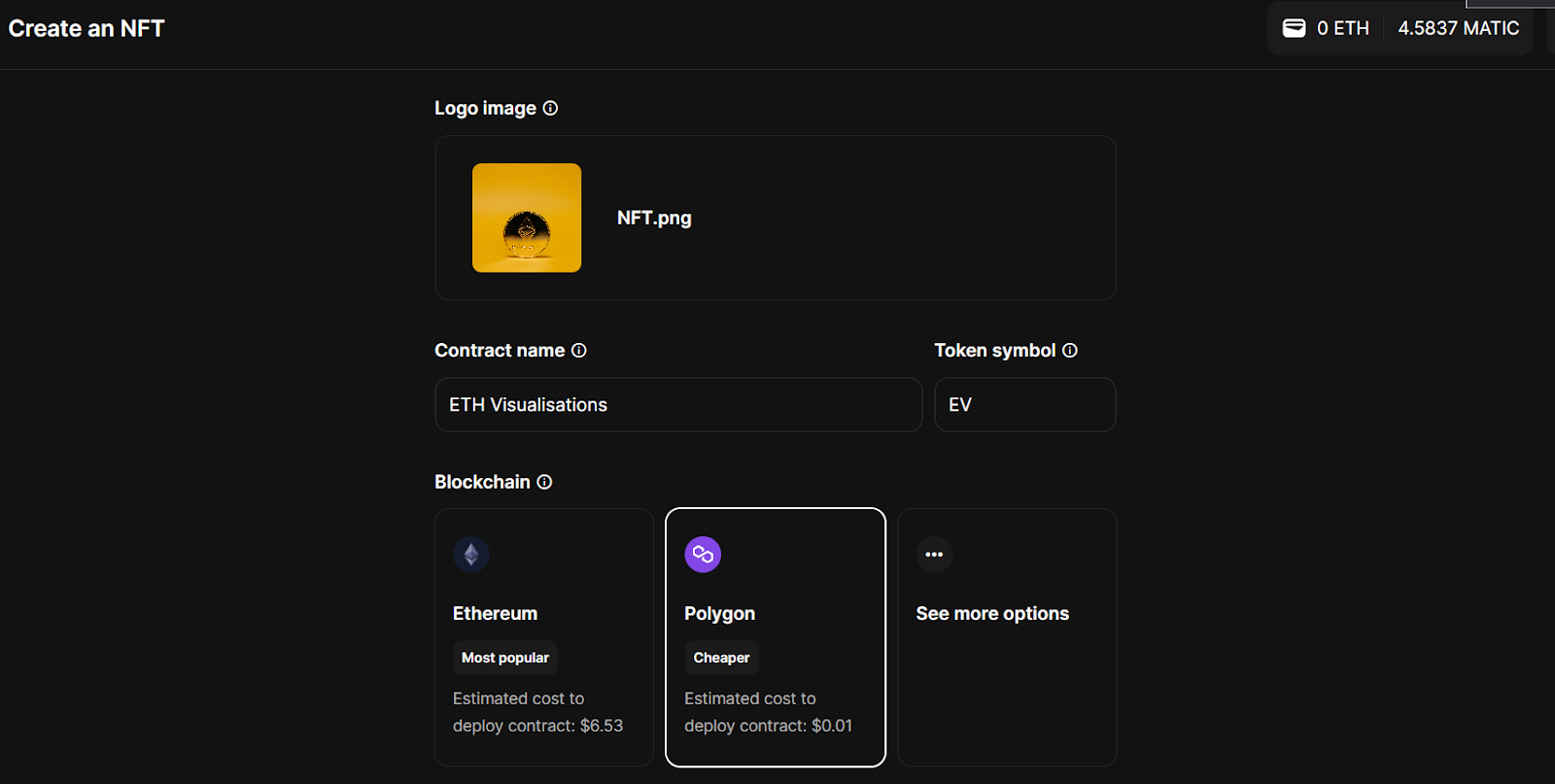

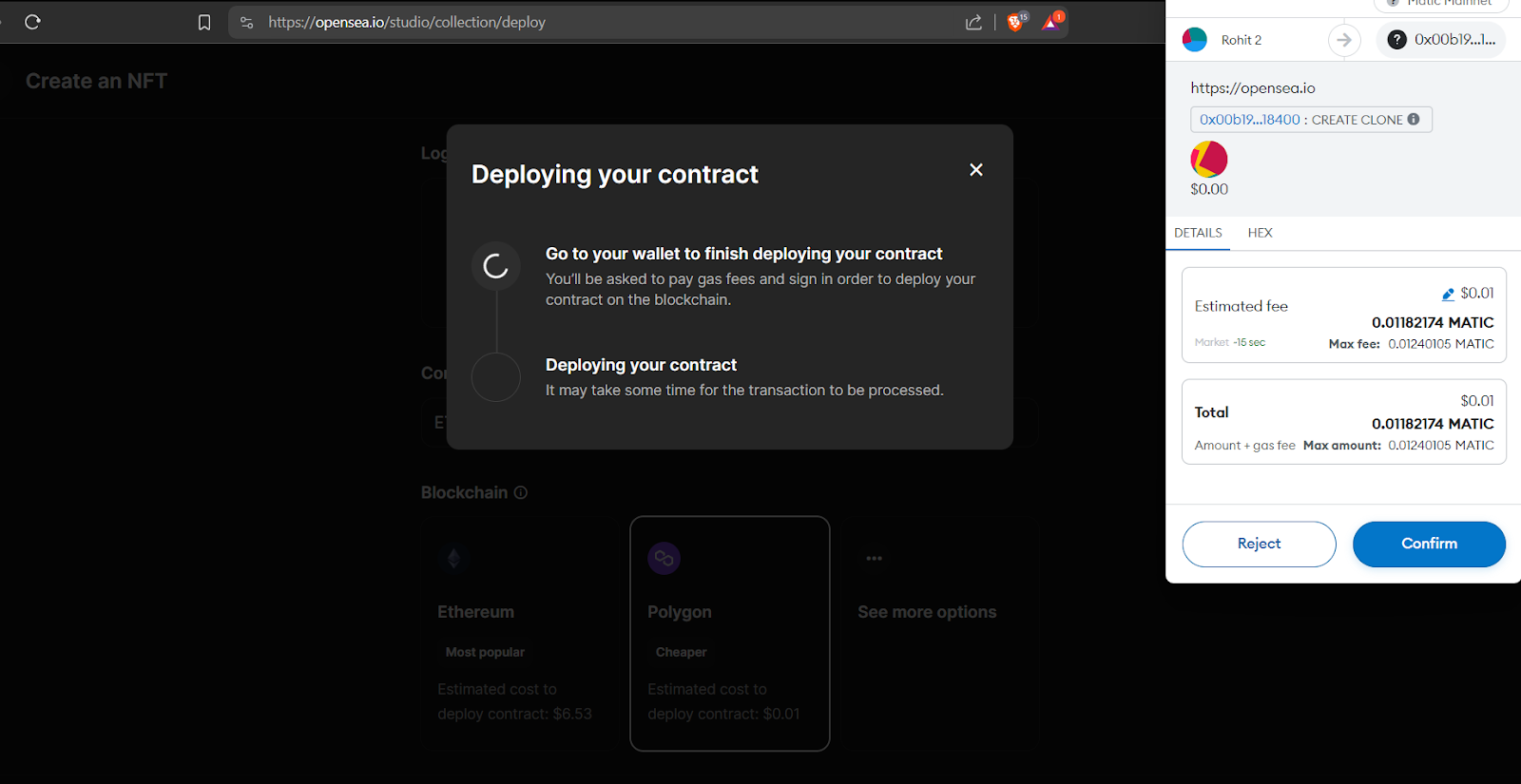

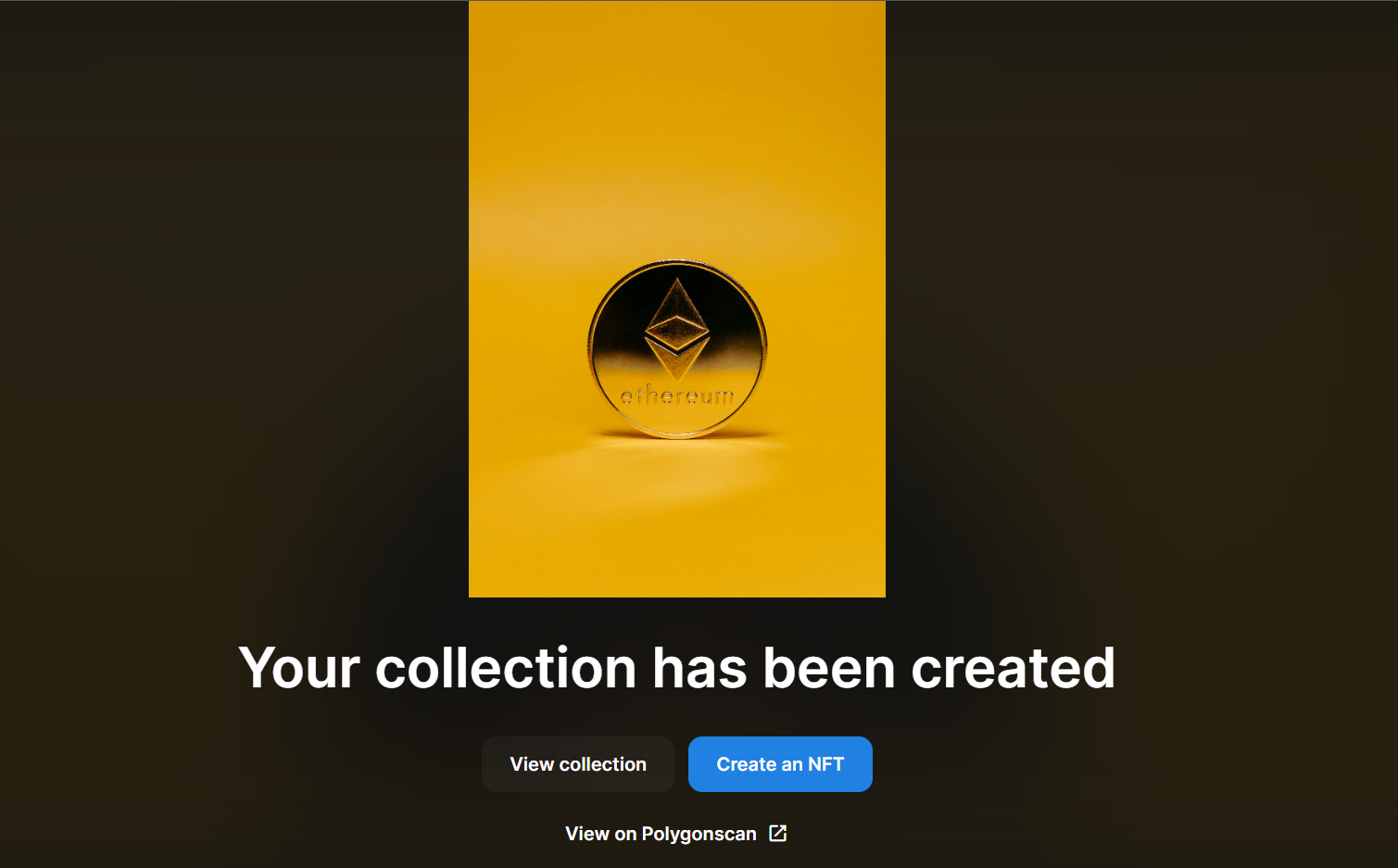

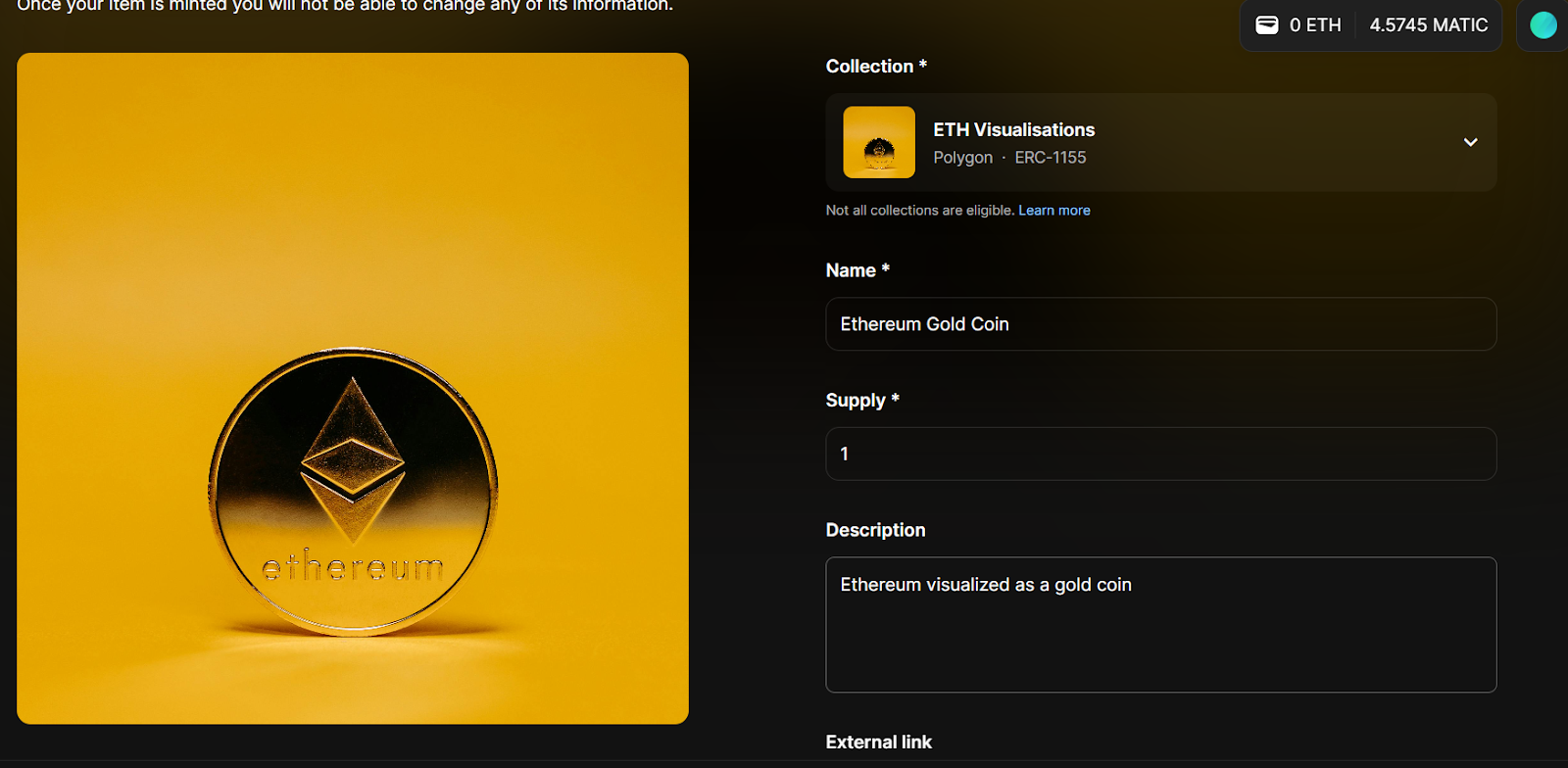

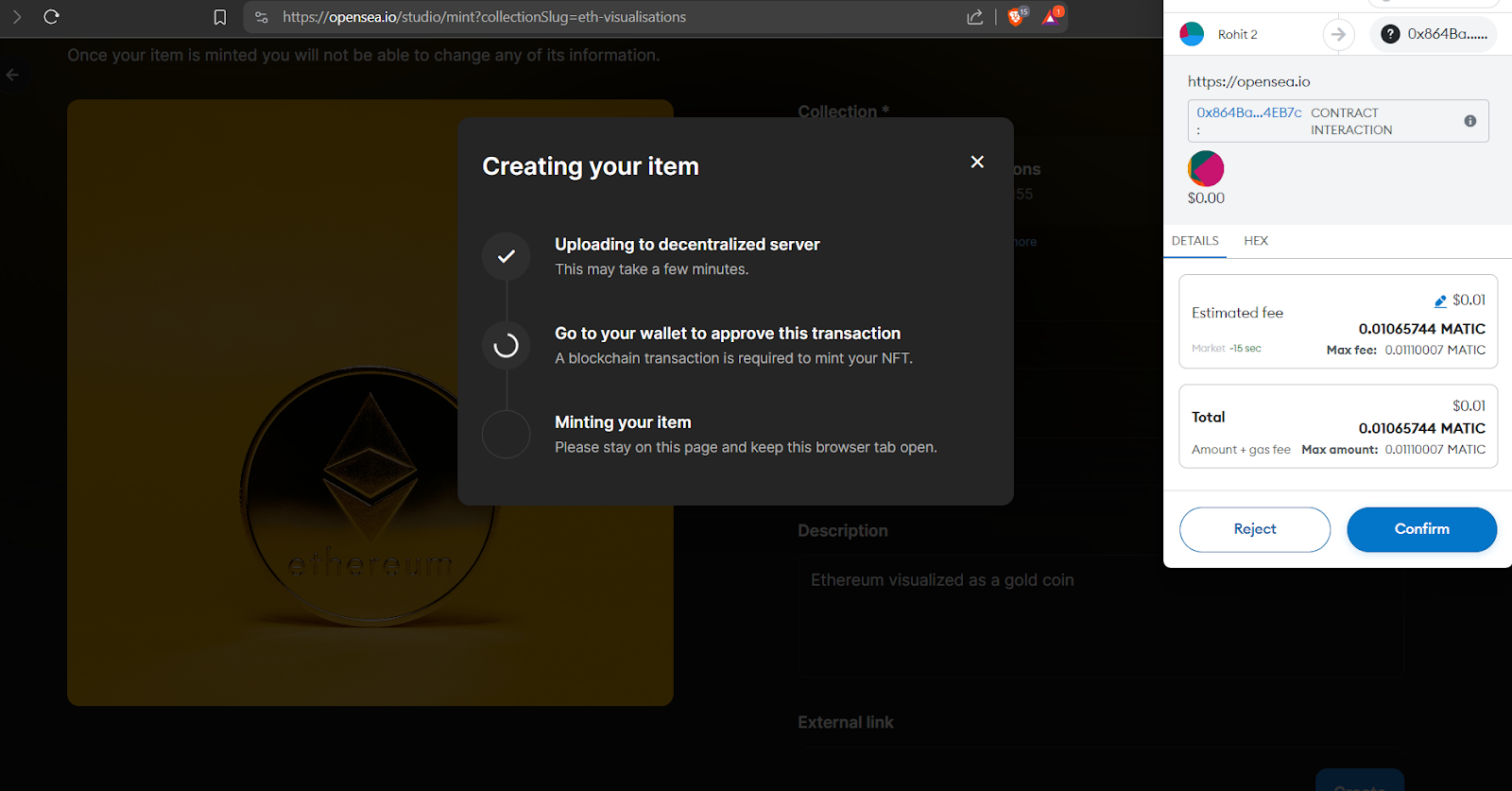

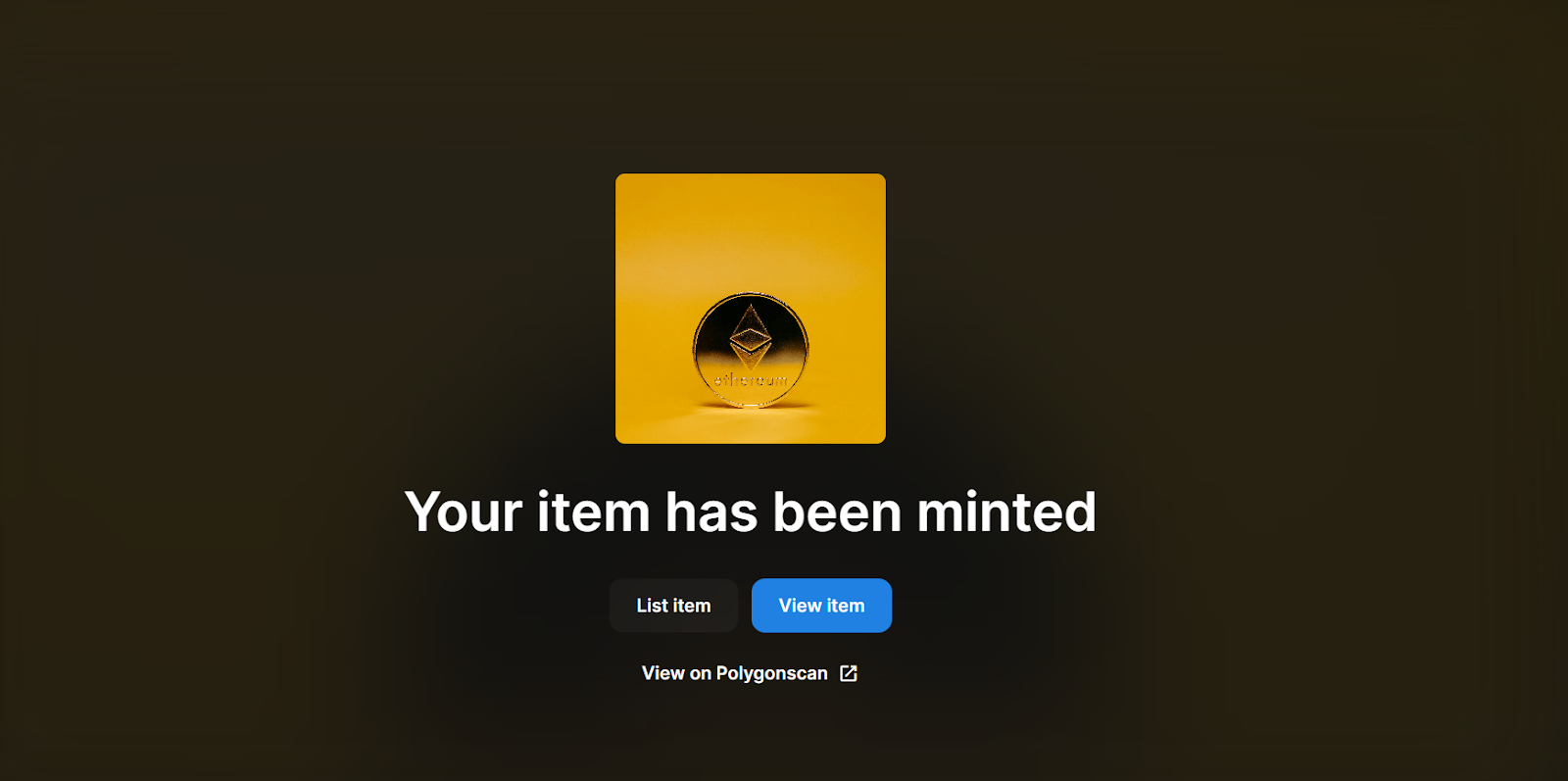

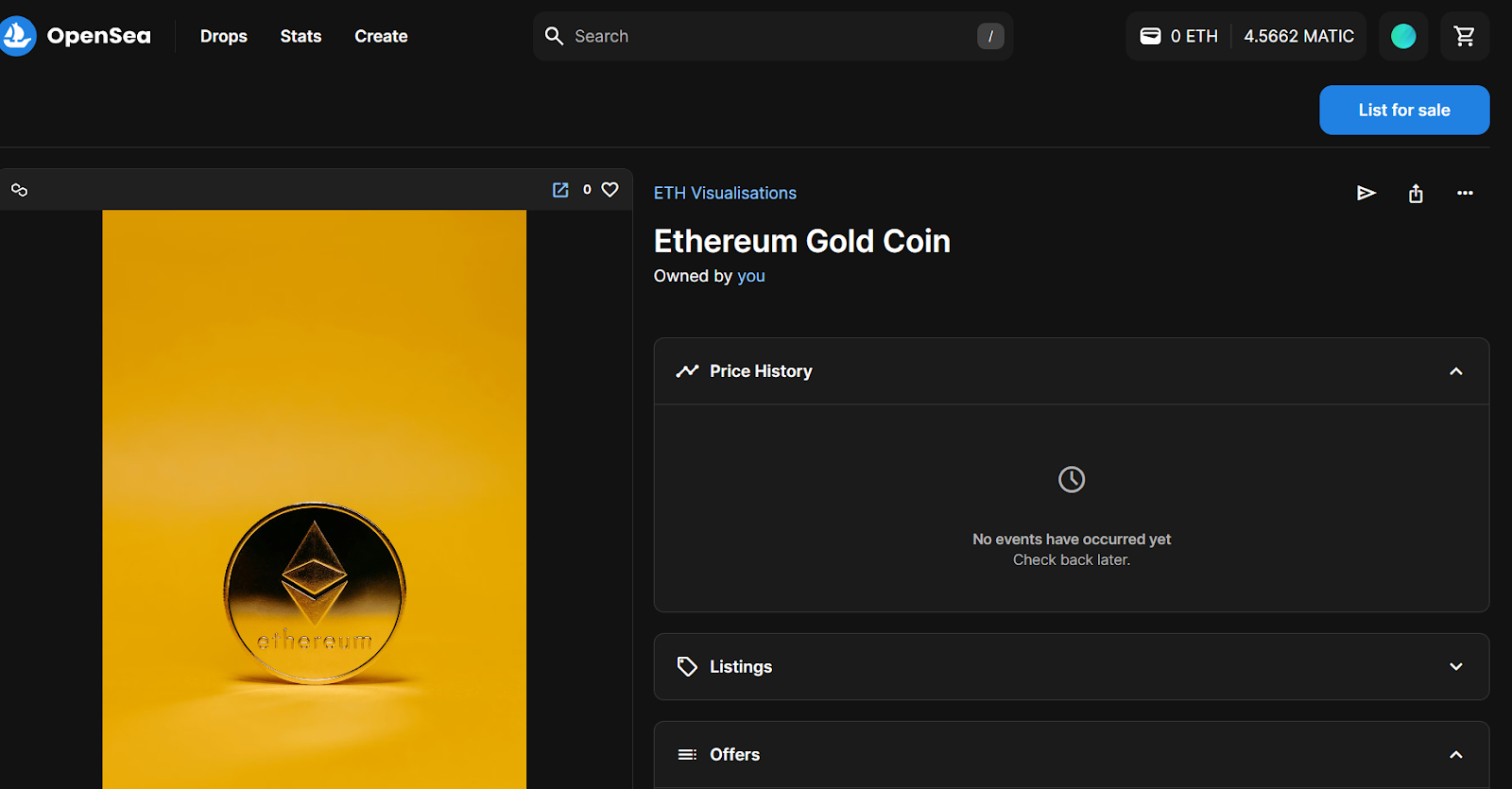

If you have a particular asset in mind to convert into an NFT, we can help! Here are 3 simple steps for you to mint your NFT on the largest NFT marketplace: OpenSea!

Yep, creating NFTs is that easy. For more information on the world of crypto and blockchain, India Crypto Research is your destination!

India Crypto Research operates independently. The information presented herein is intended solely for educational and informational purposes and should not be construed as financial advice. Before making any financial decisions, it's essential to undertake your own thorough research and analysis. If you're uncertain about any financial matters, we strongly recommend seeking guidance from an impartial financial advisor.