Why were CBDCs introduced?

A history of CBDCs

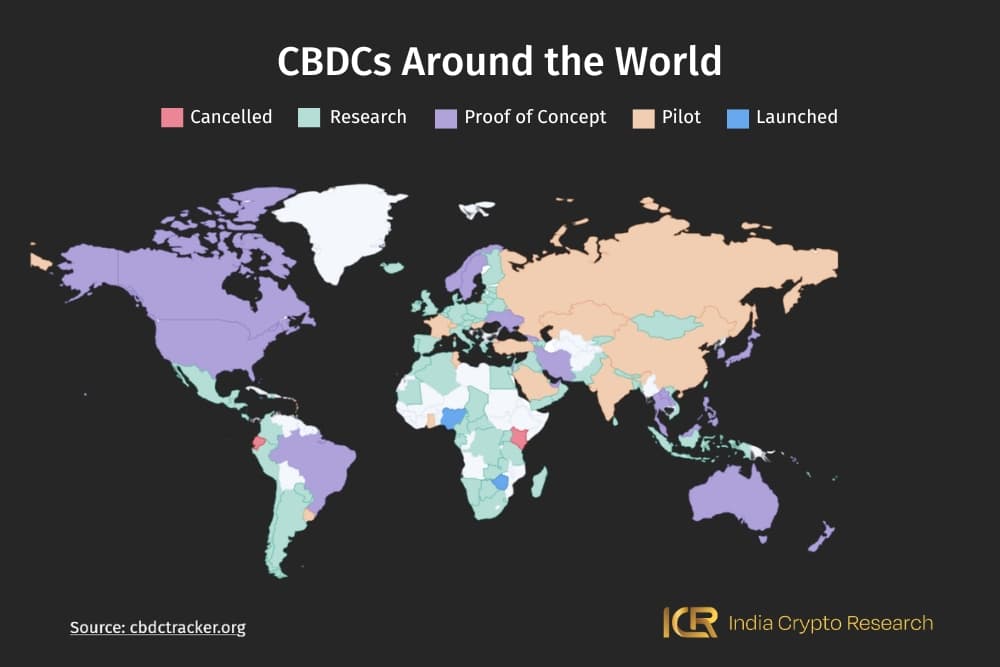

CBDC vs cryptocurrency: acceptance rate across countries

Summing up

In India, CBDC is a concept you’ve come across already, even if you aren’t super clear on the details just yet. Everyone and their mother has most likely already received notifications from their banks inviting them to participate in the digital rupee programme. This digital rupee is a CBDC or a Central Bank Digital Currency, a distant cousin (and some would say, opponent) of blockchain-based decentralised cryptocurrencies. How does a CBDC vs cryptocurrency comparison shape up?

The concept of CBDCs emerges from the desire to blend fiat and cryptocurrencies by national governments around the world. Late 2023 data indicates around 130 nations, collectively representing 98% of the world's GDP, are actively exploring CBDCs. Imagine that! To top it off, 11 countries have already launched their digital currencies, China and India are among them.

CBDCs are a digital representation of a country’s fiat currency, pegged at a 1:1 ratio to the same. Let’s figure out the need and scope for CBDCs, and the factors that differentiate CBDC vs cryptocurrency.

At the advent of cryptocurrencies, global governments realised the underlying potential of blockchain in creating a more accessible payment system. Great minds came together and developed the concept of CBDCs. The goal was to provide central banks with increased transparency into bank activities as blockchain allows, and provides users with heightened security, transferability, convenience, accessibility to financial products and services, and more. Further, such a currency can cut down on the maintenance costs that an entire fiat financial system otherwise needs, and even reduce expenses in terms of cross-border transactions.

Keeping to this principle, this is how the definition of a CBDC goes: it is virtual money backed and issued by a central bank. In turn, the primary differentiator for CBDC vs cryptocurrency is: while the former is a centralised digital currency, the latter is a decentralised digital currency.

Take a look at this map from cbdctracker.org. In January 2024, a good majority of the world is at least considering Central Bank Digital Currencies, which means the notion of them brings a marriage of regulation and convenience. To sum up, the basic reasons for introducing CBDCs include:

As you can guess, especially in the post-Covid era, the primary drivers behind the development of CBDCs include the growing digitalisation of economies and the decline in cash usage. Adding fuel to the fire is the urge of central banks to maintain control over monetary policy in the face of emerging private crypto assets and digital payment platforms.

Put two and two together, and you realise that CBDCs offer central banks a way to modernise ageing financial infrastructures and explore new monetary policy options, such as negative interest rates.

Progressive developments in several countries mark the history of Central Bank Digital Currencies (CBDCs), each at different stages of exploration and implementation. Here’s your cheat-sheet to the history of central bank-issued online money:

The takeaway is that as 2024 rolled in, a significant number of countries were in various stages of CBDC development. Out of these, over 60 countries, including major economies like Japan and Brazil, were in an advanced stage.

Here’s how the features of CBDC vs cryptocurrency look pitted against each other:

| CBDC | Cryptocurrency | |

|---|---|---|

| Extent of centralisation | Issued and controlled by central banks across countries. | Completely decentralised with no authority figure |

| Valuation | CBDCs are pegged at a 1:1 ratio with a nation’s fiat currency, and derive value from said fiat. | The value of cryptocurrencies is controlled by the dynamics of supply and demand in the markets. |

| Roles | Exist alongside respective fiat currencies, like the e-rupee (CBDC) and the usual rupee in India. Are accepted legal tenders and can be used for retail and commercial transactions. | Act as a parallel to traditional fiat currencies or play roles of mediums of exchange, governance token, and more on respective blockchain platforms. |

| Extent of regulations | CBDCs are regulated and launched by central banks in countries, therefore they enjoy the same level of regulation as fiat currencies. | Degree of regulation various across countries: for instance, they are legalised in Hong Kong, banned in China, and possess tax-related regulations in India. |

Now, let’s take a look at how different countries have taken to CBDCs as opposed to their stances on cryptocurrency:

China has an ironic scenario going on. Its government had always been unfriendly towards crypto, and even pushed a complete ban on crypto mining and trading in 2021. Paralelly though, China has pushed its CBDC, the digital yuan or the e-CNY, forward.

China started the pilot as early as 2019, the same year China’s National Development and Reform Commission (NDRC) questioned the desirability of Bitcoin mining due to the energy-intensive hardware required. By June 2023, total transactions in the digital yuan had gone up to 950 million with a value of 1.8 trillion yuan (translating to USD 249.9 billion).

China is a curious case for sure, but also a good reference for how governments tend to view CBDC vs cryptocurrency, based on the extent of control they can exert over the currency.

Another interesting duality about China: the Chainalysis Crypto Adoption Index, which measures countries based on crypto adoption at grassroots level, ranked China at the 11th spot in 2023 despite its complete crypto ban. e-CNY’s widespread adoption may be contributing to this, because CBDCs do in fact give the common man an avenue to explore digital currency, which can get them interested in cryptocurrency in turn.

Countries like Nigeria and those in the Eastern Caribbean Currency Union have made significant strides in CBDC development. Nigeria ranked second on grassroots crypto adoption in the Chainalysis Global Crypto Adoption Index 2023. Nigeria’s e-Naira did ease the journey into crypto for the common citizen. The Eastern Caribbean Currency Union also introduced "DCash," a digital currency to facilitate transactions and serve people without bank accounts.

Countries like India and those in the Eurozone are in the development phase of their CBDCs. The Indian government launched the digital rupee at the end of 2022, while the ECB is exploring the creation of a digital euro. Both are markets where crypto trading isn’t discouraged, but not clearly regulated either.

However, India secured the top spot in the 2023 Chainalysis Global Crypto Adoption Index, reaffirming the role of CBDCs in lowering the entry barrier for the common man into the crypto sector. Once a government expresses its support for CBDC research, it can be interpreted in turn as its recognition of the potential of virtual currencies altogether, putting citizens at ease.

The US, while not having a CBDC yet, is studying its potential. In April 2022, President Biden signed an executive order authorising the Federal Reserve to assess the risks and opportunities of a US CBDC. Any CBDC in the US would require Congressional approval though, so it could be several years before a US CBDC is designed and approved.

Worth noting - the US hasn’t yet legalised crypto either, but it’s the heart of the finance world, which makes crypto activity in the country significant. And the US SEC has recently given the go-ahead to a host of Bitcoin ETFs from prominent traditional entities like BlackRock and Fidelity.

As the world stands currently, both CBDCs and cryptocurrencies are pretty new, and it remains to be seen which one will stand the test of time. A realistic scenario would be CBDCs slowly replacing paper-based money and co-existing with crypto, just as fiat and crypto co-exist now.

Another crucial factor to remember would be that crypto is not only an alternative form of currency, it also serves its purpose as an asset class, a store of value, and a medium for users to access brand new products and services in the web3. So in the CBDC vs cryptocurrency debate, there’s little reason for either to snuff out the other.

India Crypto Research operates independently. The information presented herein is intended solely for educational and informational purposes and should not be construed as financial advice. Before making any financial decisions, it's essential to undertake your own thorough research and analysis. If you're uncertain about any financial matters, we strongly recommend seeking guidance from an impartial financial advisor.