What is Total Value Locked?

How is TVL calculated?

Top 7 Chains by TVL

Top 10 platforms by TVL

Importance of TVL in Investment Decisions

Criticism and Limitations of TVL

TVL Analytics Tools

FAQs

TVL, or Total Value Locked is a metric that measures the total dollar value of digital assets locked or staked on a specific blockchain network through decentralized finance (DeFi) platforms or decentralized applications (dApps).

It’s often used as a measure of the health, popularity, or growth of DeFi projects. TVL shows how much capital is being actively used within a particular project or platform, indicating the adoption rate of the project within the crypto community.

For example, in lending platforms such as AAVE, or Decentralised Exchanges such as Uniswap and Jupiter, or yield farming services such as PancakeSwap, users deposit their crypto assets in exchange for earning rewards or interest. The total of all these assets locked in the platform represents its TVL.

With respect to a Blockchain network (L1s and L2s), Chain-TVL is also used to refer to the percentage of the total supply of the tokens that is staked natively by validators and other participants. For example, the chain-TVL of Ethereum is the dollar value of all the ETH that is staked by validators.

TVL can be calculated for both a platform and a chain. However, the calculation method for each of them differs.

Platform TVL is calculated as the summation of all the assets that is locked in the platform’s smart contracts across all the chains it supports.

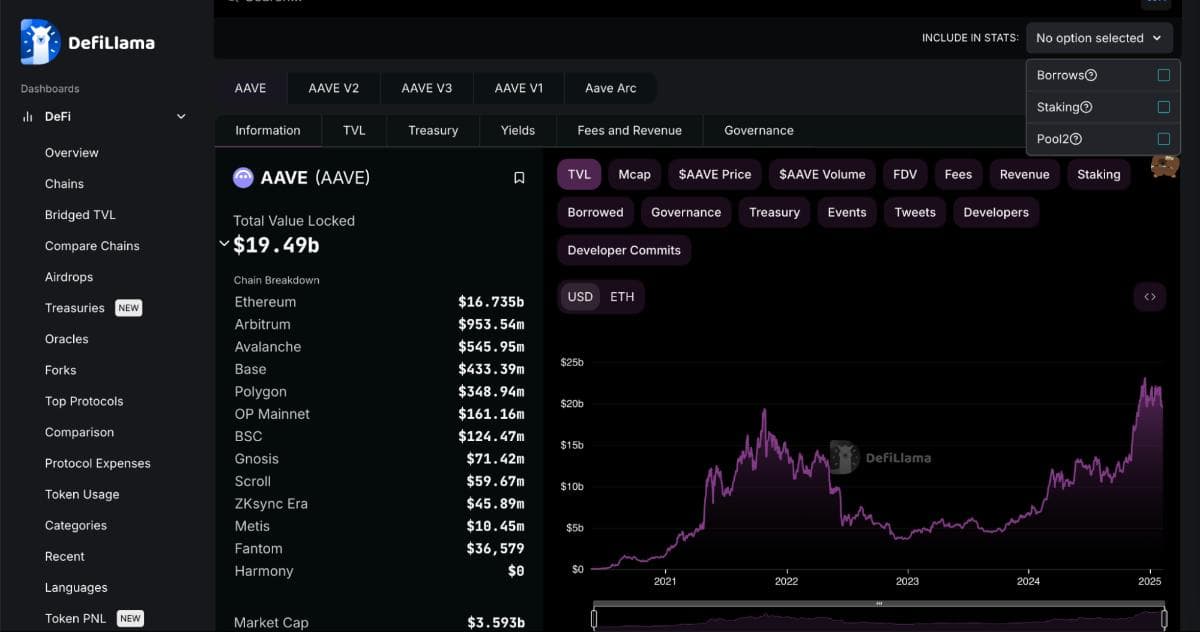

For example in AAVE, a lending and borrowing protocol, all of the user's funds that have been deposited in AAVE’s lending pools will account for the TVL. AAVE’s lending pools will have funds that have been deposited by the user solely for the purpose of earning interest or as a collateral for borrowing another asset such as stablecoins against it.

Note: Borrowed assets is not generally counted in the TVL

Chain TVL is calculated by adding up the value of all the tokens locked in the smart contracts of a blockchain.

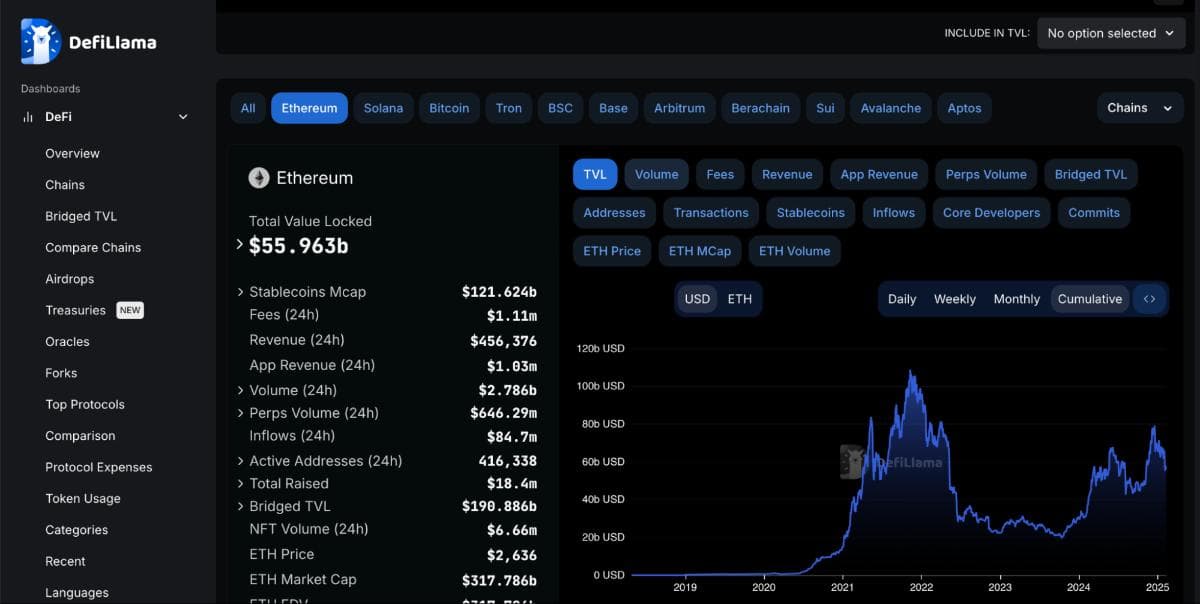

For example in Ethereum, the total value locked is a summation of the all ETH that is staked in the Ethereum Consensus Layer by stakers, or any DeFi protocol that locks ETH tokens in ETH smart contracts.

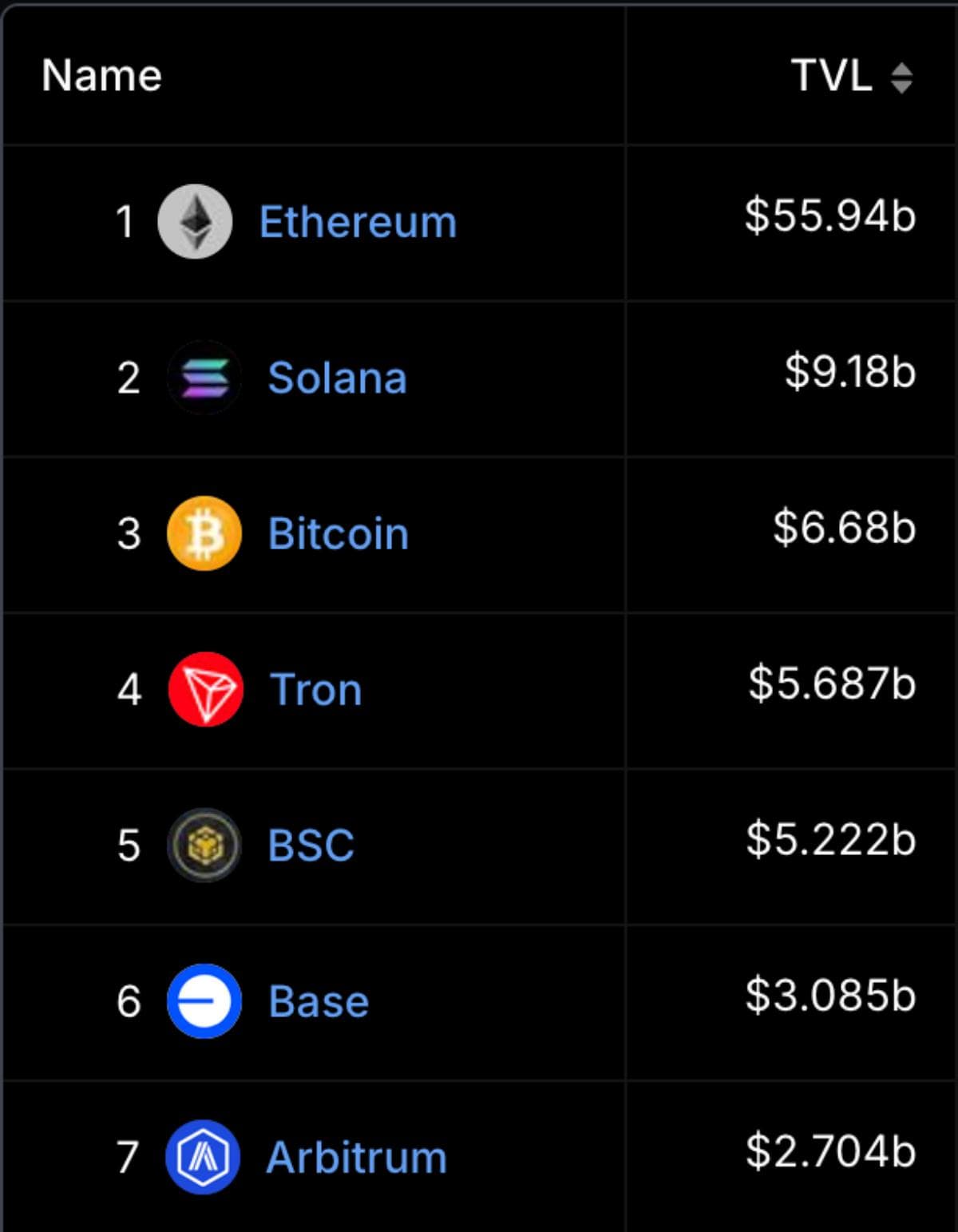

TVL for chains are as of 8th Feb, 2025. Source Defillama

Note: Bitcoin cannot be staked or locked in smart contracts as a native Layer-1 token. A 1:1 backed token against bitcoin held by a custodian such as wrapped BTC is usually further used in lending borrowing protocols or for yield staking.

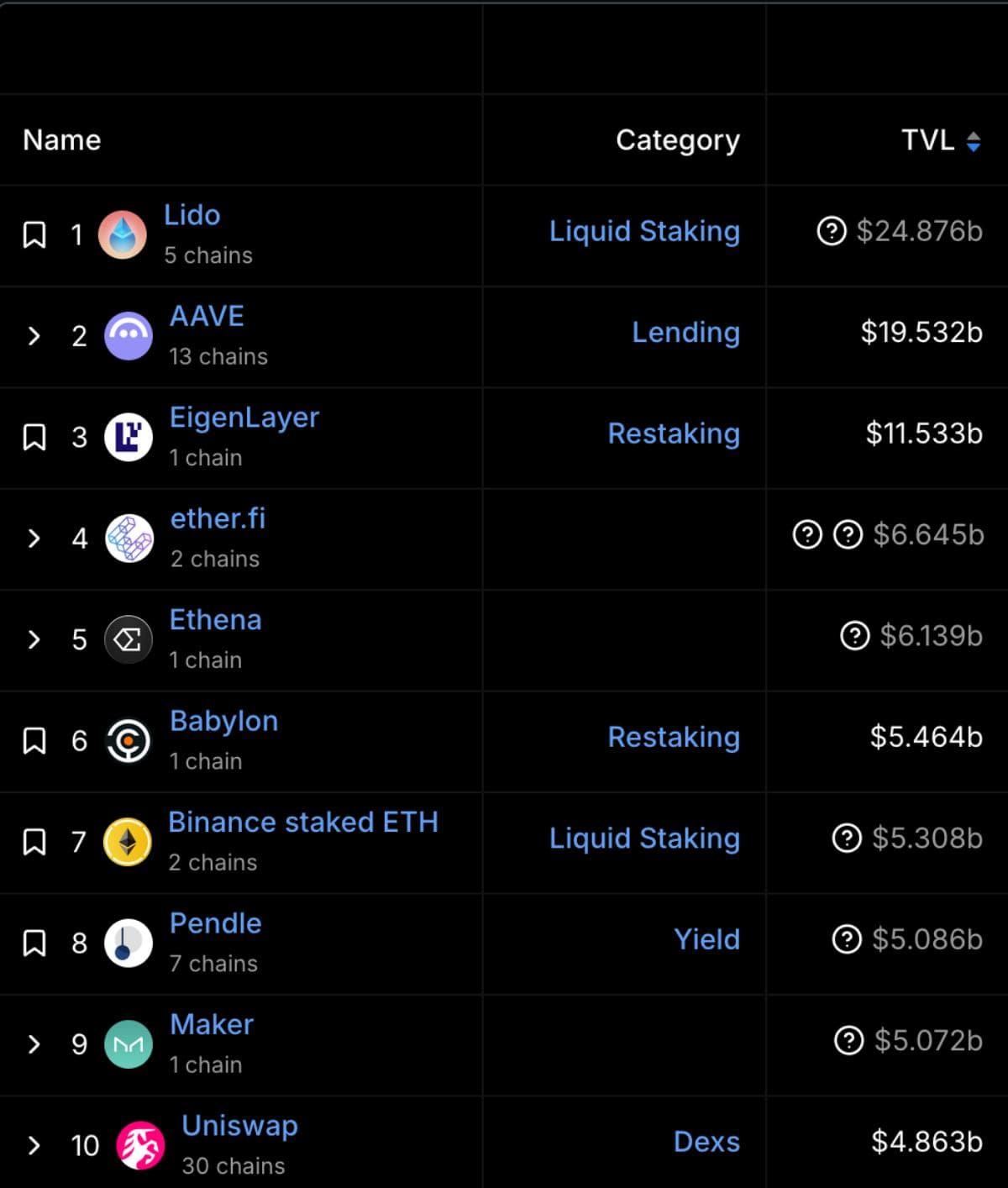

TVL for platforms are as of 8th Feb, 2025. Source Defillama

Above data shows that users are mainly locking funds in Liquid Staking, ReStaking, Lending, Yield and DEXs with the incentive of earning more rewards.

TVL is an important metric when evaluating DeFi platforms since it reflects the overall capital invested in a platform or protocol, indicating its liquidity and popularity. At IndiaCryptoResearch, the ICR score includes the Chain TVL for tokens falling under smart contract platform category and the Platform TVL for DeFi and DEXs. Higher TVL usually indicates higher adoption and thus platforms or blockchains with higher TVL generally score higher than their category counterparts.

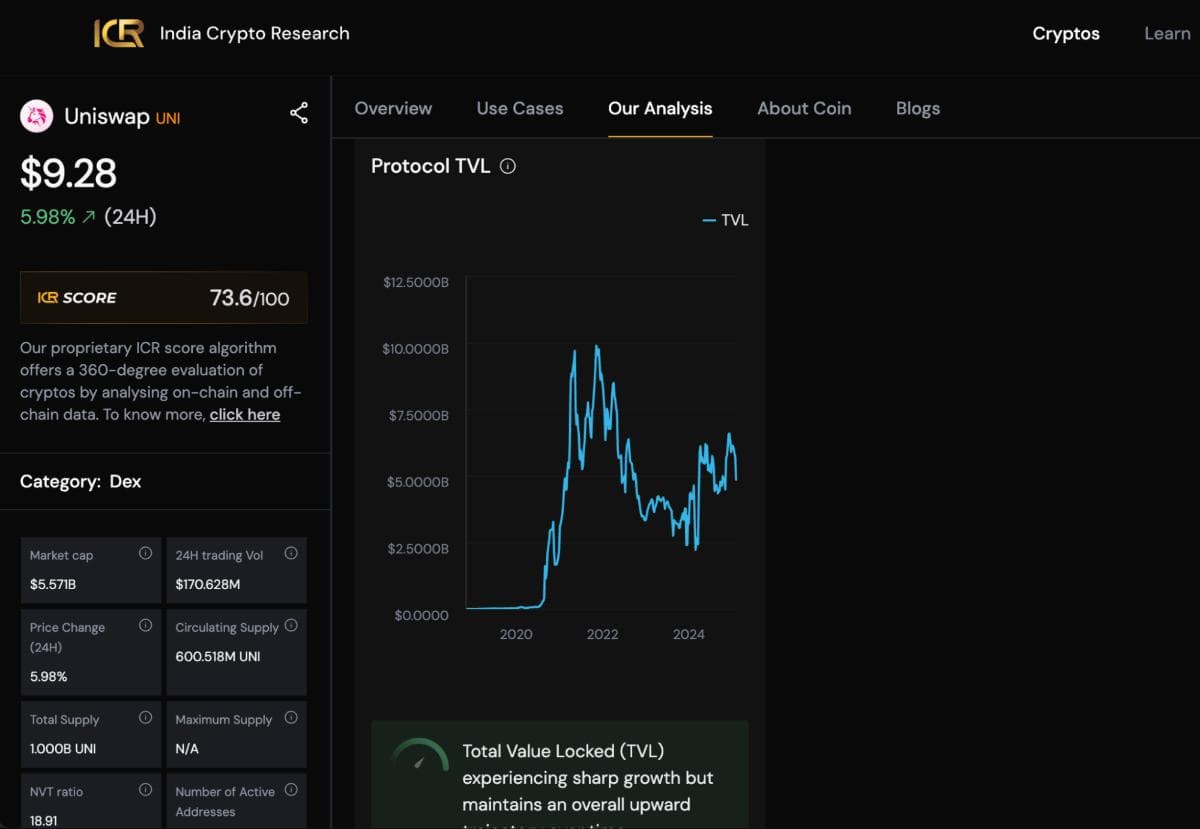

To check the historical TVL and analysis of hundreds of platforms and chains visit the ‘Our Analysis’ section of the token at indiaCryptoResearch such as Uniswap.

DeFi platforms and blockchains cannot be solely evaluated based on TVL, as certain investors may contribute to the majority of the TVL. The actual number of active users on the platform could be small. Therefore, metrics such as active addresses and the distribution of assets among holders are equally important when assessing the project's fundamentals.

Note:- Some projects might spike their TVL with their own investments to stand out in the TVL rankings in order to attract further investments.

The ICR score, comprehensively scores different cryptos by categorising them, identifying the right metrics that accurately reflects its fundamentals and assigning the right weightages to each of these metrics.

There are many free tools for checking real time and historical TVL of the project you want to analyse. Some of the popular ones are

IndiaCryptoResearch

Under ‘Our Analysis’ of tokens categorised as DeFi, DEXs, Smart Contract platforms you can find the historical TVL of those tokens in IndiaCryptoResearch.

DefiLlama

Search for any project or blockchain on DeFiLlama and you will see it as one of the most important metrics. You can even customize the calculation of TVL to exclude certain parameters such as double counts.

Token Terminal

You can get the real time TVL of 165+ projects in Token Terminal. However, for historical TVL data, you will require its premium version.

Dune Analytics

Here you can find community built dashboards of TVL comparisons of various chains, DEXs etc. Ensure you explore various interesting dashboards such as this one.

Total Value Locked of top protocols and projects have been historically increasing due to widespread adoption of crypto assets. TVL will continue to remain one of the most, but not the only important factors to evaluate the fundamentals of a platform or chain. Ensure you always do your own research thoroughly to ensure you remain invested in fundamentally solid projects and not chasing quick gains.

India Crypto Research operates independently. The information presented herein is intended solely for educational and informational purposes and should not be construed as financial advice. Before making any financial decisions, it's essential to undertake your own thorough research and analysis. If you're uncertain about any financial matters, we strongly recommend seeking guidance from an impartial financial advisor.