Where Stablecoins Are Being Used Today

USDT and USDC Dominate the Stablecoin Market

Stablecoins are Now Getting Regulated

India May Soon Have Its Own Stablecoin

What Stablecoins Mean for Global Payments Worldwide

FAQs

India’s UPI did more than just speed up payments. It changed how people and businesses handle money. Tasks that once took days and involved forms, verification, and delays now happen in seconds. Transactions are near free, and digital payments have become a normal part of everyday life. Stablecoins are starting to do something similar on a global scale. They are not just crypto tokens. They are emerging as a new way to move money faster, cheaper, and more efficiently across borders.

Stablecoins are built to hold a steady value, usually by being linked to a fiat currency. They are designed to address long-standing issues in traditional finance, such as slow money transfers and high fees. Sending money internationally through banks can take 1-5 business days and often costs 5-7% in fees. Stablecoins solve both of these issues. They can settle transactions in minutes or seconds, operate around the clock, and reduce costs by removing intermediaries. This makes them ideal for remittances, trade settlements, and any payment scenario where speed and cost matter.

The impact is already visible. Countries with heavy remittance flows, like the Philippines, Mexico, and Nigeria, are using stablecoins to send money faster and more cheaply. Businesses are beginning to explore using stablecoins for import and export settlements, avoiding the delays of traditional banking. Major payment companies like Visa and PayPal are testing stablecoin solutions for both retail and business clients. This shows that stablecoins are not limited to the crypto community. They are entering the mainstream financial system, gradually bridging the gap between decentralised finance and traditional banking.

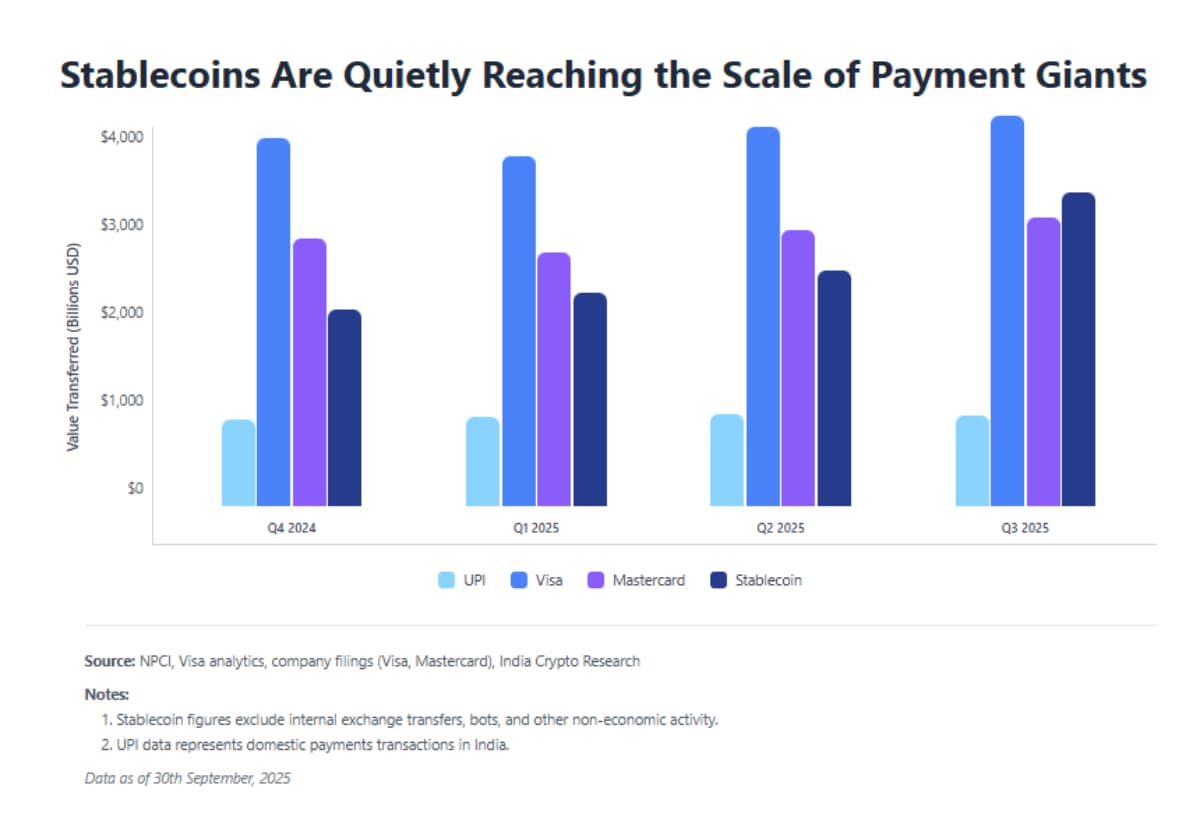

The stablecoin market is growing rapidly. Transactions have climbed steadily over the past year, rising from $1.87 trillion in Q4 2024 to nearly $3 trillion by Q3 2025. This places stablecoins at a scale comparable to global payment networks like Visa and ahead of Mastercard in quarterly transactions.

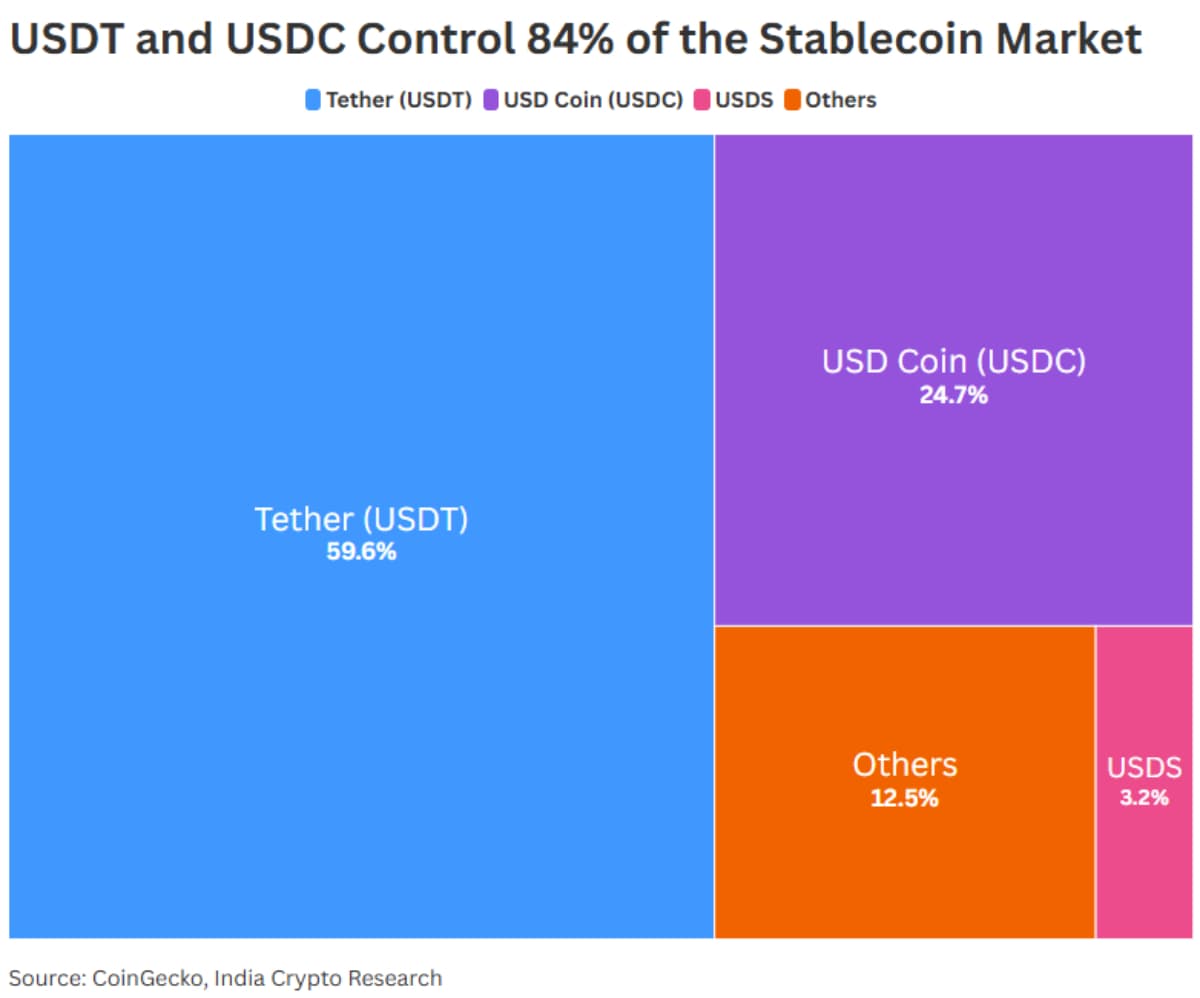

USDT and USDC dominate the stablecoin market, together accounting for more than 80% of global stablecoin supply. USDT leads in trading activity and global usage, especially across exchanges and cross-border flows, while USDC focuses on regulatory compliance and transparency, with reserves backed by cash and US Treasury bills. As stablecoin volumes expand, their footprint is increasingly overlapping with traditional finance, particularly through large holdings of short-term US government securities.

Recently, the US enacted the GENIUS Act, the first law in the US to regulate payment stablecoins. The Act permits licensed banks and certain controlled non-bank issuers to issue and redeem stablecoins at par, which must be fully backed in cash or US short-term Treasury securities. This allows institutions to move and balance their net worth more freely in stablecoins. Clearer rules around stablecoins make it easier for dollars to be used more efficiently. This means money can flow to activities that create real value, helping the entire ecosystem work better and support more meaningful transactions.

India could soon see a rupee-backed stablecoin. Polygon and Anq are working on a stablecoin called ARC, which will stay tied to the Indian rupee and be backed by Indian Government Bonds and Treasury Bills.

Currently, most stablecoins are backed by the US dollar, which means capital flows mainly strengthen the dollar rather than the rupee. ARC aims to change this by linking its value to Indian securities. This could improve domestic liquidity and increase demand for Indian government bonds, helping India’s financial ecosystem grow.

UPI fixed inefficiencies in India’s domestic payments, and stablecoins are doing the same on a global scale. They reduce friction, lower costs, and provide broader access than traditional financial systems. With real-time, borderless transactions and programmable digital money, stablecoins are shaping a more efficient, reliable, and seamless financial infrastructure, bringing the benefits of UPI to the world.

India Crypto Research operates independently. The information presented herein is intended solely for educational and informational purposes and should not be construed as financial advice. Before making any financial decisions, it's essential to undertake your own thorough research and analysis. If you're uncertain about any financial matters, we strongly recommend seeking guidance from an impartial financial advisor.