The Current Shape of Crypto Markets

Liquidity Conditions Are Improving

Institutional Capital Continues to Influence Crypto Markets

Macro Conditions Are Easing at the Margin

Risks That Could Impact Crypto in 2026

Looking Ahead to 2026

FAQs

Crypto markets made new highs in 2025, but this didn’t last long as markets saw deep corrections towards the end of the year. This tested both positioning and market structure. As we begin 2026, wider macroeconomic variables are now as important as the internal crypto market dynamics.

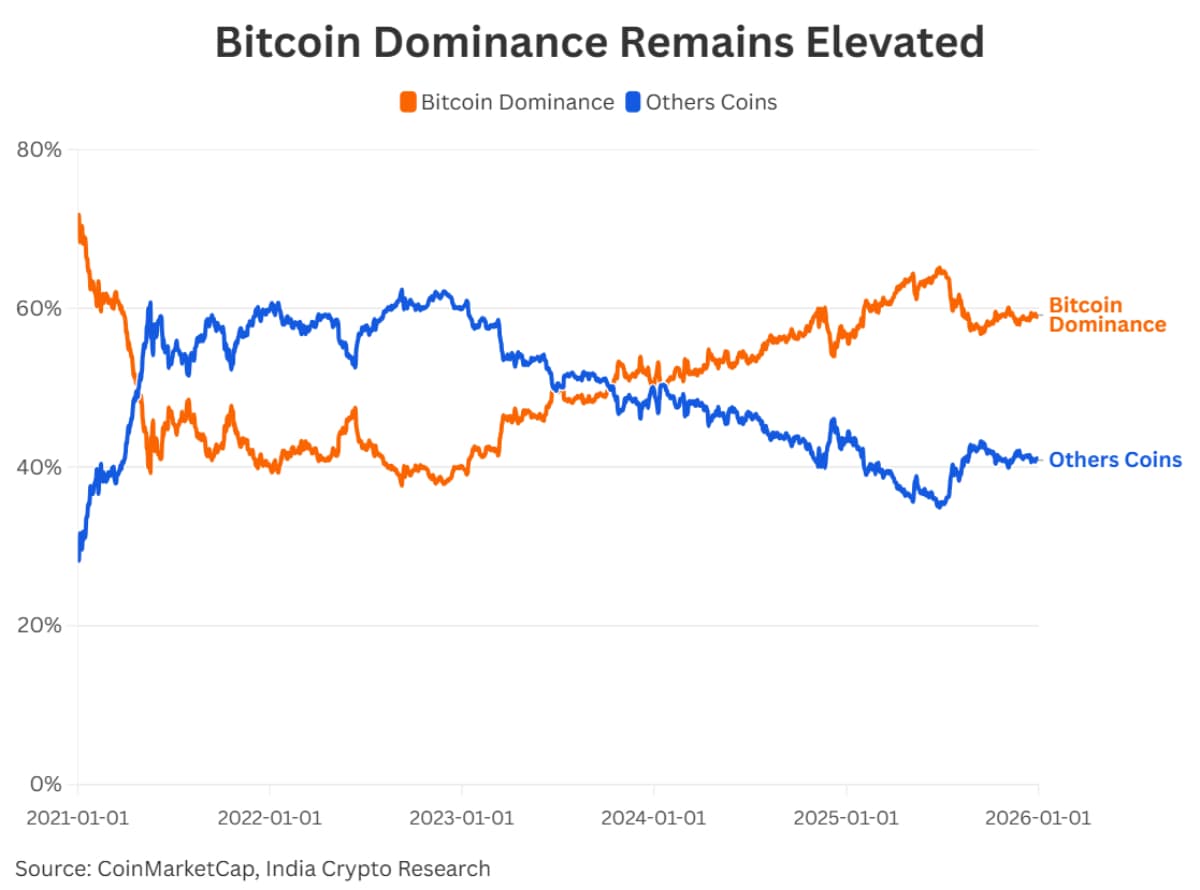

Bitcoin dominance has remained over 50% as we head into 2026, and this has been a rising trend since 2024. A large portion of the capital in the crypto market is concentrated in Bitcoin, rather than being spread across other coins, as investors continue to favour a higher exposure to Bitcoin.

Higher bitcoin dominance shows that markets are more selective, and this is reflected in the current cycle as well. When there is broader uncertainty in the market, capital is usually parked in an asset that people are confident in, and as of now, Bitcoin is that asset in the crypto market.

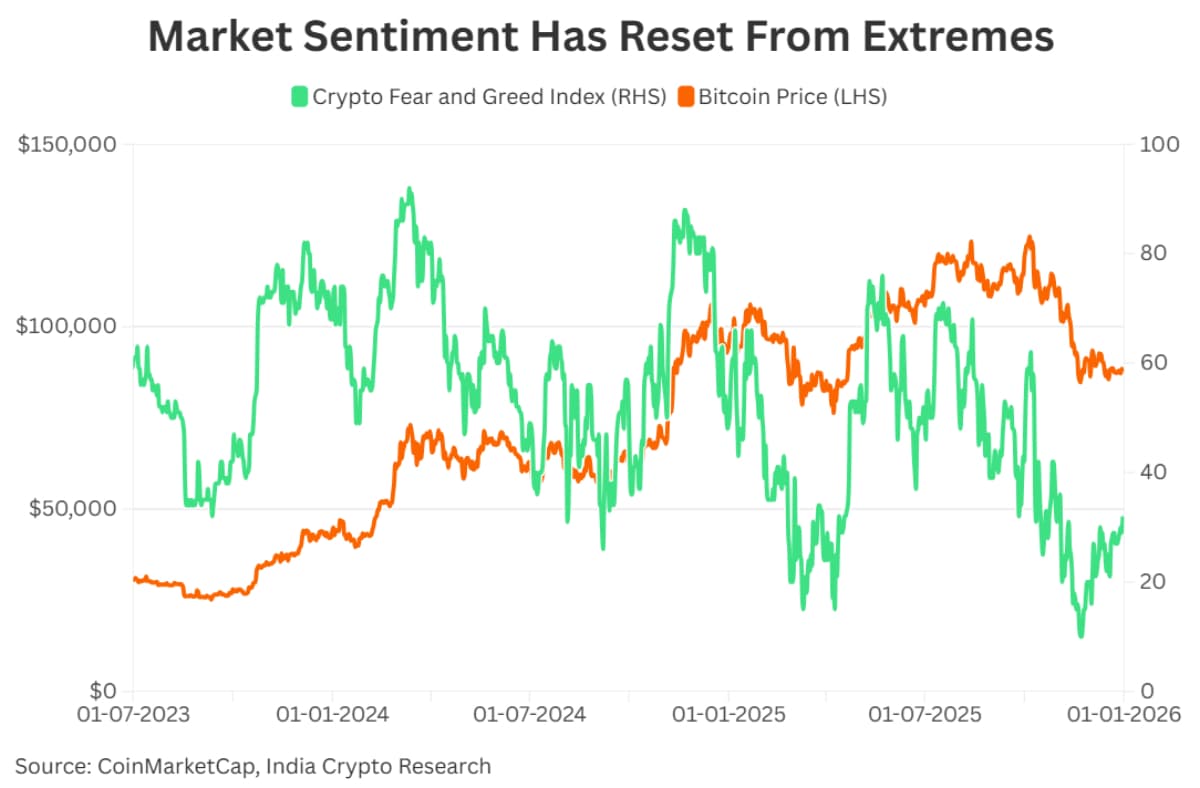

Over the past few years, the crypto market sentiment has remained sensitive to price movements. The market participation remains largely reactive. Periods of positive momentum have drawn quick optimism, while pullbacks have led to reversals in positioning.

The recent market decline has reset positioning. Markets are near the neutral zone, rather than being stretched on either side. This dynamic does not materially change the broader market set-up for 2026; it just influences short-term price movements.

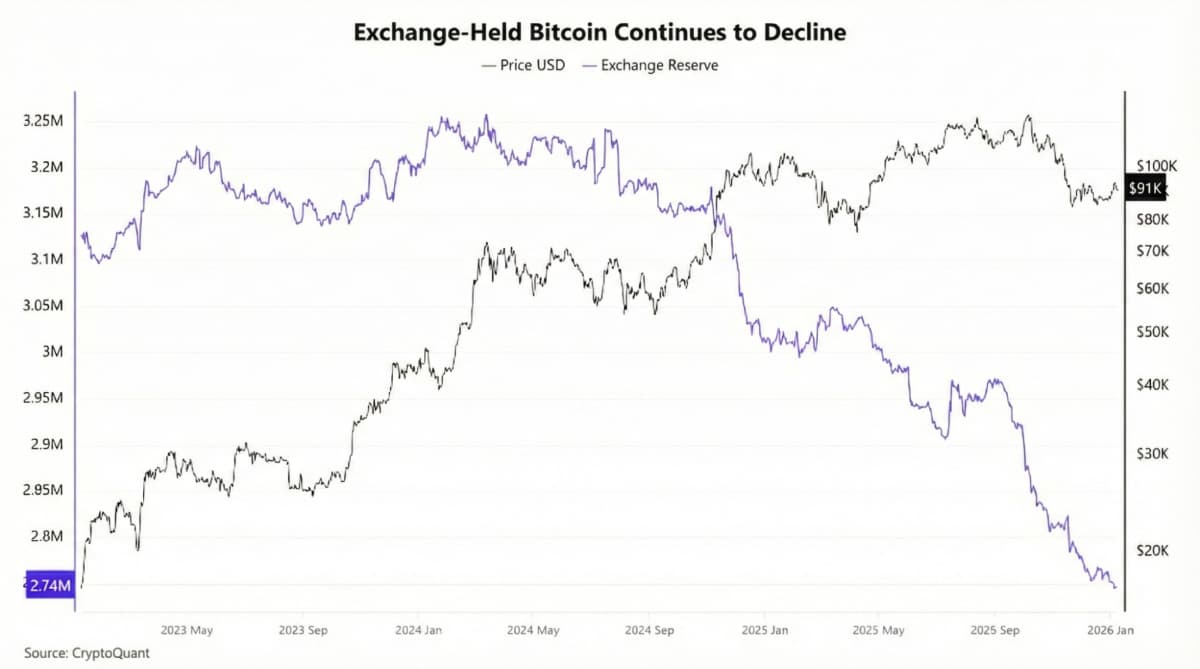

Bitcoin exchange reserves continue to decline as we head into 2026. It is now at multi-year lows after a prolonged period of outflows. Only a smaller share of Bitcoin’s supply is readily available for selling. More and more people are considering it as a store of value; as a result, it is held mostly off exchanges.

With fewer coins accessible on exchanges, the supply side of the market is tighter than in previous cycles. As exchange balances shrink, new demand is likely to have a more noticeable effect than in previous cycles.

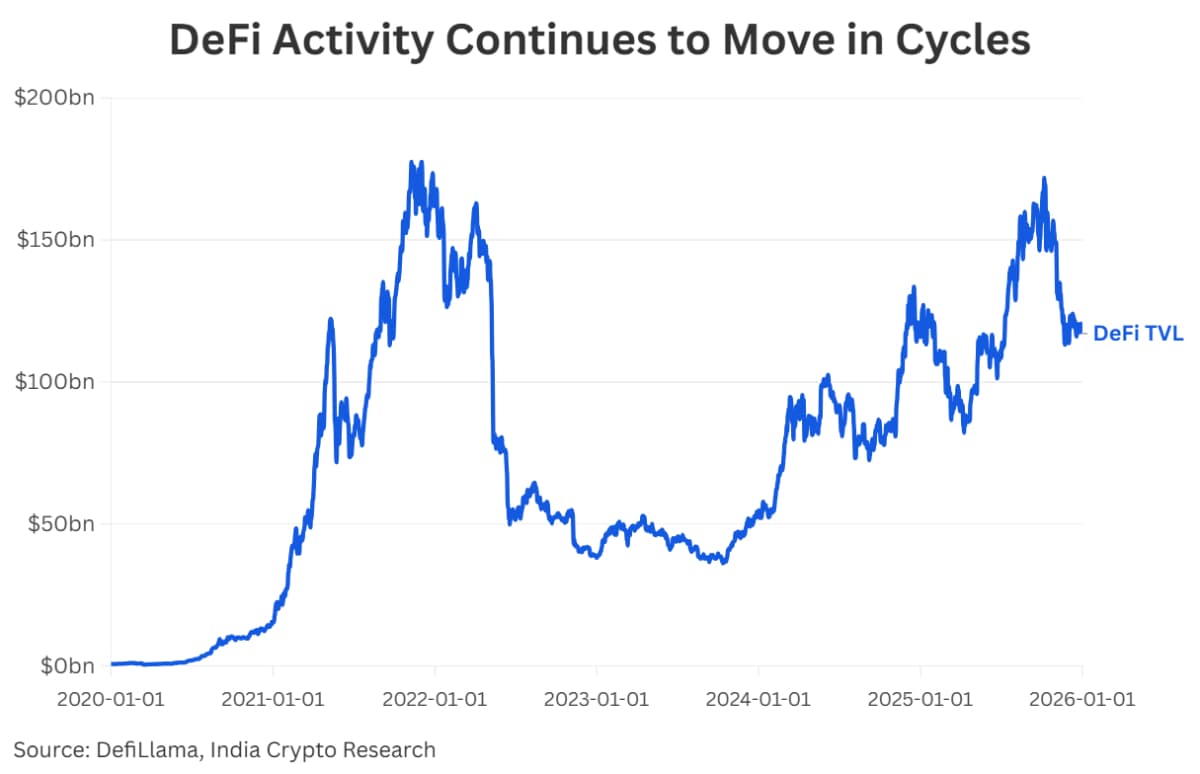

Confidence in decentralised finance (DeFi) has improved since the 2022 drawdown, and its on-chain activity is recovering. Capital has returned, protocols remain active, and participation is slowly increasing compared to the post-crash period.

But this growth has been cyclical. DeFi activity continues to expand and contract according to the broader liquidity and risk situations, rather than having a sustained momentum of its own. It's in a position where confidence has recovered, but the participation remains measured and dependent on external factors.

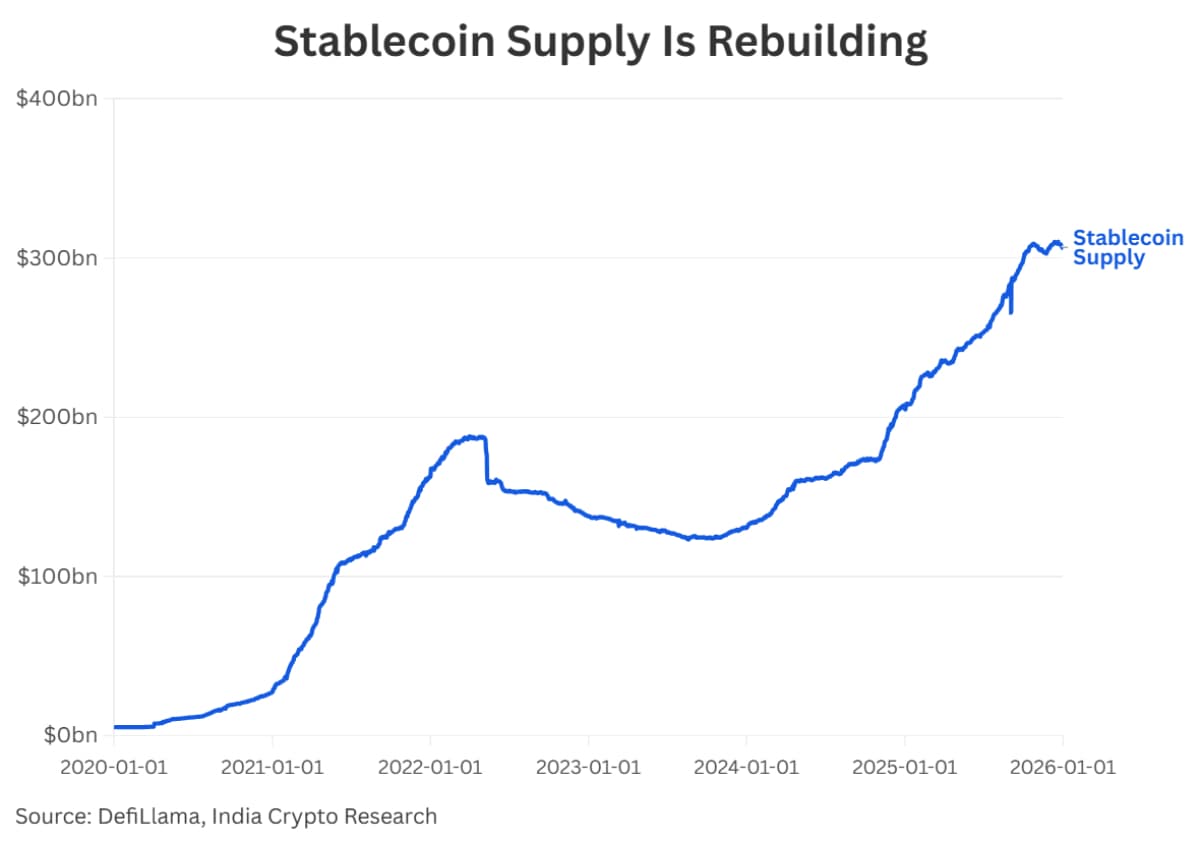

After contracting in 2022-2023, the stablecoin supply has grown shapely in the last couple of years. A higher stablecoin balance indicates a growing dry powder within the crypto markets, which tells that capital is already positioned on crypto rails. When things become favourable, this dry powder will help the market to respond.

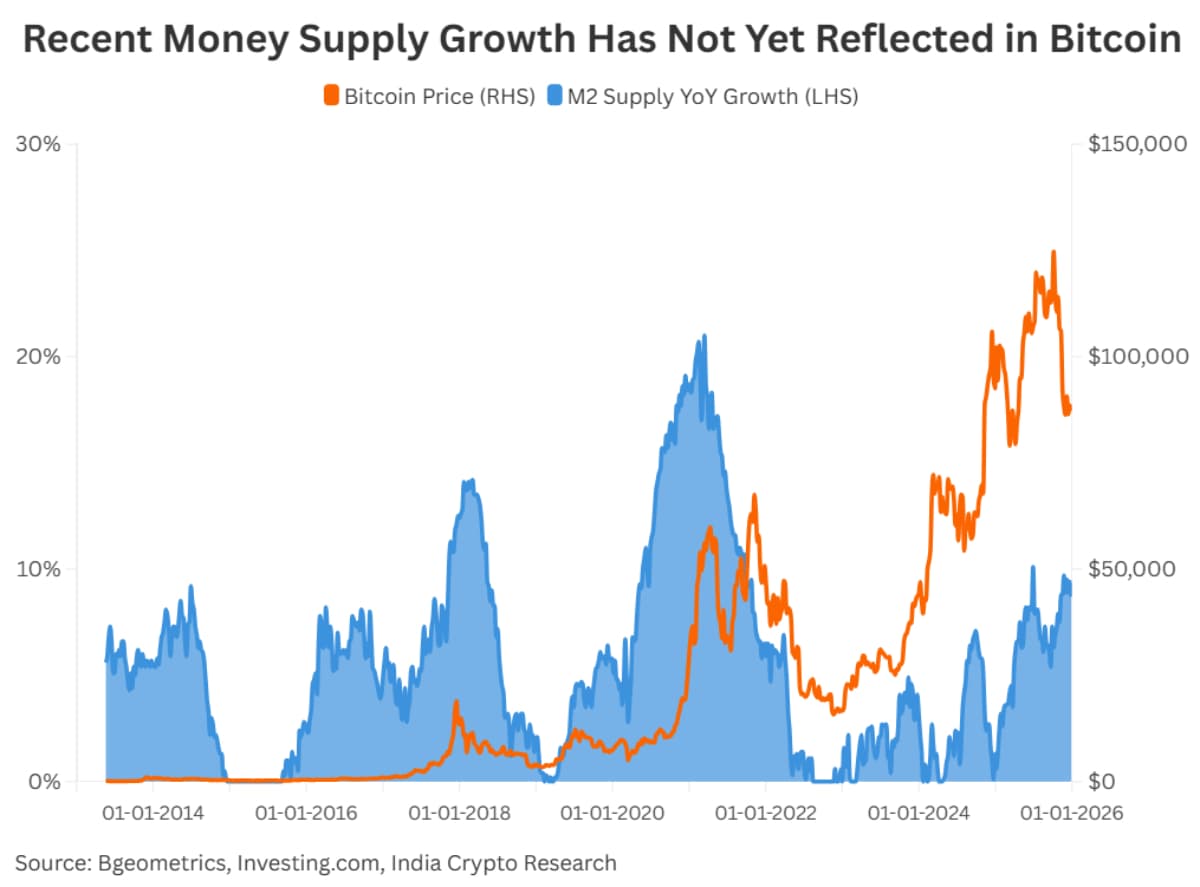

Historically, growth in global M2 money supply has supported risk assets, including Bitcoin. However, the recent money supply growth has not yet been reflected in Bitcoin.

Liquidity conditions are improving, but the effect has not fully reached crypto markets. Money is becoming more available in the system, even if it has not yet shown up in Bitcoin’s activity.

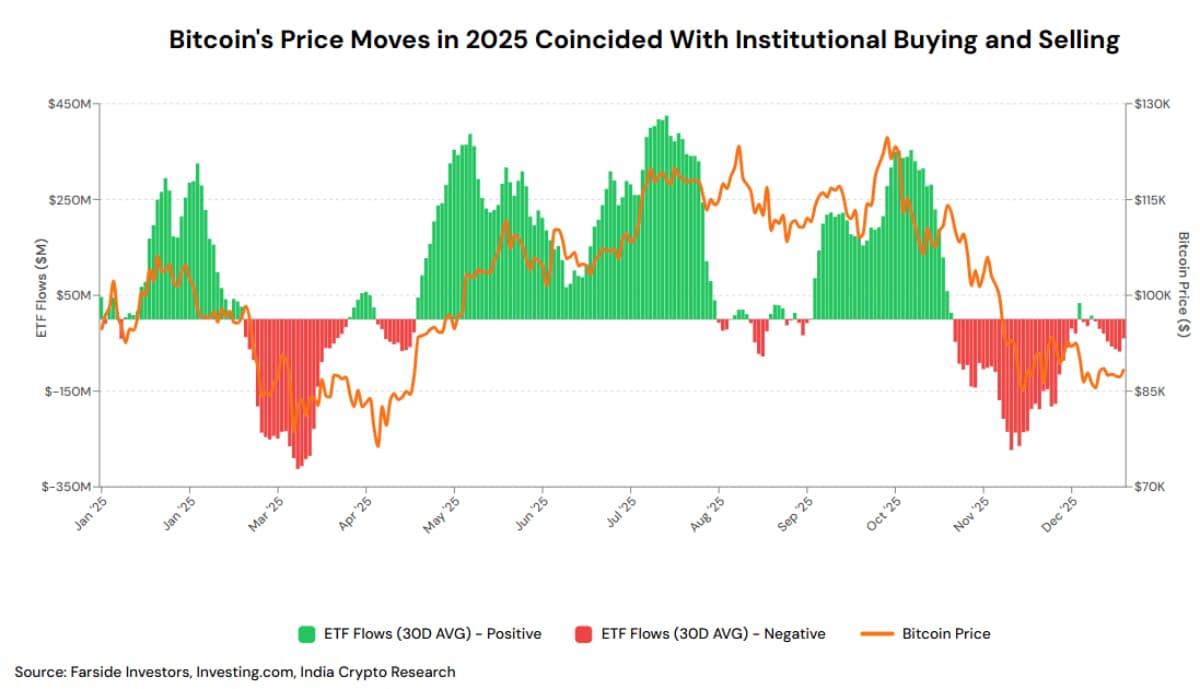

Institutions added around $57 billion to Bitcoin in just 2025 through spot ETFs. These flows have moved closely with price, with buying during rallies and selling during pullbacks. Going into 2026, institutions are already active participants and with ETFs in place, this flow is unlikely to slow in 2026.

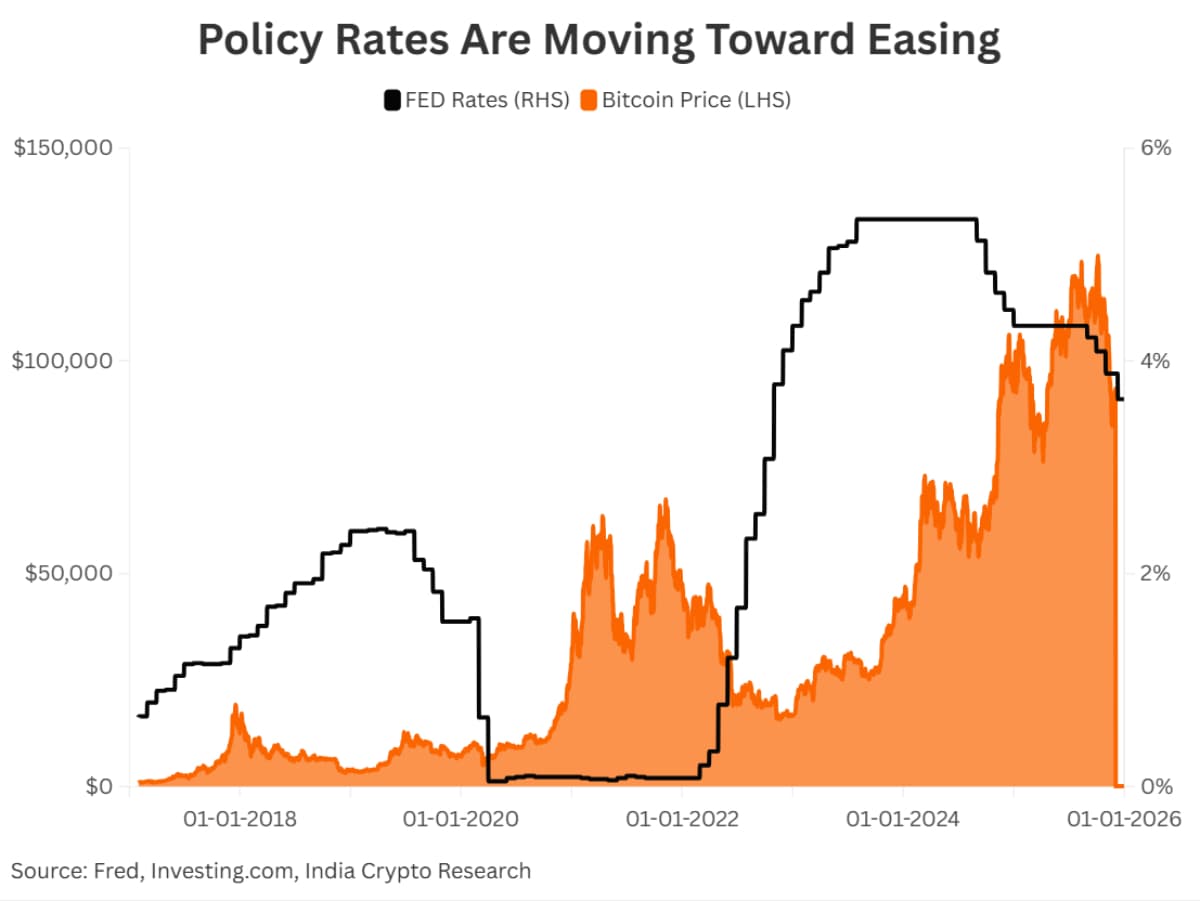

Bitcoin’s relationship with Fed rates has evolved over the years. Earlier, rate cuts had little impact on Bitcoin, as the market was smaller and was driven mainly by its internal dynamics. Now, with the entry of institutions, public companies and governments, it has started to behave more like a high-beta risk asset.

Looking ahead to 2026, the Fed is expected to ease interest rates modestly, with rate cuts of around 50 bps expected. So, policy is expected to move from tightening to accommodative. It would be placed where rates are restrictive enough to limit excessive risk-taking, while lenient enough to reduce pressure on liquidity conditions.

This is a supportive shift for the crypto market, but not a very powerful one. Rate cuts of this scale are unlikely to drive strong rallies on their own, but they will also not act as a major roadblock.

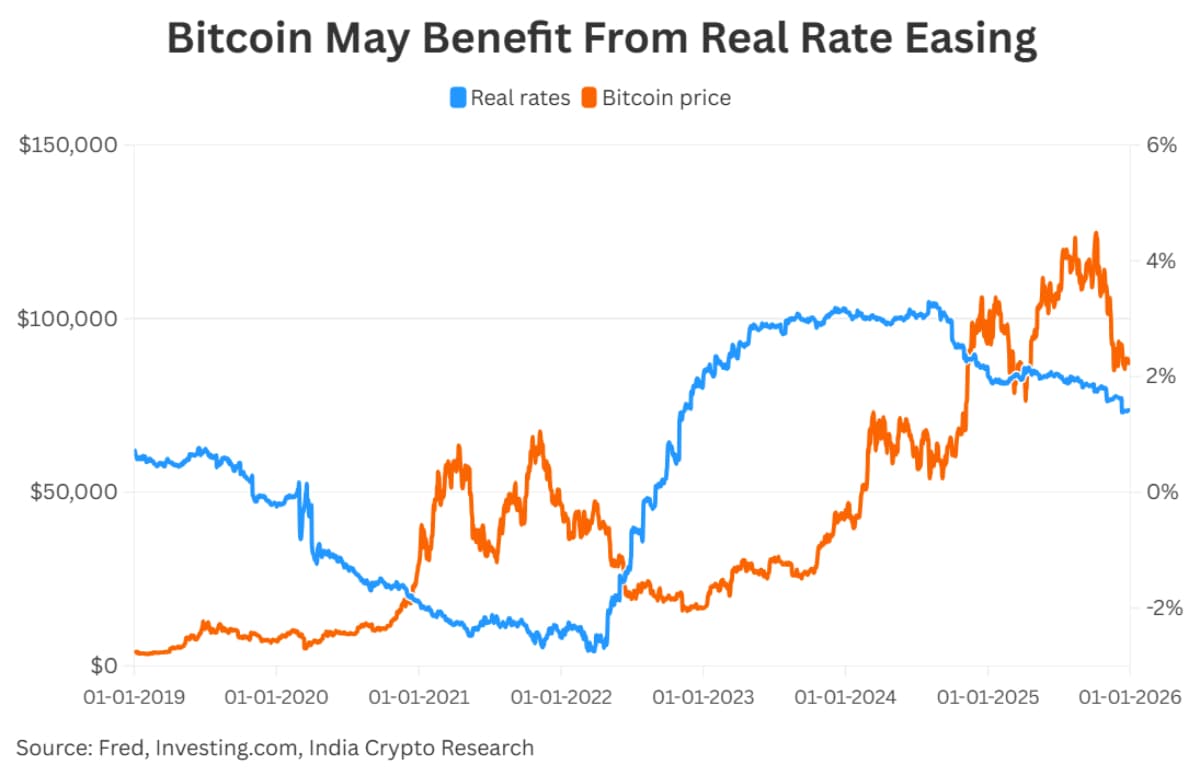

It is observed that Bitcoin performs well when real rates slow or decline. This is because the opportunity cost of holding non-yielding assets becomes less restrictive. At the same time, periods of rising real rates have coincided with pressure on Bitcoin and other risk assets.

Real returns are expected to ease gradually or remain broadly stable through 2026. Although yields are still positive, they are not moving up; in fact, they are slowly drifting lower. This will gradually lift pressure on risk assets, including bitcoin.

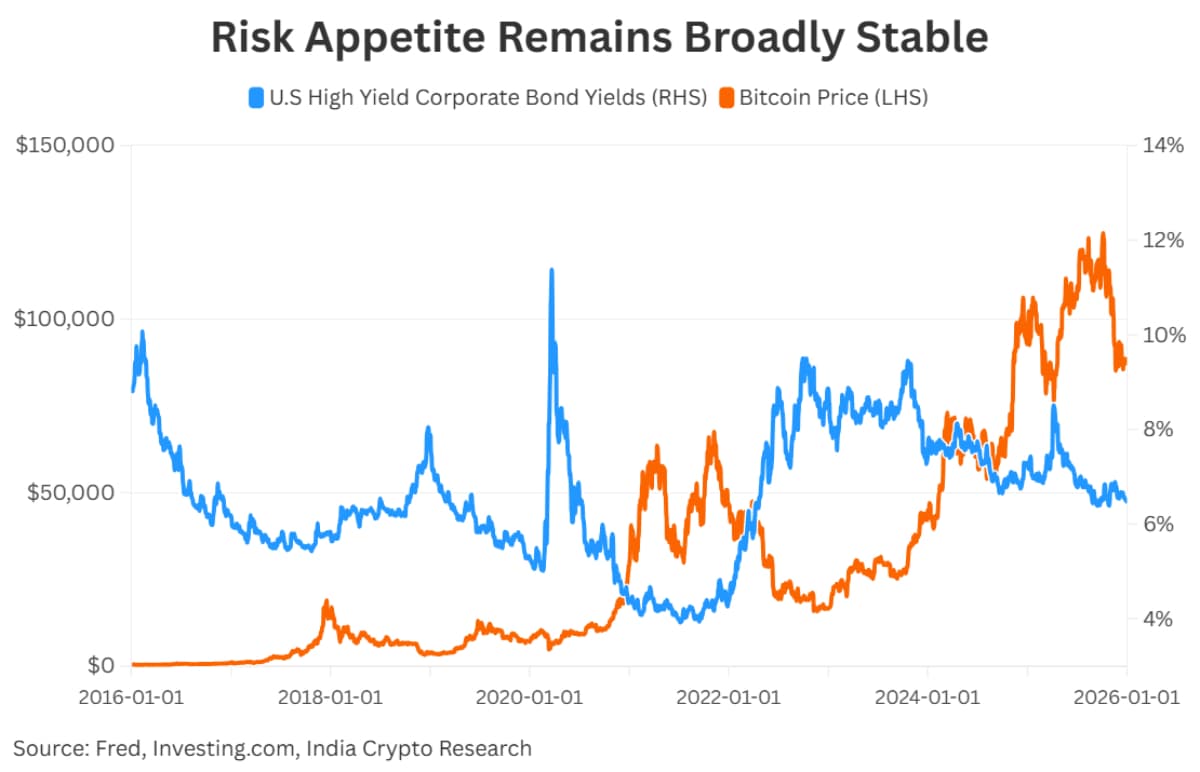

U.S. high-yield corporate bond yields tend to rise when financial conditions tighten and ease when pressure in the system reduces. At present, credit markets are not showing signs of rising stress.

50 bps rate cuts are expected to happen in 2026. Borrowing is unlikely to change massively. Corporate bond yields are more likely to remain broadly stable or ease modestly rather than move higher. This creates a modestly supportive environment for risk-taking, as macro conditions are not restrictive and allow the market to grow at a steady pace.

Geopolitical tensions remain an ongoing risk for the global markets. Any sudden escalations or political responses could disrupt capital flows, which might lead to short-term market adjustment.

Trade policies are changing frequently as countries like the U.S have started to prioritise domestic interests. Changes in tariffs and cross-border rules may redefine global growth expectations, which in turn affect the global risk appetite.

Liquidity conditions are improving, but they remain sensitive to wider financial stress. Any change in global liquidity could impact risk-taking and could lead to very selective participation.

U.S equity valuations remain high due to AI-led growth expectations. A valuation reset could affect global risk appetite and capital allocation, with spillover effects on crypto markets.

As 2026 begins, crypto markets are operating in a more defined structure with selective participation. Liquidity has improved, while macroeconomic variables are less restrictive compared to earlier times. Taken together, these conditions suggest a year of measured growth rather than of extremes.

India Crypto Research operates independently. The information presented herein is intended solely for educational and informational purposes and should not be construed as financial advice. Before making any financial decisions, it's essential to undertake your own thorough research and analysis. If you're uncertain about any financial matters, we strongly recommend seeking guidance from an impartial financial advisor.