What is a DAO?

The future of DAO projects

Blockchain technology’s hallmark lies in its core goal: decentralisation. Running organisations with power and governance focused on a centre has major limitations, from inefficiency and corruption to high costs. Blockchain’s Decentralised Autonomous Organisations (DAOs), which have emerged to fill this gap, are doing path-breaking innovation in this space.

In fact, one of the most popular DAO proposals was ConstitutionDAO, which was a collective effort to raise money to purchase an original copy of the US Constitution. The DAO raised millions in ETH and planned to take a decentralised outlook towards governance decisions after the purchase. Thus, DAO projects could have very interesting use cases!

Let’s explore some of the top DAO projects.

Even though the names of several DAO projects have become very popular, the question ‘What is a DAO’ is common among crypto beginners. Well, the answer to that is quite simple.

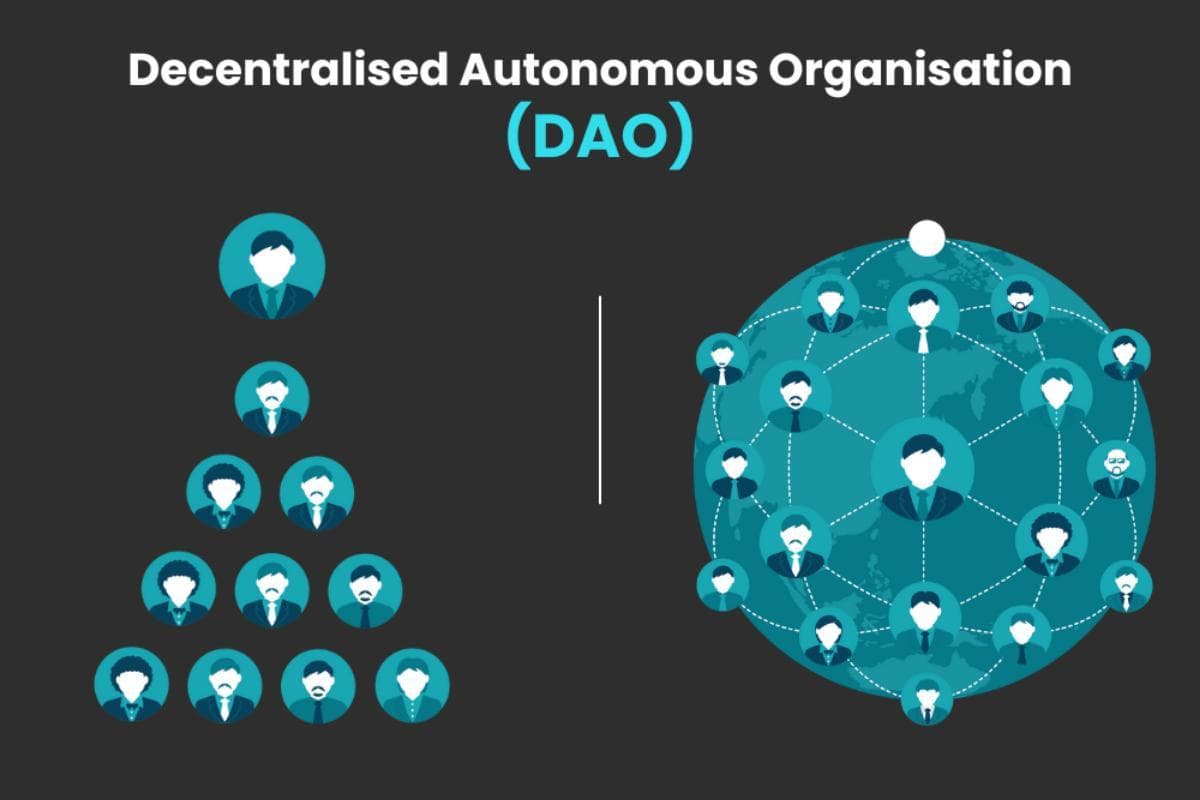

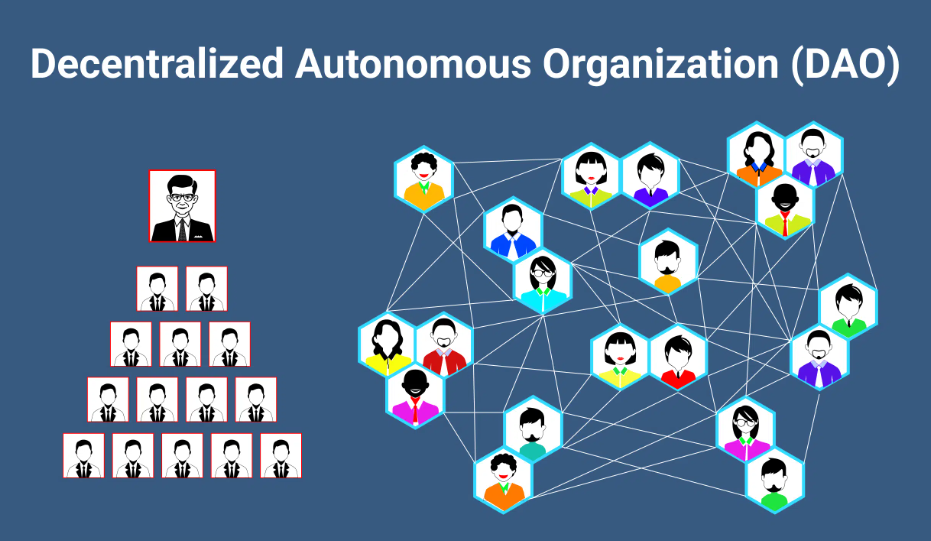

A decentralised autonomous organisation is made up of members who have a say in its governance and key decision-making process. Every decision is taken democratically, usually through votes. The blockchains on which the DAO projects are built make this possible.

DAO projects operate through blockchain-based smart contracts. The members of a DAO project often have a shared goal or purpose, and they come together to achieve these goals through the DAO. These members are issued governance tokens by the DAO, which are used for making decisions via votes.

The two key benefits of a decentralised autonomous organisation lie in the term itself: decentralisation and autonomy. In some blockchains like MakerDAO, those who have larger token holdings get a bigger say on governance decisions compared to those with relatively fewer holdings.

On the other hand, in some blockchain protocols, large token holders cannot take full advantage of their disproportionate token holdings. An example of such a blockchain protocol is Illuvium which employs a “quadratic” voting system to reduce the power of large holders.

Here’s a list of DAO projects that are trending in 2024:

MakerDAO is a unique project that runs on the Ethereum blockchain. It is a part of the Maker protocol, which helps maintain the price of the DAI token to the USD. MakerDAO issues MKR tokens to make governance decisions in the project.

Meanwhile, MakerDAO is also known in the crypto sector for venturing into real-world assets (RWA). The project holds assets such as US Treasury bonds in a bid to diversify its income streams, a strategy touted as revolutionary among DAO projects.

Uniswap is one of the oldest crypto DAO projects that works as a decentralised crypto exchange. The Uniswap protocol powering the exchange enables the exchange of ERC-20 tokens through smart contracts. Members of the Uniswap protocol are issued UNI tokens, which allow them to vote on proposals.

The Uniswap decentralised finance (DeFi) protocol also enables developers to build decentralised apps and tools on its platform, aiding them with the appropriate guides.

Similar to Uniswap, Curve operates as a DeFi protocol on the Ethereum blockchain. It provides a seamless token-swapping experience to users, who can also earn yields from their deposits in Curve’s liquidity pools. These yield rates change based on the dynamics of supply and demand. CRV token holders govern the CurveDAO project.

Compound is a crypto DAO project that operates a crypto custody platform. Holders of Compound’s governance tokens (COMP) can use the platform for crypto staking, lending, and trading. The liquidity pools in Compound, operated by smart contracts, ensure smooth borrowing and lending and reward lenders with COMP tokens.

Moreover, borrowers in the Compound protocol do not need to go through stringent credit checks to qualify for it.

Aave is an open-source liquidity protocol that conducts lending and borrowing and is also a launchpad for developers to build applications. Liquidity providers supply assets to the Aave protocol, while staking tokens (AAVE) allow you to earn steady interest and rewards from the project. Aave is also known as a crypto DAO project with long-term potential. Moreover, the protocol works through Ethereum-based smart contracts.

Borrowers in the AAVE ecosystem pay interest, liquidity fees, and other kinds of fees that contribute to the project’s revenue.

The Smog protocol is built on the Solana blockchain and is one of the latest entrants to DAO projects. Currently, it is exploring a multi-chain ecosystem using Wormhole. In February 2024, when the project launched the Smog token as a meme coin, it experienced gains of over 4000%, hitting a $50 million market cap.

Lido Finance is a unique DAO project that enables the staking of ETH and MATIC tokens but also maintains liquidity if one wants to access their holdings. As a result, LidoDAO allows us to earn steady staking income without locking up our assets. Lido Finance also operates the Lido Ecosystem Grants Organisation (LEGO), which issues grants to selected applicants.

Bitcoin Minetrix is a DAO project that is involved in tokenised cloud mining. It claims to offer high transparency and security for its users. At the same time, it offers an ecocentric approach to Bitcoin mining. Its white paper notes a ‘stake-to-mine’ mechanism for Bitcoin mining, fully automated by smart contracts.

This approach merges token staking and cloud mining to remove the need to purchase cash contracts from mining companies, while tokenisation eases access for everyone. One can purchase BTCMTX tokens to get cloud mining credits. These credits can be further exchanged for hash power

Battle Infinity is a gaming DAO project, which has created the metaverse-based game called Battle Arena. Since its advent, it has grown to be a very popular DAO project among crypto enthusiasts. It also issues IBAT tokens as rewards to players who accomplish tasks in the game, which also function as governance tokens.

ArbitrumDAO offers a layer 2 scaling solution to solve issues of congestion and gas fees in Ethereum. The solution aims to improve Ethereum’s scalability and thereby improve its performance with faster transactions. ARB token holders get to vote on governance decisions of the DAO project, while a built-in Security Council decides on matters of security and integrity of the protocol.

DAO projects are crucial in fulfilling community-based objectives innovatively in a decentralised manner. However, they have been functioning in a limited manner since owning a wallet and signing a transaction to vote could be very complex for many users. As a result, it might be difficult to drive mainstream adoption of DAO projects.

We hope this blog was helpful for you in closely understanding DAO projects.

India Crypto Research will help you stay updated with the latest trends in crypto and blockchain!

India Crypto Research operates independently. The information presented herein is intended solely for educational and informational purposes and should not be construed as financial advice. Before making any financial decisions, it's essential to undertake your own thorough research and analysis. If you're uncertain about any financial matters, we strongly recommend seeking guidance from an impartial financial advisor.