But how are bitcoins created in the first place? What is crypto mining? How do new bitcoins come into circulation?

Okay - but how secure is the Bitcoin network this way?

What is Bitcoin Halving: Its History and Future

What happens when all 21 million bitcoins are mined?

Bitcoin and renewable energy

The takeaway

Bitcoin is a peer-to-peer financial system introduced by the pseudonymous developer (or group of developers) Satoshi Nakamoto. It came about right after the 2008 financial crisis, as an alternative currency and store of value for investors wary of centralized control and inflation.

Bitcoin is an inherently deflationary currency with a limited supply, and once people are deep enough into the rabbit hole of its ideals and philosophy, a question they often ask is - how many bitcoins will ever be created?

In this post, we’ve set out to answer that question, and while we’re at it, we’ll give you some fascinating insights into how and why Bitcoin are created.

The total supply of bitcoins is capped at 21 million, and its protocol has an inbuilt deflationary measure, called the halving. This measure ensures that the new bitcoins entering circulation are cut into half approximately every four years, making Bitcoin scarce and, as economics 101 would tell you - driving up its price.

The answer to how many bitcoins will ever be created? is 21 million, and the mechanism controlling this supply is called Bitcoin mining (or cryptocurrency mining if you’re referring to all crypto assets following this protocol).

Bitcoin mining is a concept drawn from Bitcoin’s ‘proof-of-work’ (PoW) consensus mechanism (more on that below), that dictates how many bitcoins are released into circulation.

It’s also the answer to a fairly difficult question that plagued many of our age’s great thinkers - how can you create a viable decentralized currency?

Think about it. A notorious challenge with digital decentralized currencies used to be the double spending problem - how does a receiver get his money while the sender debits it from his account? Can a hacker not create fake money (it’s digital, after all) and keep his own hoard too? He can then spend this money twice.

Bitcoin solved this issue by introducing the blockchain - a common ledger of all transactions that everyone would have a copy of - so everyone’s balances and spends would be in sync across the network.

Eric Schmidt, the former CEO of Google, is a fan. He said “Bitcoin is a remarkable cryptographic achievement, and the ability to create something that is not duplicable in the digital world has enormous value”

But what’s the incentive for folks to maintain this ledger and upload transactions to it? What’s in it for them?

Bitcoin solved this too, with Bitcoin mining - which involved rewarding participants in the network for the work they’d do in securing the network (thus: proof-of-work). Bitcoin mining involves solving complex mathematical problems using your computational power (aka your computer’s performance), which is the ‘work’ miners (or participants in this process) have to put in.

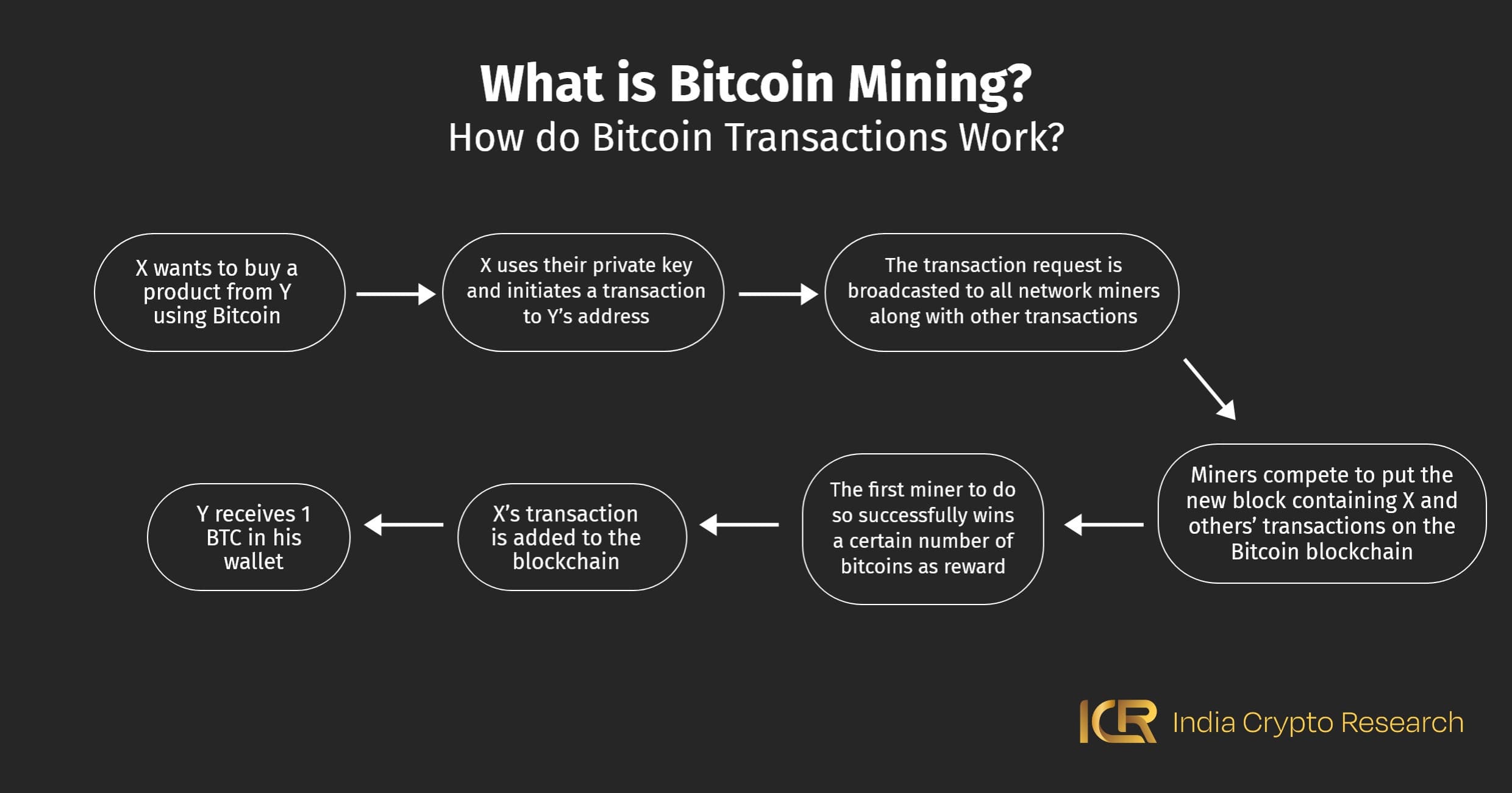

Here’s a step-by-step overview of cryptocurrency mining:

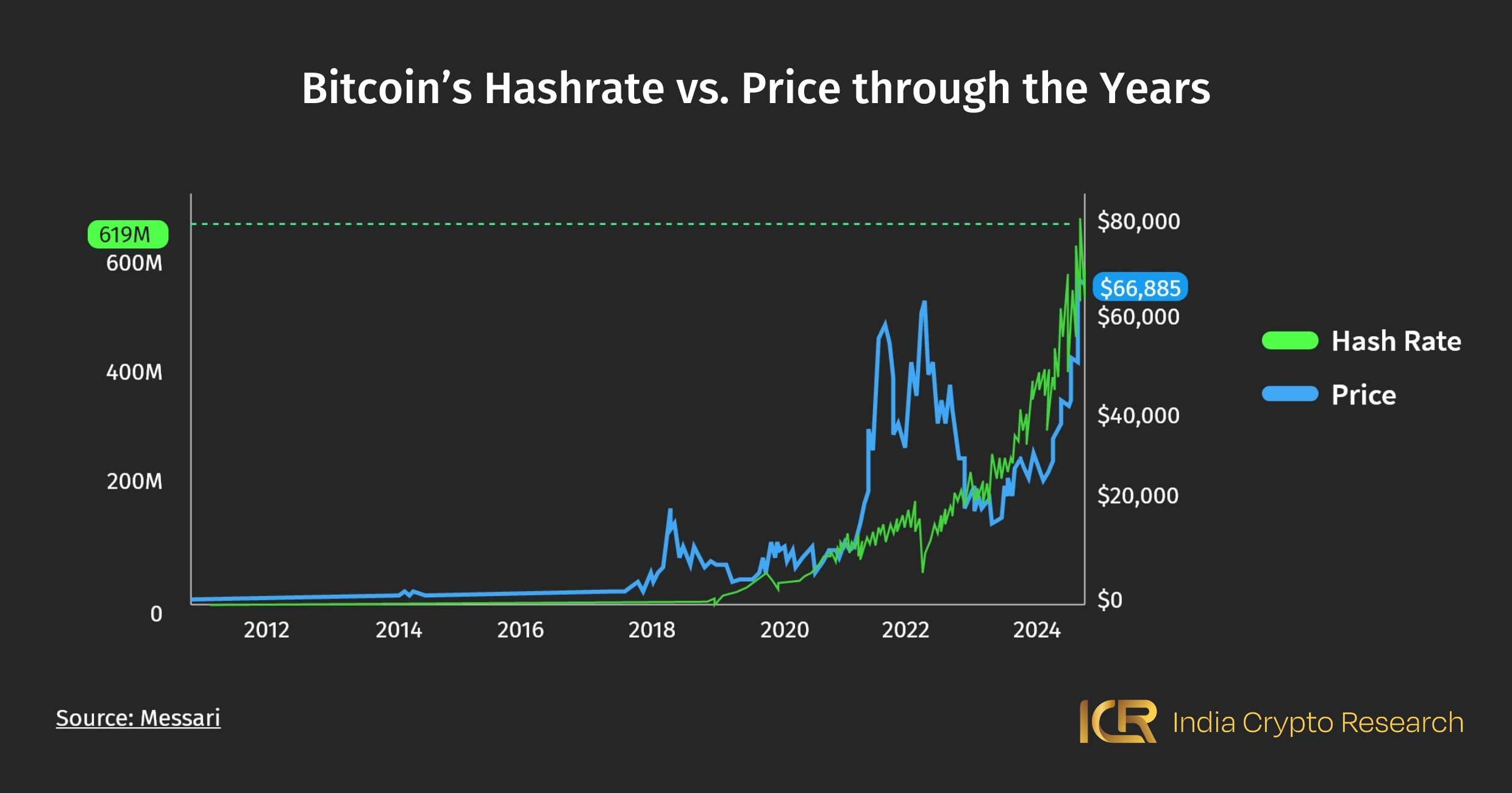

Worth noting - hash rate is a concept that refers to the computational power of the entire Bitcoin network; measured by the entire number of hashes or calculations that the network can perform every second. A higher hash rate ensures a more secure network, one that is more difficult to control for a single miner/group of miners.

The Bitcoin network adjusts the difficulty of its puzzle regularly to ensure that a new block is added to the blockchain every 10 minutes on average. This difficulty adjustment is made to compensate for changes in the network's hash rate (a lot of miners joining with super capable devices could make it trivial to mine Bitcoin). You can see a comparison of Bitcoin’s price and its hash rate throughout the years in the simple figure above, with data sourced from Messari.

The Bitcoin mining mechanism also secures the network - since the miners verify the transactions before putting them on the chain. But exactly how secure does it make Bitcoin? Can a group of malicious miners not hijack the network and put their own fraudulent transactions on the blockchain?

Well yes, there are risks - like the 51% attack - where a group of miners controls over half the network's mining power, and therefore the consensus on the network. But in the case of a large network like Bitcoin, you need massive hash rates (and therefore, tons of money for your equipment) to execute such an attack, making it virtually impossible. So proof-of-work reliably ensures the network's overall resilience against malicious activities.

Now that we know how Bitcoin mining works, let’s delve deeper into where Bitcoin halving comes into play!

Bitcoin halving is a core part of Bitcoin’s status as a deflationary currency. As its name suggests, the mechanism cuts the number of bitcoins rewarded to every successful miner per block in half. This happens roughly every 210,000 blocks - or every four years.

In 2009, the initial block reward for Bitcoin was 50 BTC (worth over INR 17 crore as of January 2024). The first Bitcoin halving happened in 2012 when each round of mining for bitcoins rewarded a miner with 25 BTC. In 2016, this was cut down to 12.5 BTC, and in 2020 the Bitcoin mining reward became 6.25 BTC per block. In 2024, we’re about to witness the fourth-ever Bitcoin halving - it’ll cut down the block reward to 3.125.

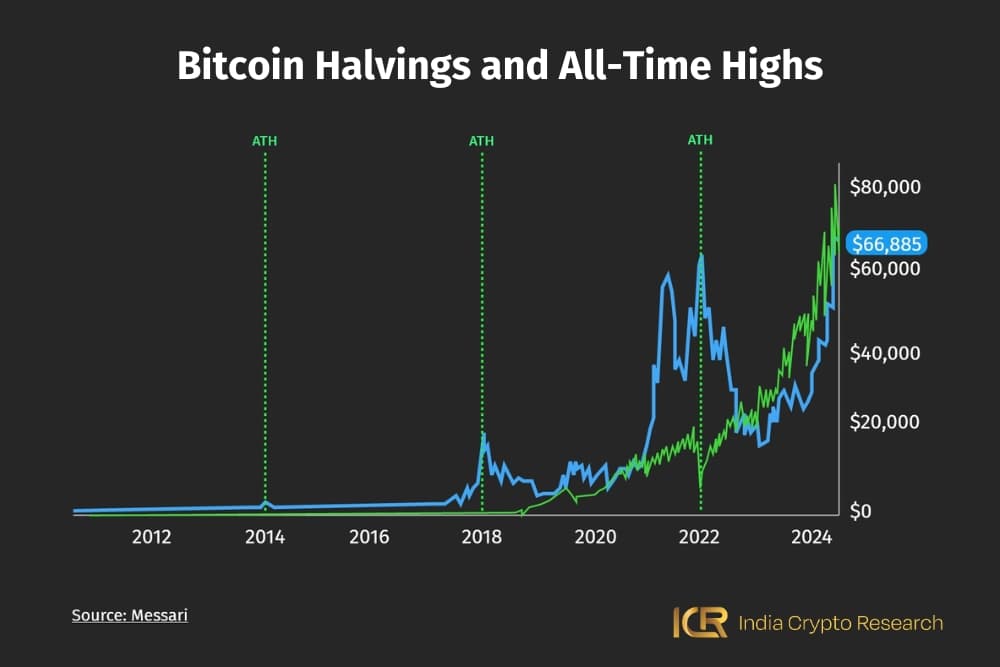

Now, here’s something interesting: CNBC and other analysts have noted that if you look at Bitcoin’s historical price chart, investors tend to accumulate Bitcoin right before the halving event. For example, the last Bitcoin halving took place on May 11, 2020, and in the 12 months prior, Bitcoin’s price went from ~$7200 to ~$8,600, an increase of 19%.

Further, every Bitcoin halving so far has been followed by a rally that has led to Bitcoin touching new all-time highs (ATH). As the figure above captures, both the first and second cycles saw new ATHs right after halvings (in 2012 and 2016 respectively). After the 2020 halving in particular, Bitcoin went up by ~688% in the next ~550 days, reaching over $69,000 on Binance on November 8, 2021.

Further, these rallies are usually followed by a market bottom, which has historically been about a 500 days distance from the next halving date. So for example, November 2022 saw Bitcoin hitting a low of $15,760, which is a little over 500 days prior to the upcoming Bitcoin halving in April 2024.

Opinions are divided for the Bitcoin halving to come: while some expect an ensuing rally as per historical data, others say the predictability of the event could dull the excitement surrounding it, which may not make it a driving factor for the next Bitcoin bull run.

However, as far as cryptocurrency mining is concerned, the Bitcoin halving 2024 event is directly related to regulating the Bitcoin supply as usual.

How many bitcoins are in the world so far? As of January 2024, over 19 million bitcoins have been mined already, and by 2140, all 21 million of bitcoins supply should be in circulation. This will affect the profitability of miners - they won’t have any more bitcoins to be rewarded with.

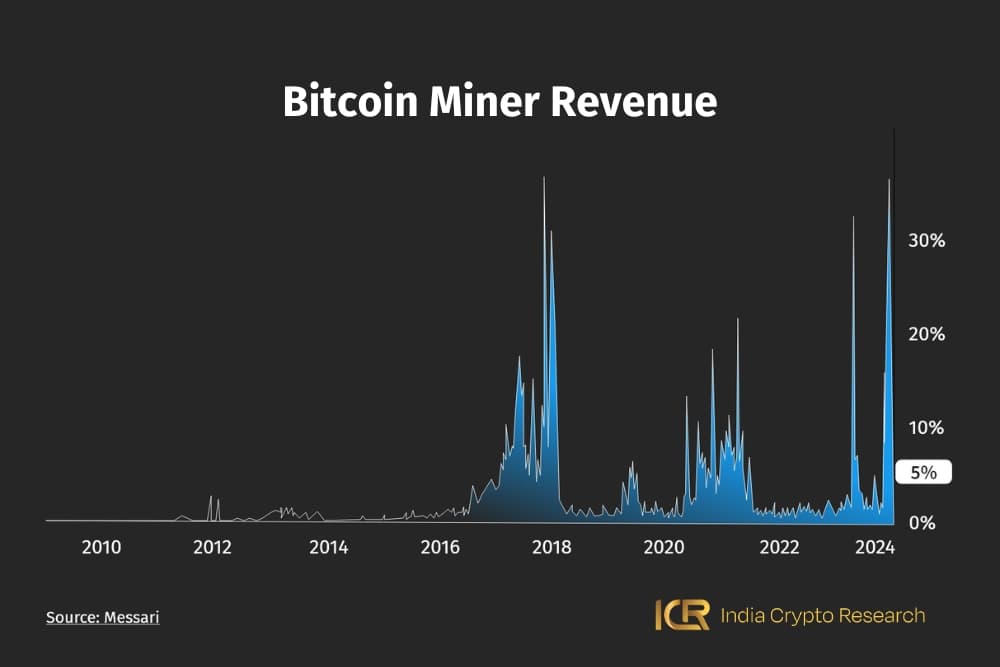

Currently, the profitability of miners depends on factors like mining rewards, electricity costs, algorithm difficulty adjustments, Bitcoin prices, and of course, equipment costs. When all 21 million bitcoins are mined, however, the mining rewards would not include new bitcoins. The expenses of Bitcoin mining will be balanced out by one remaining factor: transaction fees as a reward for mining for bitcoins.

During bull markets in particular, there is a rise in Bitcoin transaction fees. As you can see in the chart above with data from Messari, the 2017 Bitcoin rally after the 2016 halving sent miner revenue from network fees soaring high. Something similar happened after the 2020 halving and 2021 bull run, and again at the end of 2023.

As Bitcoin’s prices go up, the transaction fees generated by the network are expected to balance out the decreased block rewards.

When using proof-of-work on Bitcoin the computational power it needs is massive. It’s been estimated that Bitcoin consumes electricity at a rate of 127 terawatt-hours (TWh) annually. Just to put things into perspective, this exceeds the annual electricity consumption of a developed country like Norway.

Renewable energy has been brought up as a solution here, as otherwise mining for bitcoins in the long-term is simply too controversial, despite the numerous advantages it brings as an alternative currency and a store of value. As gauged last year, about 52.4% of all Bitcoin mining was already done with green energy, out of which about 23% is supplied by hydropower and about 14% from wind energy.

The benefits go the other way too: Bitcoin’s demand for green energy increases revenue for such energy providers and invites further investments into renewable energy globally.

Bitcoin has taken over both popular culture and intellectual discussions, with its community coming up with trends like laser eyes in their profile photos until Bitcoin reaches $100k. The proof-of-work mechanism aids this deflationary asset, making its ascent in the coming times one to watch out for.

India Crypto Research operates independently. The information presented herein is intended solely for educational and informational purposes and should not be construed as financial advice. Before making any financial decisions, it's essential to undertake your own thorough research and analysis. If you're uncertain about any financial matters, we strongly recommend seeking guidance from an impartial financial advisor.