What are Bitcoin ETFs?

History of Bitcoin ETFs in the US

Why are Bitcoin ETFs a big step to mainstream adoption of crypto?

How have US Bitcoin ETFs performed in the two months since they were launched?

Bitcoin ETF: Mudrex brings US spot crypto ETFs to India

The US is the undisputed leader in the world of finance, which is why investors around the globe look to the country for guidance on how to treat different assets.

Bitcoin is no different - while it had assumed many roles (namely that of a store of value, an inflation hedge, a permissionless peer-to-peer mode of exchange, and more) and achieved significant recognition around the world in the first fourteen years of its existence, the more traditional investors stayed wary due to a lack of regulation in the crypto space.

On January 10, 2024, the US SEC’s crypto ETF approval- that too of a whole host of spot Bitcoin ETFs (exchange-traded funds)- changed the game completely.

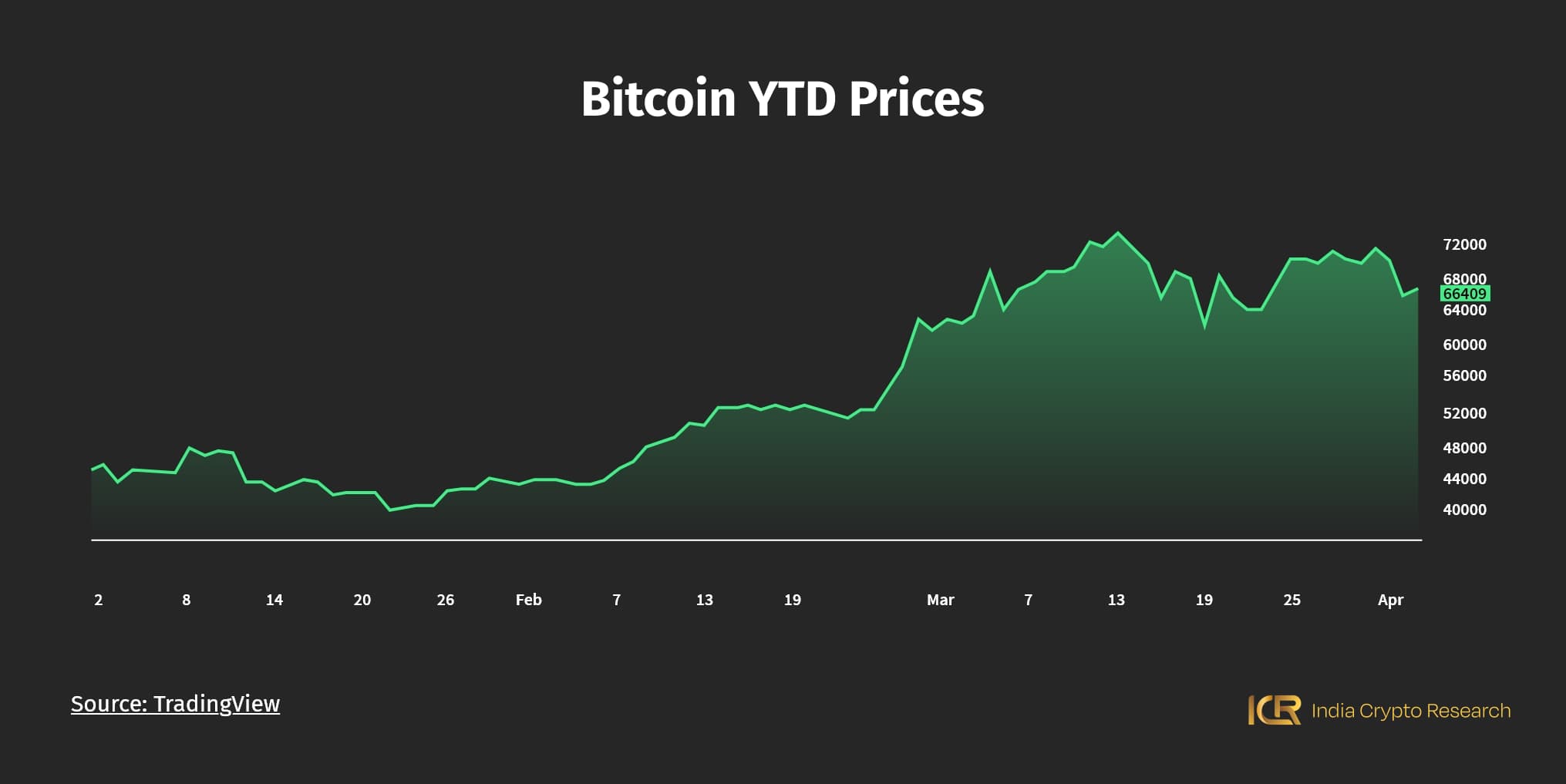

If we begin to discuss their performance, one look at Bitcoin’s recent price chart is enough. On Binance, the year-to-date increase is around 57.10% for Bitcoin, with it reaching a brand new all-time high of USD 73808 in the first half of March 2024. The rally can be credited to the historic display of Bitcoin ETFs in the US; so is their power, that they gave a push to the bulls for a sustained growth all by themselves.

Let’s explore the US Bitcoin ETFs in more detail.

The recent round of crypto ETF approvals from the US SEC (Securities and Exchange Commission) has been given to ‘spot’ Bitcoin ETFs, not to be confused with futures Bitcoin ETFs that have existed for longer, and clearly haven’t had as immense an impact on the price of Bitcoin.

Let’s clarify both types of crypto ETFs.

Spot Bitcoin ETFs track the real-time price of Bitcoin, and purchase a specific amount of Bitcoin to sell as shares. What this means is that the fund holds an equivalent amount of bitcoins for every share it sells, so it is directly backed by the crypto itself. When users buy Bitcoin ETF shares, they are actually gaining direct exposure to the asset itself. This is a revolutionary concept, especially in the US, where crypto has yet to receive regulatory clarity.

On the other hand, futures Bitcoin ETFs have existed in the US and other parts of the world for some time now. They track Bitcoin-based futures contracts, which means investors essentially get to bet on the future price of the asset and there is no direct exposure involved.

Time for a look back at the fascinating past of spot Bitcoin ETFs! Long story short, the road has been thorny to say the least.

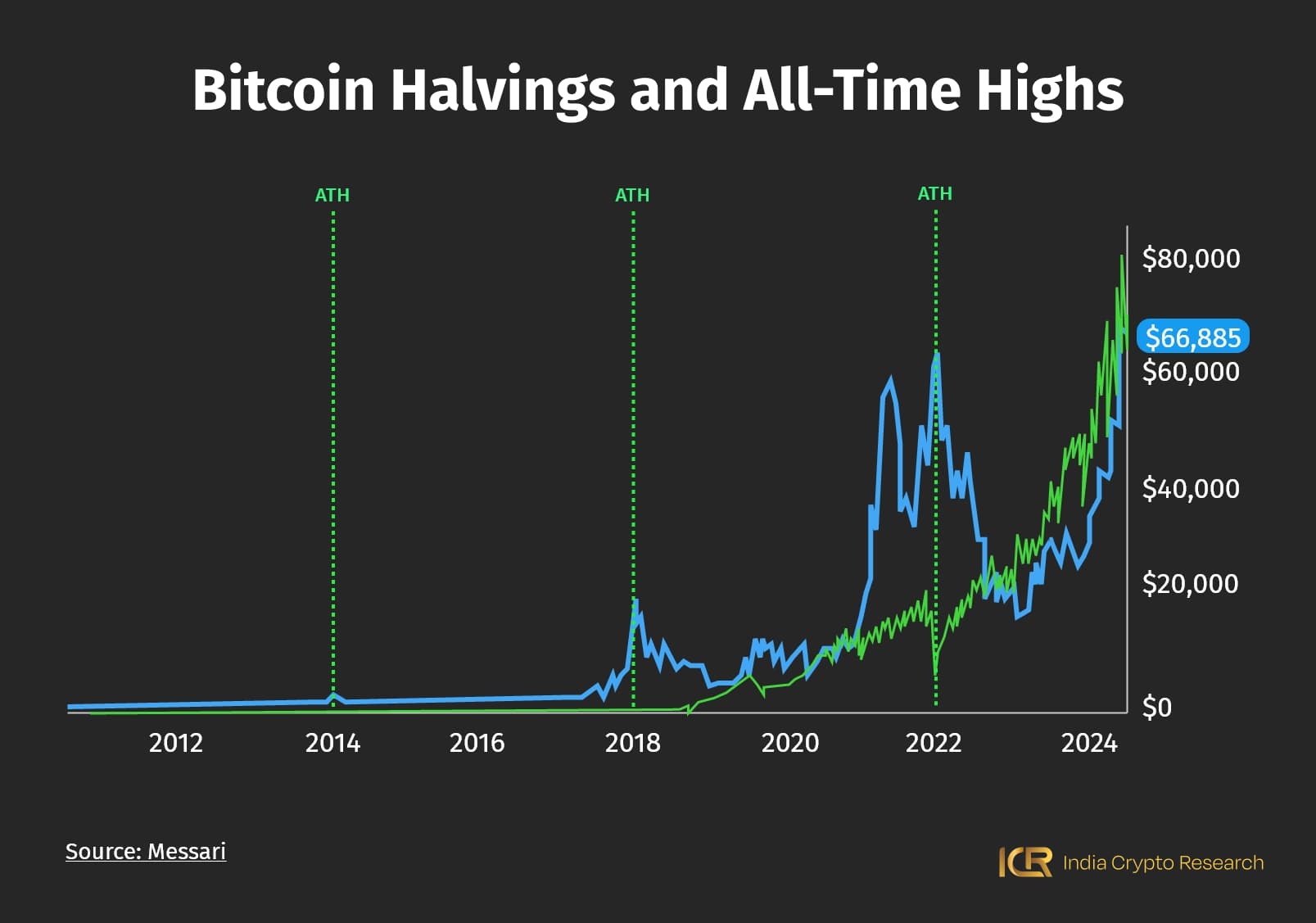

This statement has already proven its truth to a large extent: Bitcoin’s price performance is eye-catching, hitting a new all-time high even before the 2024 Bitcoin halving. As history would suggest, Bitcoin prices have always reached new all-time highs roughly one and half year after halvings. The chart below would signify the same- after 2012, 2016, and 2020 halvings, you can see how Bitcoin prices have hiked significantly.

This time however, US Bitcoin ETFs overshadowed the excitement usually reserved for halving. So is the power of Bitcoin ETFs that they propelled Bitcoin to over $70,000 all by themselves, and the general bullish statement sustains even as Bitcoin does backs and forths in the above $60,000 range.

In fact, optimistic predictions suggest Bitcoin may receive a further push by the upcoming halving and finally cross the $100,000 mark.

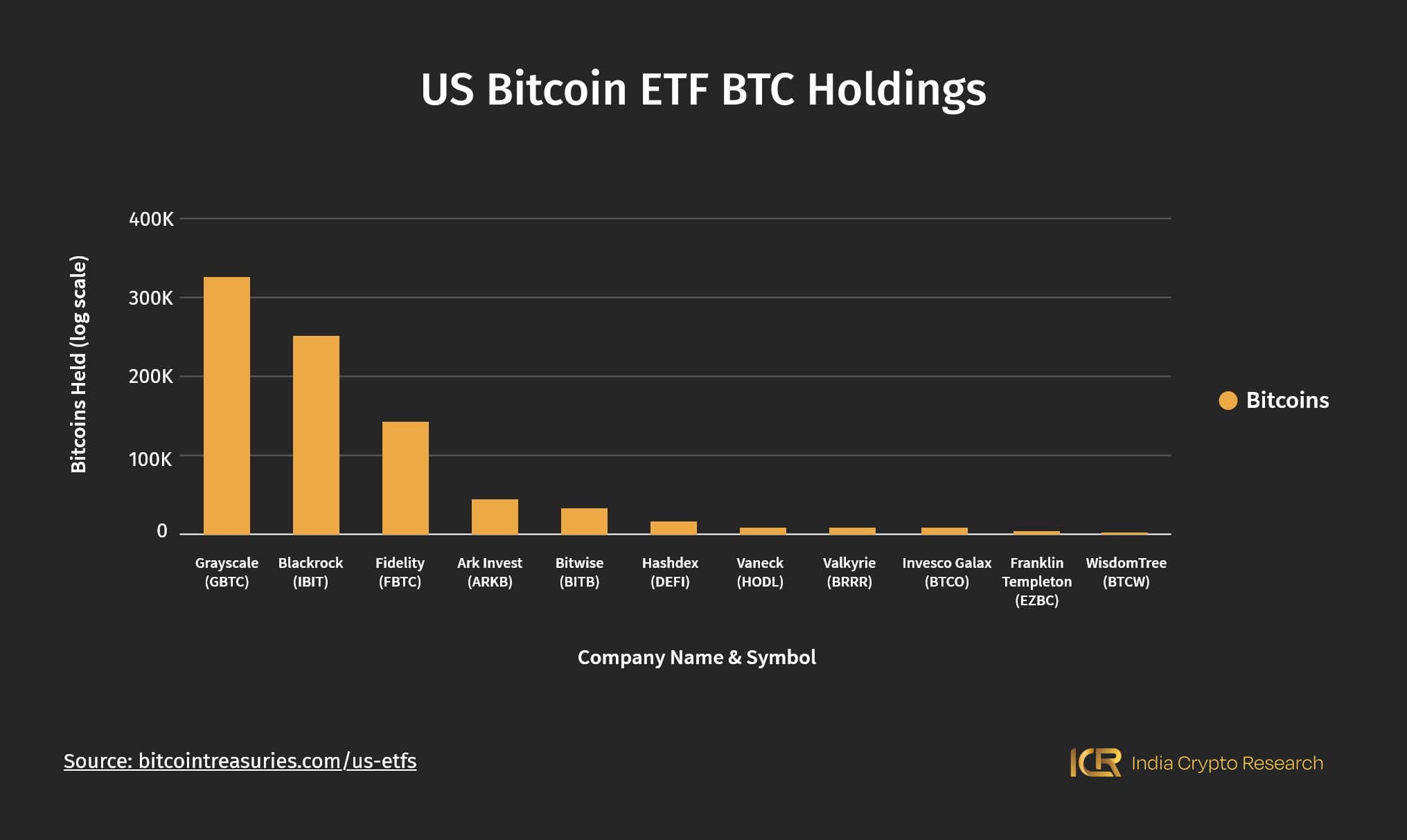

Yep, it’s been a little over two months since they began trading. It’s been one record after another for them. The BlackRock crypto ETF IBIT in particular is unstoppable: it had reached $2 billion in assets under management (AUM) before January was over, and as of the end of March 2024, IBIT has crossed $17 billion in AUM. All of the US Bitcoin ETFs together hold 4.017% of the total 21 million BTC supply (amounting to 843,513 BTC) as of the end of March.

Notably, MicroStrategy, a famous institutional investor in Bitcoin, currently owns around 214,246 bitcoins. The BlackRock crypto ETF IBIT has overtaken this number for over 254,403 BTC. The Grayscale Bitcoin Trust has around 333,619 bitcoins (coming first among the US Bitcoin ETFs in terms of BTC holdings), and Fidelity’s FBTC has around 145,338bitcoins.

The overall verdict is that spot Bitcoin ETFs in the US have broken past even the most optimistic of predictions. Their performance makes one beyond excited about the future: Bitcoin’s growth from here on out would be an incredible sight, especially as the asset matures with more traditional individual and institutional investors pouring in.

Finally, for those wondering about Bitcoin ETF in India, there’s good news. Y-Combinator backed crypto investment platform Mudrex now has plans to offer US-based crypto ETFs to Indian investors. This first phase would list Bitcoin ETFs from BlackRock, Fidelity, Franklin Templeton and Vanguard.

Which way does the wind blow, now? Certainly in the favour of crypto, now that the people have spoken. The popularity of spot Bitcoin ETFs in the US is immense, and the excitement will catch on around the world sooner or later. Comprehensive regulation may very well be on the way.

Does the Indian and global crypto space interest you? India Crypto Research is putting us blogs just for you, do visit us!

India Crypto Research operates independently. The information presented herein is intended solely for educational and informational purposes and should not be construed as financial advice. Before making any financial decisions, it's essential to undertake your own thorough research and analysis. If you're uncertain about any financial matters, we strongly recommend seeking guidance from an impartial financial advisor.