What is a DePIN?

Types of DePINs

Examples of DePINs, and how they work

Filecoin storage vs. Amazon S3

How scalable are DePINs at the moment?

Pros and Cons of DePINs

Web3 physical infrastructure has been named many things, but it seems the gaggle of enthusiasts have finally agreed on one common term: DePINs, or decentralised physical infrastructure networks. If you roam in crypto circles, you’d know they have seen a sudden burst in popularity, with more and more people interested in them. It’s safe to say that DePINs are one of the three emerging ‘De’s’ (the other two being DeFi and DeSoc) when it comes to crypto in 2024.

The reason? Largely, it’s the fact that DePINs decentralise power across industries and can be more efficient than centralised kingpins.

We will elaborate on that statement further into the article, but for now, let’s start at the definition: what is a DePIN?

This is best understood by breaking down the name- so decentralised physical infrastructure networks are basically blockchain-based decentralised platforms that incentivise a certain group of service providers to lease their industry-specific physical infrastructure to end users through the blockchain network.

There are some core mechanisms and components putting DePINs together, which include:

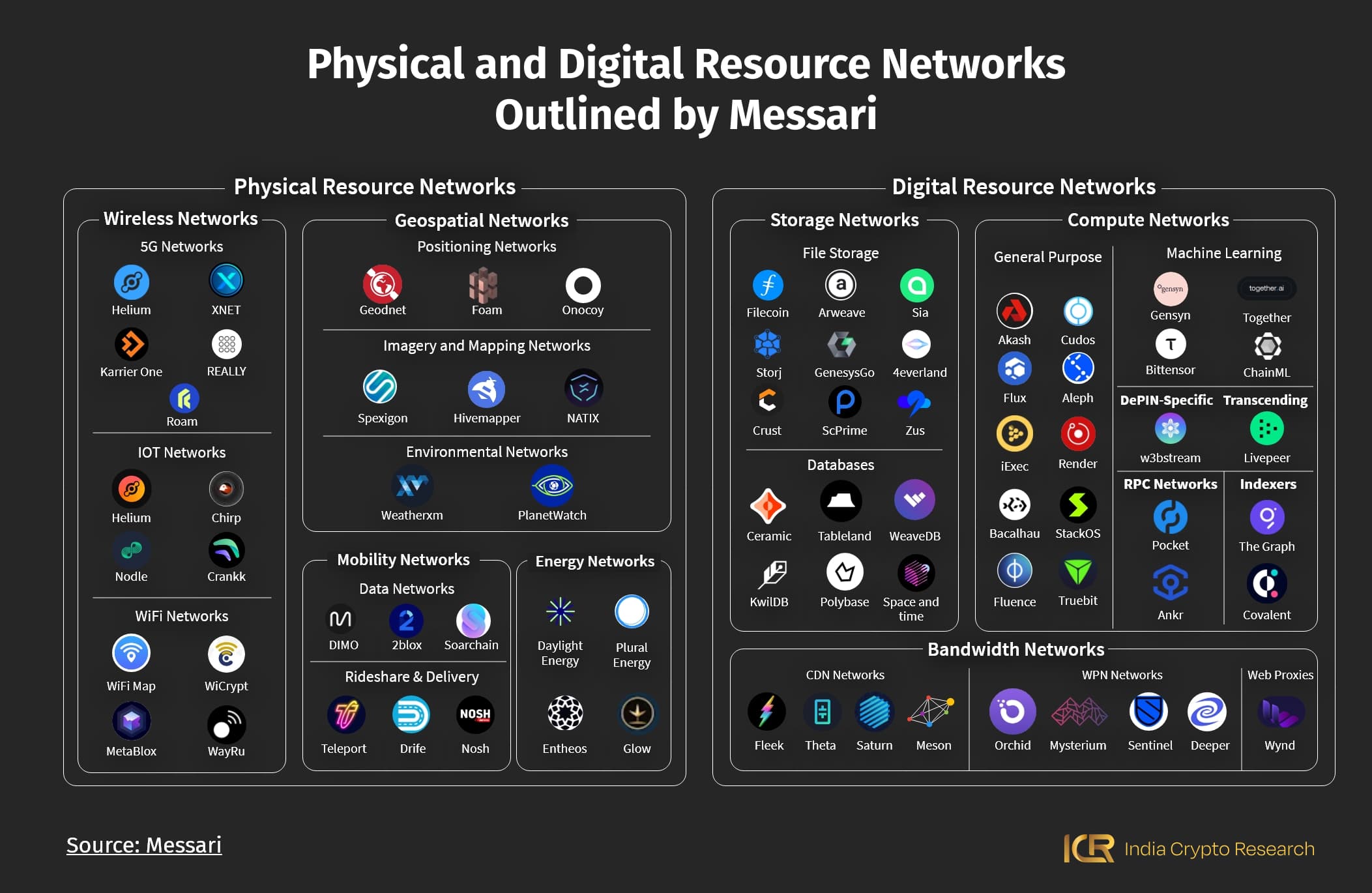

Depending on the kind of service provided, decentralised physical infrastructure networks can be divided into two major types, which are:

To understand ‘what is a DePIN?’ better, here are a few examples of decentralised physical infrastructure networks already active:

Filecoin: Filecoin is a distributed cloud storage network, for storing data (duh). On Filecoin, suppliers (storage providers) lease storage to end users for free or in exchange of a small fee, on top of receiving FIL as reward.

You can understand Filecoin as a contender to AWS or Amazon Web Services. The decentralisation of Filecoin removes a single point of failure, however, as well as removes any censorship issues.

Render: The Render Network is a distributed GPU rendering platform, letting users delegate their GPU rendering work to high-performance GPU nodes situated all over the world. Of course, service providers here lend out their unused GPU power.

The Render Network is especially helpful to artists, designers, engineers, and developers for a broad range of GPU applications like motion graphics, visual effects, monetising portable 3D assets, and virtual production. The native RNDR DePIN crypto is used to pay platform fees, among other things.

Bittensor: In an adjacent stream, Bittensor is a mining-based platform like Bitcoin. The network is dedicated to the creation of a peer to peer market for machine intelligence, making it a ‘tradable commodity.’ As the team further explains the goal of Bittensor, “It enables the collective intelligence of AI models to come together, forming a digital hive mind.”

The TAO token is the native DePIN crypto to Bittensor. TAO miners serve machine learning models to end users, and get rewarded with TAO tokens in return, as any mining mechanism works. TAO also spearheads the Bittensor payment system.

IoTeX: Another DePIN related to the Internet of Things, this open source platform looks to accelerate a decentralised machine economy. The IoTeX network is a layer 1 blockchain with the capability to host dApps (decentralised apps); the platform brings tools for NFT (non fungible token) and dApp creation as well.

IoTX is the native DePIN crypto, which can be used to pay transaction fees, for staking and participation in network governance, and for the registration of devices on the IoTeX platform.

The best way to understand just how impactful a DePIN can be against traditional alternatives would be to actually compare the two. As data storage requirements grow with the arrival of more and more AI projects on the technology scene, let’s compare Filecoin with Amazon S3 or Amazon Simple Storage Service from Amazon Web Services.

Filecoin is built on top of the IPFS protocol- also known as InterPlanetary File System, which is a peer to peer network and brings a decentralised system; there is no centralised server. Thus Filecoin offers benefits like better security, better accessibility, no censorship issues, and better privacy protection.

On the other hand, Amazon S3 is a centralised platform for data storage, creating a singular point of failure that can bring down the entire network. On the other hand, even if one or two of the Filecoin nodes go down, the network will persist overall, creating no widespread disruptions.

The only roadblock for Filecoin stands to be the mainstream acceptance that AWS enjoys. Meanwhile Filecoin is still in development, in need of more maturity and optimisation before it replaces systems like AWS.

While DePINs are quite scalable in theory- such a network can crowdsource its equipment and scale faster than traditional platforms given there are enough enthusiastic users- in actuality, it may be quite difficult to build a mature enough network, especially on a global scale.

For physical resource-based DePINs, it may be acceptable to form a localised network that serves a certain user base without requiring to scale widely. On the other hand, better scalability would be a requirement for digital resource-based infrastructure networks.

A few factors can hinder scalability for DePINs, namely:

As you may have gathered by now, the pros of DePINs include:

However, there are some cons as well, including:

However, despite the cons, DePINs bring a revolutionary concept that gives power back to the service provider and the consumer, and it’s an important step to secure a decentralised future for the world. As institutional support pours into crypto, the importance of DePINs can not be undermined. There is endless potential for such infrastructure lying on the horizon, and just the right regulation can guide us to this empowered future soon enough.

Stay tuned to India Crypto Research for more insights into the world of crypto and blockchain!

India Crypto Research operates independently. The information presented herein is intended solely for educational and informational purposes and should not be construed as financial advice. Before making any financial decisions, it's essential to undertake your own thorough research and analysis. If you're uncertain about any financial matters, we strongly recommend seeking guidance from an impartial financial advisor.